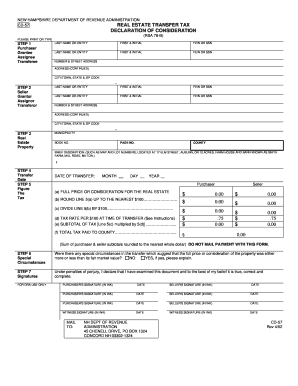

Nh Department of Revenue Form

What is the Nh Department Of Revenue Form

The Nh Department Of Revenue Form is an essential document used for various tax-related purposes within the state of New Hampshire. This form is primarily utilized by individuals and businesses to report income, claim deductions, and ensure compliance with state tax regulations. The specific requirements and sections of the form may vary depending on the type of tax being reported, such as income tax or property tax. Understanding the purpose of this form is crucial for accurate and timely tax reporting.

How to use the Nh Department Of Revenue Form

Using the Nh Department Of Revenue Form involves several steps to ensure proper completion and submission. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, carefully fill out each section of the form, ensuring that all information is accurate and complete. After completing the form, review it for any errors before submitting it to the appropriate state department. Depending on the specific form, you may have the option to submit it electronically or by mail.

Steps to complete the Nh Department Of Revenue Form

Completing the Nh Department Of Revenue Form requires attention to detail. Follow these steps for a successful submission:

- Gather all relevant financial documents, such as W-2s, 1099s, and receipts.

- Read the instructions carefully to understand the requirements for the specific form.

- Fill out the form, ensuring that all personal and financial information is accurate.

- Double-check for any missing information or errors.

- Sign and date the form as required.

- Submit the form electronically through the state’s online portal or mail it to the designated address.

Legal use of the Nh Department Of Revenue Form

The Nh Department Of Revenue Form is legally binding when completed and submitted according to state regulations. To ensure its legal validity, it is important to comply with all requirements outlined by the New Hampshire Department of Revenue Administration. This includes providing accurate information and adhering to deadlines. Failure to comply with these regulations may result in penalties or legal repercussions.

Form Submission Methods

The Nh Department Of Revenue Form can be submitted through various methods, providing flexibility for users. The primary submission methods include:

- Online Submission: Many forms can be submitted electronically via the New Hampshire Department of Revenue Administration's online portal, offering a quick and efficient option.

- Mail: Users can print the completed form and mail it to the appropriate address specified in the form instructions.

- In-Person: Some forms may also be submitted in person at designated state offices, allowing for direct interaction with tax officials.

Required Documents

To complete the Nh Department Of Revenue Form, several documents may be required. These typically include:

- Income statements such as W-2s and 1099s.

- Receipts for deductible expenses.

- Previous tax returns for reference.

- Any additional documentation specified in the form instructions.

Quick guide on how to complete nh department of revenue form

Complete Nh Department Of Revenue Form seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your paperwork swiftly without delays. Handle Nh Department Of Revenue Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Nh Department Of Revenue Form effortlessly

- Find Nh Department Of Revenue Form and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize essential sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or overlooked documents, time-consuming form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign Nh Department Of Revenue Form and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nh department of revenue form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NH Department Of Revenue Form used for?

The NH Department Of Revenue Form is utilized for various tax-related submissions and documentation needs. It allows businesses to report their income, deductions, and other tax information accurately. Using airSlate SignNow, you can easily eSign and manage these forms digitally.

-

How can airSlate SignNow help with the NH Department Of Revenue Form?

With airSlate SignNow, you can streamline the process of filling out and signing the NH Department Of Revenue Form. Our platform enables users to complete documents quickly and securely from any device. This enhances efficiency and ensures that your forms are submitted on time.

-

What are the pricing options for airSlate SignNow regarding the NH Department Of Revenue Form?

airSlate SignNow offers competitive pricing plans that cater to different needs, including the management of the NH Department Of Revenue Form. You can choose from monthly or annual subscriptions, and each plan provides essential features for efficient document management. Our pricing is designed to be affordable for businesses of all sizes.

-

Is there a mobile app for managing the NH Department Of Revenue Form?

Yes, airSlate SignNow offers a mobile app that allows users to manage the NH Department Of Revenue Form on the go. This mobile solution provides a convenient way to fill out, sign, and send documents from any location. The app ensures that you can handle your tax forms with ease, whether in the office or remote.

-

Can multiple users collaborate on the NH Department Of Revenue Form using airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to collaborate seamlessly on the NH Department Of Revenue Form. You can share documents, assign roles, and track changes in real-time, ensuring that all stakeholders can contribute to the completion of the form effectively.

-

What security measures does airSlate SignNow implement for the NH Department Of Revenue Form?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like the NH Department Of Revenue Form. We implement robust encryption protocols and secure cloud storage to protect your data. Additionally, our platform complies with industry-standard regulations to ensure your privacy.

-

Are there any integrations available for airSlate SignNow when dealing with the NH Department Of Revenue Form?

Yes, airSlate SignNow integrates with various software tools to enhance your experience with the NH Department Of Revenue Form. You can connect with tools like CRMs, cloud storage, and productivity apps to streamline your workflow. These integrations help facilitate smoother document handling and data transfer.

Get more for Nh Department Of Revenue Form

Find out other Nh Department Of Revenue Form

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy