Form Tsp 17

What is the Form Tsp 17

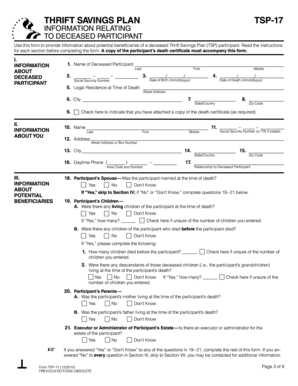

The Form Tsp 17 is a document used primarily for the Thrift Savings Plan (TSP), which is a retirement savings plan for federal employees and members of the uniformed services. This form is essential for participants who wish to make changes to their account, including contributions, withdrawals, or beneficiary designations. Understanding the purpose and function of the tsp 17 form is crucial for effective retirement planning and management.

How to use the Form Tsp 17

Using the Form Tsp 17 involves several steps to ensure that your requests are processed accurately. First, download the form from the official TSP website or obtain a physical copy through your agency. Next, carefully fill out the required sections, providing accurate personal information and details about the changes you wish to make. Once completed, submit the form according to the provided instructions, either online or via mail, ensuring you retain a copy for your records.

Steps to complete the Form Tsp 17

Completing the Form Tsp 17 requires attention to detail. Follow these steps:

- Download the form from the official TSP website.

- Read the instructions thoroughly to understand the requirements.

- Fill in your personal information, including your name, Social Security number, and TSP account number.

- Indicate the specific changes you wish to make, such as contribution adjustments or beneficiary updates.

- Review the form for accuracy before submission.

- Submit the completed form according to the guidelines provided, ensuring you keep a copy for your records.

Legal use of the Form Tsp 17

The legal use of the Form Tsp 17 is governed by federal regulations pertaining to retirement plans. To ensure that your submission is legally binding, it is essential to comply with all instructions and requirements outlined in the form. This includes providing accurate information and signatures where necessary. Utilizing a trusted electronic signature platform can enhance the legal validity of your submission, ensuring compliance with relevant eSignature laws.

Key elements of the Form Tsp 17

Several key elements are critical to the Form Tsp 17. These include:

- Personal Information: Accurate details about the participant, such as name and Social Security number.

- Account Changes: Clear indication of the changes being requested, such as contribution rates or beneficiary designations.

- Signature: A signature is required to validate the form, confirming that the information provided is true and accurate.

- Date: The date of submission is necessary for processing and record-keeping purposes.

Form Submission Methods

The Form Tsp 17 can be submitted through various methods to accommodate participants' preferences. Options include:

- Online Submission: Many participants opt to submit the form electronically through the TSP website, which often provides a quicker processing time.

- Mail: Participants can also print the completed form and send it via postal mail to the designated TSP address.

- In-Person: Some may choose to submit the form in person at their agency's human resources office, ensuring immediate confirmation of receipt.

Quick guide on how to complete form tsp 17

Accomplish Form Tsp 17 effortlessly on any gadget

Digital document management has become favored by organizations and individuals alike. It presents an ideal eco-friendly alternative to conventional printed and signed forms, enabling you to retrieve the necessary document and securely keep it online. airSlate SignNow equips you with all the features required to generate, alter, and electronically sign your files rapidly without delays. Handle Form Tsp 17 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign Form Tsp 17 without hassle

- Find Form Tsp 17 and click Get Form to commence.

- Utilize the tools we offer to fill out your document.

- Emphasize essential sections of your files or redact sensitive details with tools specifically provided by airSlate SignNow for that very purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to preserve your modifications.

- Choose how you wish to submit your document, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate the printing of new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Form Tsp 17 ensuring outstanding communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form tsp 17

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is tsp 17 and how does it relate to airSlate SignNow?

TSP 17 refers to the specific version of our secure signing technology that airSlate SignNow employs. It ensures that your documents are eSigned securely and legally, allowing businesses to streamline their workflow while maintaining compliance.

-

How much does airSlate SignNow cost for using tsp 17?

The pricing for airSlate SignNow utilizing tsp 17 starts with a competitive monthly subscription. We offer various plans that cater to the needs of small businesses to large enterprises, ensuring you get the most effective eSigning solution at a reasonable price.

-

What features does tsp 17 offer with airSlate SignNow?

TSP 17 enhances airSlate SignNow with advanced features such as customizable templates, real-time tracking, and secure cloud storage. These features allow users to manage their document workflows efficiently while enjoying the security and reliability of our platform.

-

What benefits can businesses expect from using tsp 17 with airSlate SignNow?

Businesses that implement tsp 17 with airSlate SignNow can expect faster document turnaround times, reduced paper-related costs, and higher compliance with legal regulations. This translates into increased productivity and a signNow boost in operational efficiency.

-

Can airSlate SignNow with tsp 17 integrate with other software?

Yes, airSlate SignNow using tsp 17 integrates seamlessly with a wide range of applications, including CRM systems, cloud storage services, and project management tools. This flexibility enables businesses to create a cohesive digital environment that enhances overall workflow.

-

Is tsp 17 secure for sensitive documents?

Absolutely! TSP 17 is designed with stringent security protocols to safeguard sensitive documents during the eSigning process. airSlate SignNow ensures data encryption and compliance with industry standards, providing peace of mind to businesses.

-

How can I get started with airSlate SignNow and tsp 17?

Getting started with airSlate SignNow and tsp 17 is simple. Just visit our website, choose a pricing plan that suits your needs, and sign up for an account. You’ll have access to a user-friendly interface designed to make document management as easy as possible.

Get more for Form Tsp 17

Find out other Form Tsp 17

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form