Taxpayer Consent Form

What is the taxpayer consent form?

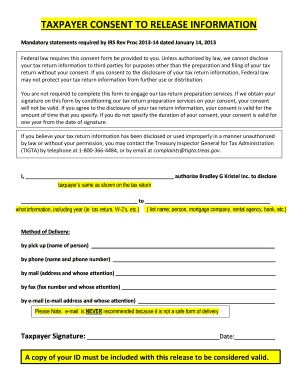

The taxpayer consent form is a document that allows a tax professional to obtain permission from a taxpayer to disclose sensitive tax information to third parties. This form is essential for ensuring compliance with privacy regulations, particularly under Section 7216 of the Internal Revenue Code. It serves as a legal safeguard for both the taxpayer and the tax preparer, ensuring that all parties understand the scope and limitations of the information shared.

How to use the taxpayer consent form

Using the taxpayer consent form involves several straightforward steps. First, the taxpayer must fill out the form with accurate personal information, including their name, Social Security number, and the specific information they consent to share. Next, the taxpayer must sign and date the form, indicating their agreement. The tax professional then retains the signed form for their records and may use it to disclose the specified information to authorized third parties, such as financial institutions or other tax preparers.

Steps to complete the taxpayer consent form

Completing the taxpayer consent form requires careful attention to detail. Here are the steps to follow:

- Obtain the taxpayer consent form, either in digital format or as a printed document.

- Fill in the taxpayer's personal details, including full name and Social Security number.

- Specify the information that the taxpayer consents to share, ensuring clarity on what is included.

- Have the taxpayer review the form for accuracy and completeness.

- Obtain the taxpayer's signature and date the form to finalize the consent.

- Store the signed form securely for future reference and compliance purposes.

Legal use of the taxpayer consent form

The legal use of the taxpayer consent form is governed by specific regulations, primarily under Section 7216 of the Internal Revenue Code. This section mandates that tax preparers obtain written consent from taxpayers before disclosing any tax return information. Failure to comply with this requirement can result in penalties for the tax preparer, including fines and potential legal action. Therefore, it is crucial for tax professionals to ensure that the consent form is properly executed and retained in accordance with legal guidelines.

Key elements of the taxpayer consent form

Several key elements must be included in the taxpayer consent form to ensure its validity:

- Taxpayer Information: Full name, address, and Social Security number.

- Scope of Consent: A clear description of what information the taxpayer is consenting to share.

- Signature: The taxpayer's signature, confirming their consent.

- Date: The date on which the consent was given.

- Tax Preparer Information: Name and contact details of the tax professional requesting consent.

IRS guidelines

The IRS provides specific guidelines regarding the use of the taxpayer consent form. According to IRS regulations, tax preparers must obtain written consent before disclosing any taxpayer information to third parties. The consent must clearly outline the nature of the information being shared and the purpose of the disclosure. Tax preparers are also required to keep a copy of the signed consent form for a minimum of three years after the tax return has been filed. Adhering to these guidelines helps protect taxpayer privacy and ensures compliance with federal laws.

Quick guide on how to complete taxpayer consent form

Complete Taxpayer Consent Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely keep it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents swiftly without delays. Handle Taxpayer Consent Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to adjust and eSign Taxpayer Consent Form with ease

- Locate Taxpayer Consent Form and click Get Form to begin.

- Utilize the features we provide to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns over missing or misplaced files, monotonous form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Modify and eSign Taxpayer Consent Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the taxpayer consent form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a taxpayer consent form, and why is it important?

A taxpayer consent form is a legal document that allows a taxpayer to grant permission for specific actions concerning their tax-related information. It's important because it ensures compliance with privacy laws and helps streamline communication between the taxpayer and relevant parties, like tax professionals or financial institutions.

-

How does airSlate SignNow facilitate the signing of taxpayer consent forms?

airSlate SignNow provides a user-friendly platform for creating and eSigning taxpayer consent forms. With easy document sharing and secure electronic signatures, businesses can efficiently manage the consent process, ensuring faster turnaround times while maintaining compliance with legal standards.

-

Are there any costs associated with using airSlate SignNow for taxpayer consent forms?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs regarding taxpayer consent forms. Each plan provides a range of features, and you can choose the one that best aligns with your document signing requirements and budget.

-

Can airSlate SignNow integrate with other tools for managing taxpayer consent forms?

Absolutely! airSlate SignNow seamlessly integrates with numerous applications, such as CRM systems and accounting software. This capability allows businesses to efficiently manage taxpayer consent forms alongside their existing workflows, enhancing overall productivity.

-

What features does airSlate SignNow offer for completing taxpayer consent forms?

airSlate SignNow includes features such as customizable templates for taxpayer consent forms, secure eSigning, and multi-party signing options. With these features, users can create efficient workflows that simplify the process of obtaining consent from multiple stakeholders.

-

Is it secure to use airSlate SignNow for taxpayer consent forms?

Yes, airSlate SignNow prioritizes security, using top-notch encryption to protect your taxpayer consent forms and sensitive information. Additionally, the platform complies with various industry regulations, ensuring that your documents remain confidential and secure throughout the signing process.

-

How can I track the status of my taxpayer consent forms using airSlate SignNow?

airSlate SignNow provides robust tracking features that allow you to monitor the status of your taxpayer consent forms in real-time. You can see who has signed the document and receive notifications when actions are completed, making it easy to stay updated on the signing process.

Get more for Taxpayer Consent Form

Find out other Taxpayer Consent Form

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF