Il Form

What is the IL-2000?

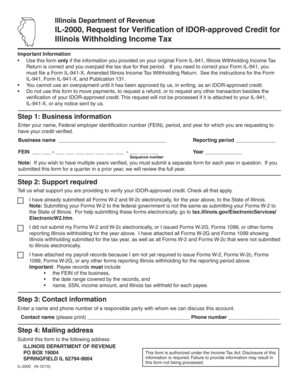

The IL-2000 is an important tax form used in Illinois for specific tax reporting purposes. It is primarily utilized by individuals and businesses to report income and calculate tax liabilities. Understanding the IL-2000 is crucial for ensuring compliance with state tax regulations and avoiding potential penalties.

How to Use the IL-2000

Using the IL-2000 involves several key steps. First, gather all necessary financial documents, such as W-2s, 1099s, and any other income statements. Next, accurately fill out the form, ensuring all information is complete and correct. Finally, submit the form either electronically or by mail, depending on your preference and eligibility.

Steps to Complete the IL-2000

Completing the IL-2000 requires careful attention to detail. Follow these steps:

- Collect all relevant income documentation.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income accurately.

- Calculate your total tax liability based on the provided instructions.

- Review the form for accuracy before submission.

Legal Use of the IL-2000

The IL-2000 must be used in accordance with Illinois tax laws. This means ensuring that all reported income is legitimate and that deductions claimed are allowable under state regulations. Failure to comply with these legal requirements can result in penalties or additional scrutiny from tax authorities.

Filing Deadlines / Important Dates

It is essential to be aware of filing deadlines for the IL-2000 to avoid late fees or penalties. Typically, the form must be submitted by April 15th of each year for individual taxpayers. However, extensions may be available under certain circumstances. Always check for the latest updates regarding deadlines, as they can vary year to year.

Required Documents

To complete the IL-2000, you will need several documents, including:

- W-2 forms from employers.

- 1099 forms for other income sources.

- Records of any deductions or credits you plan to claim.

- Proof of payments made towards estimated taxes, if applicable.

Form Submission Methods

The IL-2000 can be submitted through various methods. Taxpayers may choose to file electronically using approved software, which often provides a streamlined process. Alternatively, the form can be mailed to the appropriate tax authority or submitted in person at designated locations. Ensure to follow the instructions specific to your chosen submission method for proper processing.

Quick guide on how to complete il

Effortlessly Complete Il on Any Device

The management of online documents has gained immense traction among businesses and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to find the correct form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Il on any device using airSlate SignNow's applications for Android or iOS and enhance any document-related process today.

How to Edit and eSign Il with Ease

- Find Il and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Highlight important sections of your documents or obscure sensitive information using tools specifically designed for this purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors requiring new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign Il to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the il

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is il 2000 in relation to airSlate SignNow?

Il 2000 refers to the year 2000, and in the context of airSlate SignNow, it represents a new era of digital document solutions. Our platform allows businesses to transition from traditional methods to streamlined electronic signatures, enhancing efficiency and productivity.

-

How can airSlate SignNow help my business in il 2000?

In il 2000, businesses were beginning to understand the importance of digital solutions. airSlate SignNow supports companies in achieving a paperless workspace by facilitating easy document signing and management, which saves time and reduces operational costs.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers several pricing plans tailored to different business needs, starting from basic to premium options. Each plan is designed to provide maximum value, ensuring that even businesses operating since il 2000 can afford a seamless way to manage their documents.

-

What features does airSlate SignNow offer?

airSlate SignNow includes a range of features such as document editing, advanced templates, and cloud storage. Designed with usability in mind, these features help users effectively manage their document workflows, reflecting innovations that have evolved since il 2000.

-

Is airSlate SignNow compliant with industry regulations?

Yes, airSlate SignNow is compliant with various industry regulations such as eIDAS and ESIGN Act. This compliance ensures that your documents remain legally binding, giving businesses peace of mind when transitioning to digital solutions since the era of il 2000.

-

Can airSlate SignNow integrate with other software?

Absolutely! airSlate SignNow seamlessly integrates with various popular applications to enhance your workflow. This compatibility provides businesses with the ability to build a complete digital ecosystem without losing track of operations that started evolving in il 2000.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow for eSigning offers numerous benefits, including time savings, improved accuracy, and reduced carbon footprint. These advantages have become indispensable for businesses looking to thrive in a digital landscape that emerged around il 2000.

Get more for Il

- Temporary transfer form h3 midland football league

- Rock paper scissors probability form

- Certificate of buyer of taxable fuel lmc form

- Army packing list example form

- Lesson 7 problem solving practice distance on the coordinate plane answer key form

- Application for registration as a citizen of malta form

- Old candle barn order form gift shop

- In the matter of the application of for admission to the bar of american samoa application to the honorable chief justice of form

Find out other Il

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free