Llc Resolution to Purchase Real Estate Form

What is the LLC resolution to purchase real estate

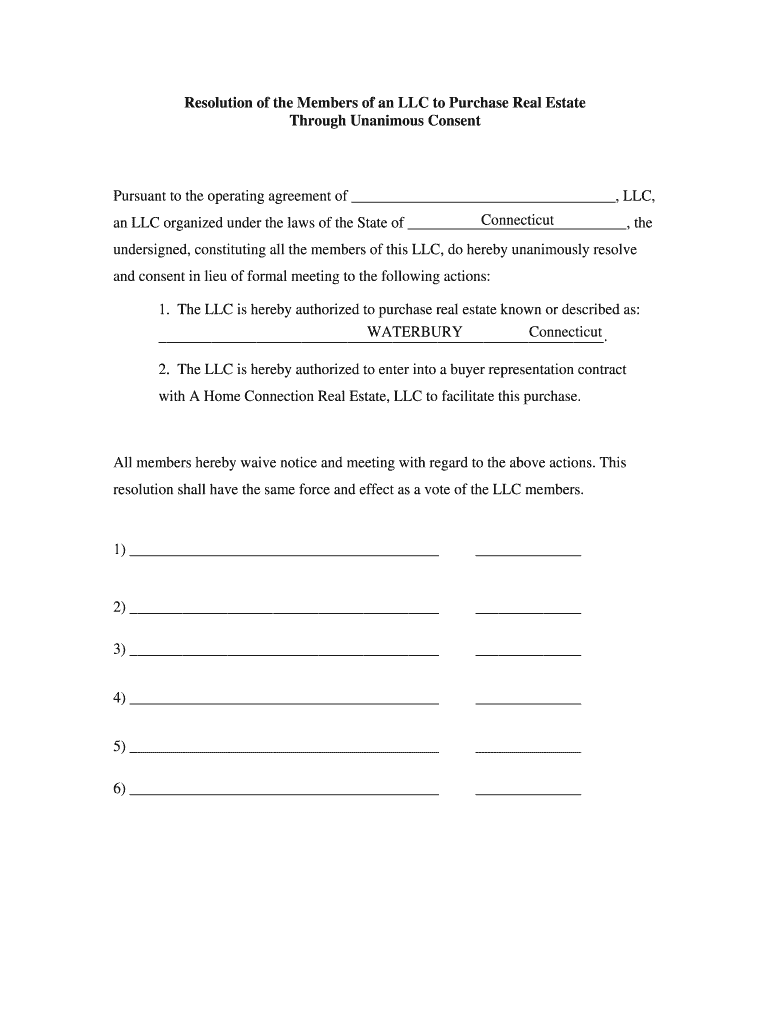

An LLC resolution to purchase real estate is a formal document that authorizes a limited liability company (LLC) to engage in the acquisition of property. This resolution outlines the decision made by the members of the LLC, confirming their agreement to proceed with the purchase. It serves as a record of the decision-making process, ensuring that all members are on the same page regarding the transaction. This document is essential for legal and financial purposes, as it demonstrates that the purchase aligns with the LLC's business objectives and complies with state laws.

How to use the LLC resolution to purchase real estate

Using an LLC resolution to purchase real estate involves several key steps. First, the members of the LLC must convene to discuss and agree on the purchase. Once consensus is reached, the resolution should be drafted, clearly stating the terms of the purchase, including the property details, purchase price, and any contingencies. After the resolution is drafted, it should be signed by all members to validate the agreement. Finally, this document should be stored with the LLC's official records, as it may be required for future reference or legal verification during the transaction process.

Key elements of the LLC resolution to purchase real estate

When drafting an LLC resolution to purchase real estate, several key elements should be included to ensure its completeness and legality:

- Title of the Resolution: Clearly state that this is a resolution to purchase real estate.

- Date of the Meeting: Indicate when the decision was made.

- Property Description: Provide specific details about the property, including address and legal description.

- Purchase Price: State the agreed-upon price for the property.

- Signatures: Include spaces for all members to sign, confirming their approval of the resolution.

- Authorization Clause: A statement authorizing specific individuals to act on behalf of the LLC in the transaction.

Steps to complete the LLC resolution to purchase real estate

Completing an LLC resolution to purchase real estate involves a systematic approach. Follow these steps:

- Schedule a meeting with all LLC members to discuss the proposed property purchase.

- Draft the resolution, ensuring it includes all necessary details and complies with state regulations.

- Present the resolution during the meeting for discussion and amendments if necessary.

- Obtain signatures from all members to finalize the resolution.

- Store the signed resolution in the LLC's official records for future reference.

Legal use of the LLC resolution to purchase real estate

The legal use of an LLC resolution to purchase real estate is crucial for protecting the interests of the LLC and its members. This document must adhere to state laws governing LLC operations and real estate transactions. By formally documenting the decision, the resolution provides legal backing for the purchase, helping to prevent disputes among members. It also serves as evidence that the transaction was conducted in accordance with the LLC's operating agreement and that proper procedures were followed, which is essential for maintaining the liability protection that an LLC offers.

Examples of using the LLC resolution to purchase real estate

There are various scenarios in which an LLC resolution to purchase real estate may be utilized. For instance:

- An LLC may decide to acquire a commercial property to expand its business operations.

- A real estate investment LLC might use a resolution to purchase residential properties for rental purposes.

- Members of an LLC may agree to purchase land for future development or investment opportunities.

In each case, the resolution serves as a formal record of the decision, ensuring that all members are informed and in agreement with the transaction.

Quick guide on how to complete resolution of the members of an llc to purchase real estate

The simplest method to obtain and sign Llc Resolution To Purchase Real Estate

On the scale of an entire organization, ineffective procedures surrounding document approval can consume a signNow amount of productive time. Signing documents such as Llc Resolution To Purchase Real Estate is a standard aspect of operations across all sectors, which is why the effectiveness of each agreement’s lifecycle signNowly impacts the overall success of the business. With airSlate SignNow, signing your Llc Resolution To Purchase Real Estate can be as straightforward and swift as possible. This platform provides the latest version of nearly any form. Even better, you can sign it instantly without the need to install external software on your computer or to print anything as physical copies.

Steps to obtain and sign your Llc Resolution To Purchase Real Estate

- Browse our collection by category or utilize the search box to locate the form you require.

- View the form preview by clicking on Learn more to confirm it’s the right one.

- Hit Get form to start editing immediately.

- Fill out your form and include any essential information using the toolbar.

- When finished, click the Sign tool to autograph your Llc Resolution To Purchase Real Estate.

- Select the signature method that works best for you: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to complete editing and proceed to document-sharing options if needed.

With airSlate SignNow, you possess everything necessary to manage your documentation efficiently. You can find, complete, modify, and even send your Llc Resolution To Purchase Real Estate all within a single tab effortlessly. Optimize your procedures with one intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

Real Estate: How do I best structure a rental property if the bank refuses to title it to an LLC but I still want to operate it out of an LLC?

The bank doesn’t have anything to do with the title to the property.The bank makes loans.What you seem to be saying is that you are buying the property with a partner and you want the bank to loan money to an LLC.Why would the bank do that?The bank needs a first lien on the property to secure the loan. Only the owner of the property can give the bank a first lien. That is you and your partner.If you are saying that you want to create a Limited Liability Company (LLC) with you and your partner as the sole owners, and then have the LLC purchase the property, and you want the bank to loan the money to the LLC to purchase the property, then the answer is simple.The bank is the one who makes the decision about loaning money.If the bank is not comfortable loaning money to a company that, by its very nature and name, has no liability for paying it back, beyond foreclosure on the property, then the bank will not loan the money.The bank would prefer that you and your partner borrow the money.That way, if you do not pay it back, the bank will foreclose on the property and sell it at auction and apply the net proceeds to satisfy your loan.And then, the bank will sue you for the remaining balance and get a deficiency judgment against you for the unpaid part of the loan.And that’s why banks will not loan to an LLC, but will loan to the owner of the LLC.Plus, and I don’t want to scare you with this, if you try to pull some stunt to get around this, you are operating in the area that is called “fraud” and you really don’t want to go there.Accept the decision of the bank, and look for a commercial loan, or to private “hard money lenders” to provide the funds.I hope this helps.Good Luck.Michael Lantrip, Author “How To Do A Section 1031 Like Kind Exchange.”

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

I am a Maryland resident about to purchase real estate in Tennessee (inside of an LLC) - Is there any benefit to creating my LLC in Nevada or Wyoming?

Some states, including Delaware, Nevada and Wyoming, have stronger asset protection laws for an LLC than other states. Primarily, a charging order is the sole remedy of a creditor in a lawsuit. That means a creditor can get a court order to receive any cash flow from the property, but cannot actually seize the property itself. The creditor does not get the right to vote or manage the LLC. So, the LLC can decide not to make any cash distributions and can retain profits for future use.In weak LLC states, a creditor can seize the property in a lawsuit. Would you prefer to lose the golden goose or a few golden eggs?Wyoming allows for an LLC continuation. That means you can form an LLC in one state and then re-locate to Wyoming later if there is a reason, such as a potential lawsuit. It is like putting on your legal battle armor if needed.Many business and real estate attorneys are not knowledgeble in asset protection law. Read some books on asset protection and LLCs. Wyoming LLC fees are lower than Nevada and Delaware.

-

Why is a Delware LLC the best type of company to form to invest in and hold real estate? If not, what is better and why?

It may or may not be "the best" depending on your circumstances - you need to find a lawyer and an accountant for your jurisdiction and ask them.However, here are some of the advantages:It has a separate Court of Chancery, so commercial disputes got handled relatively quickly.Low tax regime.Ability for the owners to be anonymised (though the IRS still get to know - this is about keeping a low profile from people who might try to sue you personally.)You don't have to do business in Delaware to set one up.Low filing and setup costs.A single person can be "all the officers."

-

What is the best state to set up a LLC for residential property rental?

Wherever you are buying your rentals is a good state.But buy in landlord-friendly states, or you may regret it. States like California and New York think rich people are bad, and by virtue of them being rich, they owe everybody else money, despite the fact that said rich people provide thousands of jobs and homes to the population. They don’t think that’s good enough, so they attack them with taxes. Of course, the rich people don’t sit around doing nothing, and they find ways around these taxes. Thus, the citizens who voted these laws in end up being the ones that pay these taxes. Ironic, isn’t it?The conservative states are better for buying property, as they don’t automatically hate landlords and think they’re evil. If you have a professional squatter, you can kick them out relatively easily and relatively quickly. If you’re in a liberal state, you’ll have to go to court and spend a lot of money while losing months and months of income.This isn’t a political debate, but fact. I prefer living in the liberal states, for they are more “live and let live”, but I would never want my money to live there. There’s good things on both sides.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

How does it work to purchase real estate anonymously in an LLC with a registered agent?

There are no set rules for this and it depends on the jurisdiction. Some places do not allow anonymous LLCs. Nevada does though.However the local agent who sets up your LLC will still likely have to know who you are to get an Employer number for you. And they are not sworn to secrecy if your LLC gets investigated. The shell of anonymity you get is pretty thin.

-

What paperwork do I need to fill out to launch an LLC in the state of WA?

WA Secretary of State - Online Registration Form for LLC - $200https://corps.secstate.wa.gov/ll... ... That will give you a Washington State "Certification of Formation" & UBI (Unique Business ID). But don't forget you also have to register with the federal gov to get an EID (Employer Identification Number). The EID is the number you will use to open bank accounts, etc.You can register for that online as well - Free. http://www.irs.gov/businesses/sm...

-

What happens to all of the paper forms you fill out for immigration and customs?

Years ago I worked at document management company. There is cool software that can automate aspects of hand-written forms. We had an airport as a customer - they scanned plenty and (as I said before) this was several years ago...On your airport customs forms, the "boxes" that you 'need' to write on - are basically invisible to the scanner - but are used because then us humans will tend to write neater and clearer which make sit easier to recognize with a computer. Any characters with less than X% accuracy based on a recognition engine are flagged and shown as an image zoomed into the particular character so a human operator can then say "that is an "A". This way, you can rapidly go through most forms and output it to say - an SQL database, complete with link to original image of the form you filled in.If you see "black boxes" at three corners of the document - it is likely set up for scanning (they help to identify and orient the page digitally). If there is a unique barcode on the document somewhere I would theorize there is an even higher likelihood of it being scanned - the document is of enough value to be printed individually which costs more, which means it is likely going to be used on the capture side. (I've noticed in the past in Bahamas and some other Caribbean islands they use these sorts of capture mechanisms, but they have far fewer people entering than the US does everyday)The real answer is: it depends. Depending on each country and its policies and procedures. Generally I would be surprised if they scanned and held onto the paper. In the US, they proably file those for a set period of time then destroy them, perhaps mining them for some data about travellers. In the end, I suspect the "paper-to-data capture" likelihood of customs forms ranges somewhere on a spectrum like this:Third world Customs Guy has paper to show he did his job, paper gets thrown out at end of shift. ------> We keep all the papers! everything is scanned as you pass by customs and unique barcodes identify which flight/gate/area the form was handed out at, so we co-ordinate with cameras in the airport and have captured your image. We also know exactly how much vodka you brought into the country. :)

Create this form in 5 minutes!

How to create an eSignature for the resolution of the members of an llc to purchase real estate

How to generate an eSignature for your Resolution Of The Members Of An Llc To Purchase Real Estate in the online mode

How to make an electronic signature for the Resolution Of The Members Of An Llc To Purchase Real Estate in Chrome

How to make an eSignature for putting it on the Resolution Of The Members Of An Llc To Purchase Real Estate in Gmail

How to generate an eSignature for the Resolution Of The Members Of An Llc To Purchase Real Estate from your mobile device

How to make an eSignature for the Resolution Of The Members Of An Llc To Purchase Real Estate on iOS

How to generate an electronic signature for the Resolution Of The Members Of An Llc To Purchase Real Estate on Android devices

People also ask

-

What is an LLC resolution template?

An LLC resolution template is a document that outlines important decisions made by the members of a limited liability company. This template serves as a formal record of the resolutions approved, ensuring compliance with legal requirements. Using a well-crafted LLC resolution template can streamline business processes and maintain organizational clarity.

-

How does airSlate SignNow simplify creating an LLC resolution template?

airSlate SignNow offers customizable LLC resolution templates that can be tailored to meet your specific business needs. With its intuitive interface, you can easily edit and adjust the template to include relevant details for your LLC. This simplification not only saves time but also enhances accuracy in your documentation.

-

Is there a cost associated with using the LLC resolution template on airSlate SignNow?

Yes, there is a pricing structure for using airSlate SignNow, which includes access to various document templates including the LLC resolution template. The cost-efficient plans ensure that businesses of all sizes can utilize top-notch e-signature solutions. For exact prices, you can visit our pricing page for detailed information.

-

What are the benefits of using an LLC resolution template?

Using an LLC resolution template provides numerous benefits, including legal protection, organizational clarity, and improved accountability. It serves as a formal record for crucial decisions and makes it easier for LLC members to reference past actions. With airSlate SignNow, you can eSign these templates easily, ensuring they are both legally binding and securely stored.

-

Can I integrate the LLC resolution template with other software?

Absolutely! airSlate SignNow offers multiple integrations with popular business applications, allowing you to seamlessly use the LLC resolution template with your existing workflows. This integration capability ensures you can manage documents efficiently without disrupting your regular operations. Check our integration section for a list of compatible software.

-

What types of businesses should use an LLC resolution template?

Any business structured as a limited liability company can benefit from using an LLC resolution template. Whether you operate a small business or a larger enterprise, formalizing decisions through this template fosters transparency and helps maintain compliance. It's a crucial tool for any LLC looking to establish a solid operational foundation.

-

Are there any specific features included in airSlate SignNow's LLC resolution template?

Yes, airSlate SignNow's LLC resolution template includes features like customizable fields, e-signature capabilities, and cloud storage for easy access. These features ensure that your LLC resolution is both personalized and legally effective. Additionally, the user-friendly platform enhances your overall experience when creating and managing this essential document.

Get more for Llc Resolution To Purchase Real Estate

Find out other Llc Resolution To Purchase Real Estate

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe