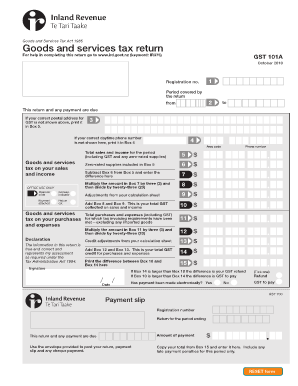

Gst101a Form

What is the ebkary?

The ebkary is a specific form used for various administrative and legal purposes. It serves as an essential document for individuals and businesses to communicate information accurately and efficiently. Understanding the ebkary is crucial for ensuring compliance with relevant regulations and for facilitating smooth transactions.

How to use the ebkary

Using the ebkary involves several straightforward steps. First, ensure you have the correct version of the form. Next, gather all necessary information required to fill out the form accurately. This may include personal details, financial information, or other relevant data. Once completed, review the form for accuracy before submission to avoid delays or rejections.

Steps to complete the ebkary

Completing the ebkary requires careful attention to detail. Follow these steps for successful completion:

- Obtain the ebkary form from a reliable source.

- Read the instructions thoroughly to understand the requirements.

- Fill out the form with accurate information, ensuring all fields are completed.

- Double-check your entries for any errors or omissions.

- Sign and date the form as required.

- Submit the form according to the specified guidelines, whether online, by mail, or in person.

Legal use of the ebkary

The ebkary must be used in compliance with applicable laws and regulations. This includes ensuring that all information provided is truthful and accurate. Legal use also involves understanding the implications of submitting the form, as inaccuracies or omissions can lead to penalties or legal repercussions.

Key elements of the ebkary

Several key elements define the ebkary and its purpose:

- Identification Information: Details that identify the individual or business submitting the form.

- Purpose of the Form: A clear statement of why the ebkary is being submitted.

- Signature: A required signature that validates the information provided.

- Date: The date on which the form is completed and submitted.

Form Submission Methods

The ebkary can typically be submitted through various methods, depending on the requirements set forth by the issuing authority. Common submission methods include:

- Online Submission: Many forms can be completed and submitted electronically through designated websites.

- Mail: Physical copies of the ebkary can be printed and mailed to the appropriate office.

- In-Person: Some situations may require individuals to submit the form in person at a designated location.

Quick guide on how to complete gst101a

Effortlessly prepare Gst101a on any device

The management of online documents has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools needed to create, edit, and electronically sign your documents swiftly and without complications. Manage Gst101a on any device with the airSlate SignNow applications for Android or iOS, and streamline any document-related process today.

The easiest way to edit and eSign Gst101a with minimal effort

- Obtain Gst101a and then click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize applicable sections of the documents or obscure confidential details with the tools that airSlate SignNow provides specifically for this purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and then click the Done button to save your modifications.

- Select how you wish to send your form, whether via email, text message (SMS), invite link, or by downloading it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign Gst101a and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gst101a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ebkary, and how does it relate to airSlate SignNow?

EbKary is a powerful tool integrated with airSlate SignNow, designed to streamline the document management process. It enables users to efficiently send and electronically sign documents within a secure environment, ensuring compliance and enhancing productivity.

-

What pricing plans are available for ebkary with airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to various business sizes, including options tailored for ebkary users. Each plan includes essential features that allow businesses to manage their documents effectively, making it a cost-effective solution for digital document signing.

-

What features does ebkary provide within airSlate SignNow?

EbKary users benefit from a range of features within airSlate SignNow, including customizable templates, real-time tracking, and bulk sending capabilities. These features empower businesses to enhance their document workflows and ensure a seamless signing experience for all parties involved.

-

How can ebkary improve my business’s document workflow?

Implementing ebkary within airSlate SignNow can signNowly enhance your document workflow by automating repetitive tasks and reducing manual effort. This allows businesses to focus on more strategic activities while ensuring that documents are signed quickly and securely.

-

Is ebkary easy to integrate with other software solutions?

Yes, ebkary is designed to easily integrate with various software solutions, enhancing the functionality of airSlate SignNow. This seamless integration means that your existing tools can work together, improving overall productivity and document management efficiency.

-

What benefits can I expect from using ebkary with airSlate SignNow?

Using ebkary with airSlate SignNow offers numerous benefits, including increased efficiency in document handling, enhanced security measures, and improved collaboration among team members. These advantages help businesses enhance their operational efficiency while maintaining a high level of document integrity.

-

Are there any security features in ebkary for document signing?

Absolutely, ebkary includes robust security features within airSlate SignNow that protect your documents during the signing process. With advanced encryption, authentication methods, and compliance with industry standards, you can trust that your sensitive information remains safe.

Get more for Gst101a

Find out other Gst101a

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer