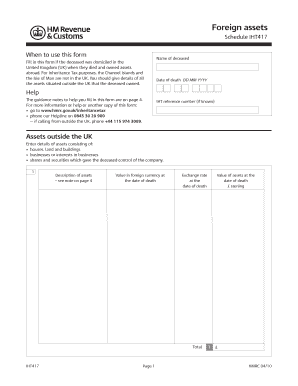

Iht407 Form

What is the Iht407

The Iht407 is a specific form used in the United States for reporting the value of an estate for tax purposes. It is part of the estate tax process and is typically filed by the executor or administrator of an estate. This form helps determine the tax liability of an estate after the death of an individual. Understanding the Iht407 is essential for ensuring compliance with federal tax regulations.

How to use the Iht407

To use the Iht407 effectively, the executor must gather all relevant information regarding the deceased's assets and liabilities. This includes real estate, bank accounts, investments, and any debts owed by the estate. Once all necessary information is compiled, the executor can begin filling out the form, ensuring that all sections are completed accurately to reflect the true value of the estate.

Steps to complete the Iht407

Completing the Iht407 involves several key steps:

- Gather all financial documents related to the deceased's assets and liabilities.

- Fill out the personal information section, including the deceased's name, date of death, and Social Security number.

- List all assets, including real estate, personal property, and financial accounts, along with their fair market values.

- Detail any outstanding debts or liabilities of the estate.

- Review the completed form for accuracy and completeness before submission.

Legal use of the Iht407

The Iht407 is legally binding when filled out correctly and submitted to the appropriate tax authorities. It serves as an official document that can be used in legal proceedings or audits. Ensuring that the form complies with the Internal Revenue Service (IRS) guidelines is crucial for avoiding potential penalties or legal issues.

Required Documents

When preparing to file the Iht407, certain documents are necessary to support the information provided on the form. These may include:

- Death certificate of the deceased.

- Current appraisals of real estate and other significant assets.

- Bank statements and investment account statements.

- Documentation of any debts owed by the estate.

Form Submission Methods

The Iht407 can be submitted through various methods, including:

- Online submission via the IRS e-file system, if applicable.

- Mailing a paper copy of the form to the designated IRS address.

- In-person submission at local IRS offices, if necessary.

Quick guide on how to complete iht407 22555607

Prepare Iht407 effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents quickly without interruptions. Manage Iht407 on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related operations today.

The easiest method to alter and electronically sign Iht407 with ease

- Locate Iht407 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, or an invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Alter and electronically sign Iht407 and ensure outstanding communication at any phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the iht407 22555607

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is iht407 and how does it work with airSlate SignNow?

The iht407 is a specific document format that can be easily managed with airSlate SignNow. This powerful eSignature tool allows you to send, sign, and store iht407 documents securely and efficiently, streamlining your workflow.

-

What are the pricing options for airSlate SignNow related to iht407 usage?

airSlate SignNow offers various pricing plans that cater to different business needs when dealing with iht407 documents. Each plan includes features designed to facilitate the efficient handling of documents, providing excellent value for your investment.

-

How can airSlate SignNow enhance my business processes related to iht407?

By using airSlate SignNow for iht407 documents, your business can improve efficiency, reduce turnaround times, and enhance collaboration. The platform simplifies the signing process, allowing stakeholders to sign documents from anywhere, improving overall productivity.

-

Does airSlate SignNow support integrations for managing iht407 documents?

Yes, airSlate SignNow supports a variety of integrations that enable seamless management of iht407 documents. These integrations make it easy to connect with other tools you already use, enhancing your overall document workflow.

-

What security measures are in place for iht407 documents in airSlate SignNow?

airSlate SignNow prioritizes security for all documents, including iht407. With robust encryption, secure cloud storage, and compliance with industry standards, you can confidently manage sensitive documents without compromising security.

-

How does airSlate SignNow compare to other eSignature solutions for iht407?

airSlate SignNow stands out among eSignature solutions for managing iht407 documents due to its user-friendly interface and extensive features. Businesses can rely on its comprehensive toolkit to easily send and sign documents while ensuring compliance and security.

-

Can I track the status of my iht407 documents with airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features for your iht407 documents, allowing you to monitor their status in real-time. This transparency helps you stay organized and informed about the signing process.

Get more for Iht407

- The total money makeover pdf full download form

- Child support forms wa 09 280b

- Waive 90 day waiting period divorce iowa form

- Rccl medical examination form

- Pediatric nutrition reference guide pdf form

- Reservation agreement avida land form

- Osha complaint form pdf

- Advisorship acceptance letter mindanao university of must edu form

Find out other Iht407

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple