Form 1118

What is the Form 1118

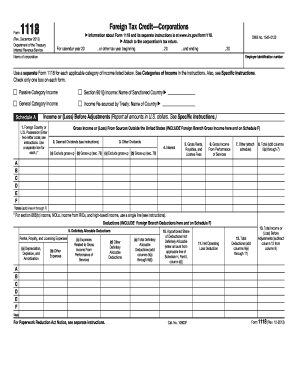

The Form 1118, also known as the Foreign Tax Credit—Corporations, is a tax form used by U.S. corporations to claim a credit for foreign taxes paid or accrued during the tax year. This form helps corporations avoid double taxation on income earned abroad. By utilizing the Form 1118, businesses can effectively reduce their U.S. tax liability, making it a crucial tool for companies operating internationally.

How to use the Form 1118

To use the Form 1118, corporations must first determine the amount of foreign taxes paid or accrued. This includes taxes on income, profits, or gains imposed by foreign countries. After calculating the eligible foreign taxes, businesses complete the form by providing necessary details, such as the type of income and the country where the taxes were paid. The completed Form 1118 is then submitted with the corporation's tax return, allowing the IRS to process the foreign tax credit claim.

Steps to complete the Form 1118

Completing the Form 1118 involves several key steps:

- Gather all relevant financial documents, including records of foreign income and taxes paid.

- Calculate the total foreign taxes paid or accrued for the tax year.

- Fill out the form, ensuring that all information is accurate and complete.

- Attach any required schedules or supporting documentation.

- Review the form for errors before submitting it with your corporate tax return.

Legal use of the Form 1118

The legal use of the Form 1118 is governed by IRS regulations. To ensure compliance, corporations must accurately report foreign taxes and adhere to the rules outlined in the Internal Revenue Code. The form must be filed within the specified deadlines, and any inaccuracies may lead to penalties or disallowance of the foreign tax credit. Maintaining thorough records of foreign income and taxes is essential for legal compliance.

Filing Deadlines / Important Dates

Corporations must be aware of specific deadlines when filing the Form 1118. Typically, the form is due on the same date as the corporation's tax return, which is usually the fifteenth day of the fourth month following the end of the tax year. For corporations operating on a calendar year, this means the deadline is April 15. Extensions may be available, but it is crucial to file the Form 1118 timely to avoid penalties.

Required Documents

When completing the Form 1118, corporations should prepare the following required documents:

- Financial statements detailing foreign income.

- Records of foreign taxes paid or accrued.

- Any relevant tax treaties that may affect the credit.

- Supporting schedules that provide additional details about foreign operations.

Eligibility Criteria

To be eligible to use the Form 1118, corporations must meet specific criteria. They must be U.S. corporations that have paid or accrued foreign taxes on income earned outside the United States. Additionally, the foreign taxes must be imposed on income, profits, or gains. Understanding these eligibility requirements is essential for corporations seeking to benefit from the foreign tax credit.

Quick guide on how to complete form 1118

Complete Form 1118 effortlessly on any device

Digital document management has gained traction among enterprises and individuals alike. It offers an environmentally friendly substitute for conventional printed and signed paperwork, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Form 1118 on any system with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Form 1118 without hassle

- Locate Form 1118 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred delivery method for your form: via email, text message (SMS), invitation link, or download to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Form 1118 and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1118

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 1118 and how does it work with airSlate SignNow?

Form 1118 is a crucial IRS tax form used by U.S. corporations to claim a foreign tax credit. airSlate SignNow simplifies the process of submitting form 1118 by allowing users to eSign and share documents securely and efficiently, streamlining your tax filing experience.

-

How can I send form 1118 using airSlate SignNow?

To send form 1118 with airSlate SignNow, simply upload the document onto our platform, add the recipients’ email addresses, and request an eSignature. Our intuitive interface ensures that the entire process is quick and user-friendly.

-

Is there a cost associated with sending form 1118 through airSlate SignNow?

Yes, airSlate SignNow offers competitive pricing plans that cater to different business needs. You can send form 1118 and enjoy unlimited eSignatures with our affordable monthly subscriptions or pay-per-use options.

-

What features does airSlate SignNow offer for managing form 1118?

airSlate SignNow offers features like customizable templates, secure storage, and real-time tracking for sent form 1118 documents. These tools enhance document management and ensure your filings are timely and organized.

-

How secure is the transmission of form 1118 with airSlate SignNow?

Security is a priority at airSlate SignNow; we use industry-standard encryption protocols to protect your form 1118 during transmission and storage. You can confidently eSign and share sensitive documents without compromising data integrity.

-

Can I integrate airSlate SignNow with other applications for form 1118?

Absolutely! airSlate SignNow seamlessly integrates with various apps such as Google Drive and Dropbox, allowing you to manage and send form 1118 effortlessly alongside your other business tools. This connectivity enhances productivity and collaboration.

-

What benefits does airSlate SignNow provide for processing form 1118?

Using airSlate SignNow for form 1118 offers numerous benefits, including reduced paper usage, improved turnaround time for signatures, and enhanced compliance with tax regulations. This solution helps businesses save time and resources.

Get more for Form 1118

- Chem 2600 organic chemistry ii susan findlay form

- Green shield claim form for ltc 2015 2019

- Ainp 008b 2014 2019 form

- Printable ocf 18 forms 2010

- Driver experience certificate format marathi 2015 2019

- Vehicle import form form 1 13 0132 2018 2019

- Material and information is to be forwarded to the ontario municipal board by the clerk of the municipality within 15 days

- Ladys island eagles youth football and cheerleading form

Find out other Form 1118

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation