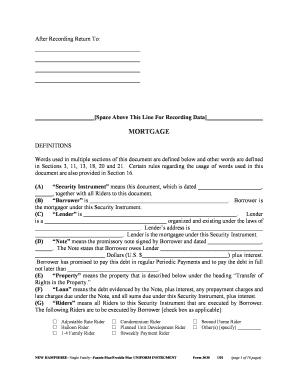

Sample Mortgage Form in New Hampshire

What is a quit claim deed form in New Hampshire?

A quit claim deed form in New Hampshire is a legal document used to transfer ownership of real estate from one party to another without any guarantees or warranties regarding the title. This form is particularly useful in situations where the property is being transferred between family members or in divorce settlements. Unlike other types of deeds, a quit claim deed does not ensure that the grantor has clear title to the property, making it essential for both parties to understand the implications of this transfer.

Key elements of the quit claim deed form in New Hampshire

The quit claim deed form in New Hampshire includes several critical elements that must be present for the document to be valid:

- Grantor and Grantee Information: The full names and addresses of both the person transferring the property (grantor) and the person receiving it (grantee).

- Property Description: A detailed description of the property being transferred, including its address and any relevant parcel identification numbers.

- Consideration: The amount of money or value exchanged for the property, which may be nominal in family transfers.

- Signature: The grantor must sign the document in the presence of a notary public to validate the transfer.

- Notarization: The signature must be notarized to ensure authenticity and compliance with state laws.

Steps to complete the quit claim deed form in New Hampshire

Completing a quit claim deed form in New Hampshire involves several straightforward steps:

- Obtain the Form: Access the quit claim deed form, which can typically be found online or at local government offices.

- Fill Out the Form: Provide all necessary details, including grantor and grantee information, property description, and consideration.

- Sign the Document: The grantor must sign the form in front of a notary public to authenticate the transfer.

- File the Deed: Submit the completed and notarized deed to the appropriate county registry of deeds to ensure it is officially recorded.

Legal use of the quit claim deed form in New Hampshire

The quit claim deed form in New Hampshire is legally recognized and can be used for various purposes, including transferring property between family members, clearing title issues, or in divorce settlements. However, it is crucial to understand that this type of deed does not provide any guarantees about the property's title. Therefore, the grantee assumes the risk associated with any potential claims against the property. Legal advice may be beneficial to ensure that all parties understand their rights and responsibilities when using this form.

State-specific rules for the quit claim deed form in New Hampshire

New Hampshire has specific regulations governing the use of quit claim deeds. Some important considerations include:

- Recording Requirements: The deed must be recorded at the county registry of deeds to be effective against third parties.

- Transfer Tax: Depending on the circumstances of the transfer, a transfer tax may apply, which needs to be paid at the time of recording.

- Legal Description: The property description must be precise and comply with state standards to avoid any disputes.

Who issues the quit claim deed form in New Hampshire?

The quit claim deed form is not issued by a specific agency in New Hampshire. Instead, it is available for download from various legal resources, including state government websites and legal document providers. Once completed, the form must be submitted to the local county registry of deeds for recording. It is advisable to ensure that the form complies with state laws and includes all necessary information before submission.

Quick guide on how to complete sample mortgage form in new hampshire

Complete Sample Mortgage Form In New Hampshire effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and safely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents swiftly without any delays. Handle Sample Mortgage Form In New Hampshire on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Sample Mortgage Form In New Hampshire seamlessly

- Find Sample Mortgage Form In New Hampshire and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or conceal sensitive information using tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your edits.

- Select how you wish to share your form, via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and eSign Sample Mortgage Form In New Hampshire and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sample mortgage form in new hampshire

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a quit claim deed form in New Hampshire?

A quit claim deed form in New Hampshire is a legal document used to transfer ownership of real estate. It allows one party to relinquish their interest in a property to another party without making any guarantees about the title's validity. This type of deed is often used among family members or in situations where the parties know each other well.

-

How do I obtain a quit claim deed form for New Hampshire?

You can obtain a quit claim deed form for New Hampshire through various online platforms, including airSlate SignNow. Our platform provides a customizable and easy-to-use quit claim deed form New Hampshire template that you can fill out and eSign quickly, ensuring compliance with state regulations.

-

What are the benefits of using airSlate SignNow for a quit claim deed form in New Hampshire?

Using airSlate SignNow for your quit claim deed form in New Hampshire offers simplicity and convenience. Our platform allows you to easily customize your forms and eSign them securely, saving you time and reducing paperwork hassle. Additionally, you can track the status of your documents in real-time.

-

Is there a cost associated with the quit claim deed form New Hampshire from airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow for your quit claim deed form New Hampshire, but it is competitively priced and designed to be budget-friendly for individuals and businesses. We offer various subscription plans to fit different needs, ensuring you only pay for what you use.

-

Does airSlate SignNow provide support for quit claim deed forms in New Hampshire?

Absolutely! airSlate SignNow offers customer support to assist you with any questions or issues regarding your quit claim deed form New Hampshire. Whether you need help with filling out the form or using our electronic signing features, our support team is here to help.

-

Can I integrate airSlate SignNow with other software for my quit claim deed form?

Yes, airSlate SignNow can integrate seamlessly with various third-party applications, enhancing your workflow for the quit claim deed form New Hampshire. This allows you to manage your documents alongside other platforms like CRMs and cloud storage for a more efficient process.

-

How long does it take to complete a quit claim deed form with airSlate SignNow?

Completing a quit claim deed form in New Hampshire through airSlate SignNow typically takes just a few minutes. With our user-friendly interface, you can quickly fill out the necessary information and eSign, making it a fast and efficient option for document management.

Get more for Sample Mortgage Form In New Hampshire

Find out other Sample Mortgage Form In New Hampshire

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document