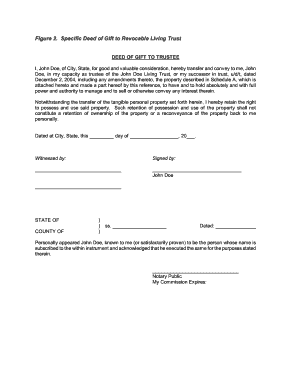

General Deed of Gift to Revocable Living Trust Form

What is the General Deed of Gift to Revocable Living Trust

The general deed of gift to revocable living trust is a legal document that allows an individual to transfer ownership of assets into a trust while retaining the ability to revoke or amend the trust during their lifetime. This type of deed is essential for estate planning, as it helps manage assets and provides clarity on how they will be distributed upon the grantor's death. The trust remains flexible, allowing for changes to be made as circumstances evolve.

How to Use the General Deed of Gift to Revocable Living Trust

Using the general deed of gift to revocable living trust involves several steps. First, the grantor must identify the assets they wish to transfer into the trust. This can include real estate, bank accounts, or personal property. Next, the grantor fills out the deed, specifying the details of the trust and the assets being transferred. Once completed, the deed should be signed, dated, and notarized to ensure its legal validity. Finally, the grantor must formally fund the trust by transferring the assets, which may require additional documentation depending on the asset type.

Steps to Complete the General Deed of Gift to Revocable Living Trust

Completing the general deed of gift to revocable living trust involves a clear process:

- Gather necessary information about the assets to be transferred.

- Draft the deed, including the names of the grantor and trustee.

- Clearly describe each asset being transferred.

- Sign the document in the presence of a notary public.

- Distribute copies of the signed deed to relevant parties.

- Transfer ownership of the assets to the trust, ensuring all legal requirements are met.

Legal Use of the General Deed of Gift to Revocable Living Trust

The legal use of the general deed of gift to revocable living trust is governed by state laws that dictate how trusts are created and managed. It is crucial for the grantor to comply with these laws to ensure the deed is enforceable. This includes adhering to specific requirements for execution, such as witnessing and notarization. Additionally, the trust must be properly funded to be effective, meaning that the assets must be legally transferred into the trust's name.

Key Elements of the General Deed of Gift to Revocable Living Trust

Several key elements must be included in the general deed of gift to revocable living trust for it to be valid:

- The full legal name and address of the grantor.

- The full legal name and address of the trustee.

- A detailed description of the assets being transferred.

- Clear language indicating that the transfer is a gift to the trust.

- Signatures of the grantor and a notary public.

State-Specific Rules for the General Deed of Gift to Revocable Living Trust

State-specific rules can significantly impact the execution of the general deed of gift to revocable living trust. Each state has its own regulations regarding trust formation, asset transfer, and the requirements for valid deeds. It is essential for individuals to consult their state laws or seek legal advice to ensure compliance. This may include variations in notarization requirements, tax implications, and the treatment of certain types of assets.

Quick guide on how to complete general deed of gift to revocable living trust

Complete General Deed Of Gift To Revocable Living Trust effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage General Deed Of Gift To Revocable Living Trust on any device using airSlate SignNow Android or iOS apps and streamline any document-related operation today.

The easiest way to alter and eSign General Deed Of Gift To Revocable Living Trust without hassle

- Locate General Deed Of Gift To Revocable Living Trust and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, be it via email, SMS, or invitation link, or download it to your computer.

Say goodbye to missing or lost documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign General Deed Of Gift To Revocable Living Trust and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the general deed of gift to revocable living trust

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a general deed of gift to revocable living trust?

A general deed of gift to revocable living trust is a legal document that allows an individual to transfer assets into a trust while retaining the right to amend or revoke the trust. This document helps protect your assets and manage them according to your wishes, making it a vital part of estate planning.

-

How does using airSlate SignNow simplify the general deed of gift to revocable living trust process?

airSlate SignNow simplifies the process of creating a general deed of gift to revocable living trust by providing an easy-to-use platform for drafting, signing, and managing your legal documents. With our intuitive interface, users can quickly create and customize their deeds, streamlining the workflow signNowly.

-

What are the benefits of a general deed of gift to revocable living trust?

The benefits of a general deed of gift to revocable living trust include ensuring your assets are distributed according to your wishes, avoiding probate, and maintaining privacy. Additionally, it allows for flexibility, as you can change or revoke the trust at any time during your lifetime.

-

Is airSlate SignNow cost-effective for managing a general deed of gift to revocable living trust?

Yes, airSlate SignNow offers a cost-effective solution for managing your general deed of gift to revocable living trust. With various pricing plans available, you can choose one that fits your budget while benefiting from unlimited document signing and collaboration features.

-

Can I integrate airSlate SignNow with other software for my general deed of gift to revocable living trust?

Absolutely! airSlate SignNow offers seamless integrations with popular software and applications, making it easier to manage your general deed of gift to revocable living trust alongside your existing tools. This enhances productivity and ensures a smooth workflow.

-

What features does airSlate SignNow provide for creating a general deed of gift to revocable living trust?

AirSlate SignNow provides several features for creating a general deed of gift to revocable living trust, including customizable templates, digital signing options, and secure cloud storage. These features will help you ensure your documents are completed accurately and securely.

-

How can airSlate SignNow help with the legal validity of a general deed of gift to revocable living trust?

Using airSlate SignNow guarantees that your general deed of gift to revocable living trust meets legal standards, as the platform guides you through the necessary steps to ensure compliance. Additionally, the use of electronic signatures is legally recognized across many jurisdictions.

Get more for General Deed Of Gift To Revocable Living Trust

Find out other General Deed Of Gift To Revocable Living Trust

- How Do I Sign Oregon Bank Loan Proposal Template

- Help Me With Sign Oregon Bank Loan Proposal Template

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe