Net Does System Windows Forms Have a Non Static Messagebox

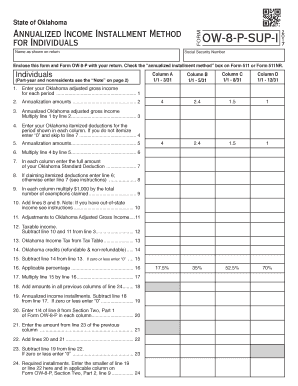

Understanding annualized income

Annualized income refers to the total income a person or business expects to earn over a year. This figure is crucial for various financial assessments, including loan applications and tax filings. It can be calculated by taking a monthly income and multiplying it by twelve or by aggregating all sources of income over the year. Understanding this concept helps individuals and businesses plan their finances more effectively.

How to calculate annualized income

Calculating annualized income is straightforward. Follow these steps:

- Identify all sources of income, including salaries, bonuses, and any additional earnings.

- For monthly income, multiply the monthly figure by twelve.

- For irregular income, sum all earnings over the year.

- Consider deductions and taxes that may apply to arrive at a net annualized income.

IRS guidelines on annualized income

The Internal Revenue Service (IRS) provides specific guidelines on how to report annualized income on tax returns. It is essential for taxpayers to accurately report their income to avoid penalties. The IRS allows for the annualization of income in certain situations, such as when calculating estimated taxes for self-employed individuals. Understanding these guidelines ensures compliance and helps in proper tax planning.

Required documents for reporting annualized income

When reporting annualized income, certain documents are necessary to substantiate claims. These may include:

- W-2 forms for employees

- 1099 forms for independent contractors

- Pay stubs reflecting monthly earnings

- Bank statements showing deposits

Having these documents ready aids in accurate reporting and can simplify the filing process.

Penalties for inaccurate reporting of annualized income

Inaccurate reporting of annualized income can lead to significant penalties from the IRS. Common consequences include:

- Fines for underreporting income

- Interest on unpaid taxes

- Potential audits

Ensuring that annualized income is reported correctly is crucial to avoid these penalties.

Eligibility criteria for annualized income calculations

Eligibility for calculating annualized income may vary based on individual circumstances. Generally, anyone earning income can calculate their annualized income. However, specific criteria may apply for self-employed individuals or businesses, such as:

- Consistent income streams

- Documentation of all earnings

- Compliance with IRS regulations

Understanding these criteria helps in accurately determining annualized income for various financial needs.

Quick guide on how to complete messagebox windows forms

Effortlessly Prepare messagebox windows forms on Any Device

Managing documents online has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without hassle. Handle annualized income from any device using the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

The easiest method to modify and electronically sign messagebox windows forms effortlessly

- Find system windows forms messagebox and click Get Form to initiate.

- Use the tools provided to complete your form.

- Emphasize important sections of your documents or obscure sensitive data with the tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Choose how you'd like to share your form, either via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign annualized income and ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs messagebox windows forms

-

How many application forms does a person need to fill out in his/her lifetime?

As many as you want to !

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

When do I have to learn how to fill out a W-2 form?

Form W-2 is an obligatory form to be completed by every employer. Form W-2 doesn’t have to be filled out by the employee. It is given to inform the employee about the amount of his annual income and taxes withheld from it.You can find a lot of information here: http://bit.ly/2NjjlJi

-

Does a marine on deployment have to fill a form out?

As an 0331 I was pointed in the right direction and deployed. No forms, had more shots in 2 days than I ever thought possible. Flew from LAX to Hawaii to Okinawa then LPD 9 USS Denver to Da Nang. As a PFC at the time no forms I can recall. Made out my will in Boot Camp. No Visa, no port entry inspection, Just grab your gear and go. During my 18 months in South East Asia I deployed 6 different times from Vietnam, Okinawa and the Philippines. No paperwork involved on my part. Probably why they didn’t know where I was for 3 month’s in 1971. I found this out when I was approved for Agent Orange benefits in 2014. I told them. Back then it was an office pogue that typed out your military record on a remington typewriter, hard copy using the sneaker net. So stuff got misplaced or just not done. Who Knows, at least I got my orders to cross the pond and 45 days payed vacation at home. So the important stuff was done. Still didn’t do paperwork to stand down and go home.

-

Does the Aakash institute help us to fill out the NEET form or do we have to fill it out by ourselves (I'm a non-attending student and I have not taken admission into a school with the help of the Aakash institute)?

No Aakash won’t help you in filling the NEET application, they will just help you in updating about NEET like when is the application coming and what is the last date of submission of the application. After filling up the application, they will just ask your roll number, registration number and etc.Don’t worry filling of NEET application is not difficult, just follow the instructions given in the information bulletin and with the help of your elders fill it.hope it helps…!!

-

When does a candidate have to fill out a post preference form for SSC CGL?

At the time of filling intial enrolement for exam . The notification of the exam was expected on 11 march but wait it will come shortly . You can subscribe my channel MrSSC for latest devlopments.

Related searches to system windows forms messagebox

Create this form in 5 minutes!

How to create an eSignature for the annualized income

How to create an electronic signature for the Net Does Systemwindowsforms Have A Non Static Messagebox in the online mode

How to generate an electronic signature for your Net Does Systemwindowsforms Have A Non Static Messagebox in Google Chrome

How to make an eSignature for putting it on the Net Does Systemwindowsforms Have A Non Static Messagebox in Gmail

How to make an eSignature for the Net Does Systemwindowsforms Have A Non Static Messagebox straight from your smart phone

How to make an eSignature for the Net Does Systemwindowsforms Have A Non Static Messagebox on iOS

How to create an eSignature for the Net Does Systemwindowsforms Have A Non Static Messagebox on Android devices

People also ask system windows forms messagebox

-

What is annualized income and why is it important for my business?

Annualized income refers to the total income a business generates over a year, adjusted to a standard annual format. Understanding your annualized income is crucial for budgeting, forecasting, and evaluating business performance. It helps you make informed decisions regarding investments and expenditures.

-

How can airSlate SignNow help in managing contracts that affect annualized income?

airSlate SignNow streamlines the signing and management of contracts, which can signNowly impact your annualized income. By facilitating quick eSigning processes, you can accelerate the time to close deals and improve cash flow. Keeping contracts organized also helps you monitor income sources more effectively.

-

Does airSlate SignNow offer pricing plans based on annualized income?

While airSlate SignNow doesn't have pricing plans specifically based on annualized income, our tiered pricing model provides options to suit businesses of various sizes and revenues. This flexibility ensures you can choose a plan that aligns with your operational needs and budget. Review our pricing page for detailed information.

-

Can I track changes in my annualized income using airSlate SignNow?

Yes, airSlate SignNow allows you to track your document workflows and transactions, which can contribute to calculating your annualized income. The platform’s analytics features help you monitor contract statuses and closing times, giving insights into income trends. By analyzing this data, you can refine your strategies for improved results.

-

What features does airSlate SignNow offer that can help improve annualized income?

airSlate SignNow provides features like automated reminders and document templates that can enhance efficiency in transactions affecting your annualized income. These tools minimize delays in contract signings, leading to faster revenue recognition. Additionally, integrating with your CRM can help in tracking sales performance linked to annualized income.

-

Is it easy to integrate airSlate SignNow with other financial tools to manage annualized income?

Absolutely, airSlate SignNow offers integrations with various financial and accounting tools, simplifying the management of your annualized income. Whether you use CRM systems or other financial applications, seamless integration ensures that all income-related documents are easily accessible. This connectivity enhances your ability to analyze financial data effectively.

-

How does efficient document management affect my annualized income projections?

Efficient document management through airSlate SignNow can signNowly improve your annualized income projections. By ensuring quick access to contracts and eSigned documents, you reduce the risk of delays that can affect your financial forecasts. An organized workflow contributes to a more accurate assessment of expected revenues over the year.

Get more for annualized income

- Wpa form 2

- Abcc cori formpdffillercom

- Request for departmental action fee transmittal form 2011

- Caregiver authorization affidavit massachusetts editable form

- Mass gov abcc form

- Anrad wetland fee transmittal form mass gov mass

- Mercury certification for vehicle recyclers amp mobile mass gov mass form

- Membership renewal form 13 season

Find out other messagebox windows forms

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now