Nbk Loan Form

What is the nbk loan?

The nbk loan is a financial product designed specifically for expatriates looking to secure funding while living abroad. This type of loan typically offers competitive interest rates and flexible repayment terms, making it an attractive option for those who may not have traditional credit histories in the United States. The nbk loan can be used for various purposes, including purchasing a home, financing education, or covering personal expenses.

How to obtain the nbk loan

Obtaining an nbk loan involves several key steps. First, potential borrowers should assess their eligibility, which may include factors such as income, creditworthiness, and residency status. Next, applicants must gather necessary documentation, including proof of income, identification, and any relevant financial statements. Once prepared, individuals can submit their application through the nbk's designated channels, either online or in person, depending on their preference.

Steps to complete the nbk loan

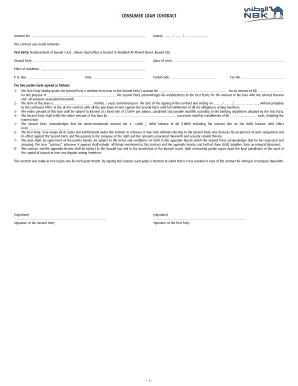

Completing the nbk loan process requires careful attention to detail. Start by filling out the loan application form accurately, ensuring all personal and financial information is correct. After submission, the lender will review the application, which may involve a credit check and verification of the provided documents. If approved, borrowers will receive a loan agreement outlining the terms and conditions, which must be signed to finalize the loan. It is crucial to read this agreement thoroughly before signing to understand all obligations.

Legal use of the nbk loan

The legal use of the nbk loan is governed by various regulations that ensure both the lender and borrower adhere to fair lending practices. Borrowers must use the funds for the purposes specified in the loan agreement, whether for personal, educational, or investment needs. Failure to comply with these terms can result in penalties, including the possibility of loan default. Understanding these legal implications is essential for maintaining a good financial standing.

Required documents

To successfully apply for the nbk loan, applicants must prepare a set of required documents. Commonly needed items include:

- Proof of identity (e.g., passport or driver's license)

- Proof of income (e.g., pay stubs, tax returns)

- Bank statements

- Employment verification

- Any additional financial documentation as requested by the lender

Having these documents ready can streamline the application process and improve the chances of approval.

Eligibility criteria

Eligibility for the nbk loan typically depends on several factors. Applicants should generally meet the following criteria:

- Must be an expatriate residing in the United States

- Must have a stable source of income

- Must demonstrate a good credit history or provide alternative financial documentation

- Must meet any additional requirements set by the lender

Understanding these criteria can help potential borrowers prepare their applications more effectively.

Quick guide on how to complete nbk loan

Complete Nbk Loan effortlessly on any gadget

Digital document management has gained traction among enterprises and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage Nbk Loan on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and eSign Nbk Loan without hassle

- Locate Nbk Loan and click Get Form to begin.

- Utilize the tools we offer to submit your document.

- Emphasize relevant sections of the document or conceal sensitive details using tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to share your form: via email, SMS, invitation link, or download it to your PC.

Forget about lost or misplaced files, tedious document searches, or errors that require new document copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and eSign Nbk Loan and ensure exceptional communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nbk loan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nbk loan for expats?

The nbk loan for expats is a financial product designed specifically for expatriates living in Kuwait. It provides competitive interest rates and flexible repayment options, making it easier for expatriates to manage their finances while living abroad.

-

Who can apply for the nbk loan for expats?

Any expatriate residing in Kuwait with a valid residency permit can apply for the nbk loan for expats. Applicants should also have a stable income and meet the bank's credit assessment criteria for a successful application.

-

What are the benefits of the nbk loan for expats?

The nbk loan for expats offers several benefits, including quick processing times, customizable loan amounts, and flexible repayment periods. It allows expatriates to achieve their financial goals without the stress of cumbersome paperwork.

-

What documents do I need to apply for the nbk loan for expats?

To apply for the nbk loan for expats, applicants typically need to provide identity documents, proof of income, and residency permits. Additional documentation may be required based on individual circumstances, so it's advisable to check with the bank for specific details.

-

How long does it take to process the nbk loan for expats?

The processing time for the nbk loan for expats generally takes a few business days once all required documents are submitted. The quick turnaround is designed to facilitate a smooth and efficient experience for expatriates needing financial assistance.

-

Are there any hidden fees with the nbk loan for expats?

With the nbk loan for expats, transparency is a priority, and any applicable fees should be clearly outlined during the application process. It's important for applicants to review the terms and conditions to ensure they understand all potential costs involved.

-

Can I manage my nbk loan for expats online?

Yes, borrowers can easily manage their nbk loan for expats online through the bank's digital banking platform. This allows expats to track their loan status, make repayments, and access essential documents from anywhere.

Get more for Nbk Loan

- School refusal assessment scale printable form

- Althafer senior placement and referral services althafer assisted form

- Temple university letterhead form

- Example of promissory note for baptism for not yet marriage form

- Etrade com online distribution form

- Mastering inventory final exam answers form

- Buying or selling a vehicle in illinois form

- Imm 5782 e application to voluntarily renounce permanent resident status imm5782e pdf form

Find out other Nbk Loan

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online