Nh 1099 Irs Form

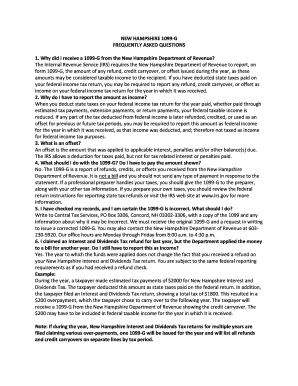

What is the NH 1099 IRS?

The NH 1099 IRS form is a crucial tax document used in the state of New Hampshire. It is primarily issued to report various types of income, such as interest, dividends, and other earnings that are subject to taxation. This form is essential for both individuals and businesses to ensure compliance with state tax laws. Understanding the specifics of the NH 1099 IRS can help taxpayers accurately report their income and avoid potential penalties.

Steps to Complete the NH 1099 IRS

Completing the NH 1099 IRS form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to the income being reported, including any W-2 forms or other income statements. Next, accurately fill out the form by entering the payer's information, the recipient's details, and the total amount of income. It is important to double-check all entries for accuracy. Once completed, the form should be submitted to the appropriate state tax authority by the specified deadline.

Legal Use of the NH 1099 IRS

The NH 1099 IRS form is legally recognized for reporting income to the state. To ensure its legal validity, the form must be filled out correctly and submitted on time. Compliance with state regulations is essential, as failure to do so can result in penalties or audits. Utilizing trusted digital tools for completion and submission can enhance the legal standing of the document, ensuring that it meets all necessary requirements.

Filing Deadlines / Important Dates

Timely filing of the NH 1099 IRS form is critical to avoid penalties. The deadline for submitting this form typically aligns with federal tax deadlines, which are usually set for the end of January for the previous tax year. It is advisable to check the New Hampshire Department of Revenue Administration's website for any specific updates or changes to these deadlines. Keeping track of these dates ensures that taxpayers remain compliant and avoid unnecessary fines.

Who Issues the Form

The NH 1099 IRS form is typically issued by businesses, financial institutions, and other entities that make payments to individuals or other businesses. This includes employers reporting wages, banks reporting interest income, and corporations reporting dividends. Each issuer is responsible for providing accurate information on the form to ensure that recipients can report their income correctly.

Penalties for Non-Compliance

Failure to file the NH 1099 IRS form or inaccuracies in reporting can lead to significant penalties. The New Hampshire Department of Revenue Administration may impose fines for late submissions or incorrect information. Additionally, taxpayers may face further scrutiny during audits, which can result in additional financial repercussions. Understanding these penalties underscores the importance of accurate and timely submissions.

Quick guide on how to complete nh 1099 irs

Effortlessly prepare Nh 1099 Irs on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents quickly and efficiently. Manage Nh 1099 Irs on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

Edit and electronically sign Nh 1099 Irs with ease

- Obtain Nh 1099 Irs and click on Get Form to begin.

- Make use of the tools available to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select how you would like to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Nh 1099 Irs to ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nh 1099 irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 1099g nh and how does it work with airSlate SignNow?

A 1099g nh is a tax form used in New Hampshire to report certain types of income, including unemployment compensation. With airSlate SignNow, you can easily eSign and manage your 1099g nh documents electronically, ensuring a smooth and efficient filing process.

-

How can airSlate SignNow help me manage my 1099g nh forms?

airSlate SignNow provides a user-friendly platform for securely sending, signing, and storing your 1099g nh forms. You can track the status of your documents in real-time, ensuring you stay organized and compliant with tax regulations.

-

What are the pricing options for using airSlate SignNow for 1099g nh?

airSlate SignNow offers flexible pricing plans to suit different business needs, including options for high volume users of 1099g nh forms. These plans are designed to be cost-effective, providing tools to manage your documents efficiently without breaking the bank.

-

Is airSlate SignNow legally compliant for signing 1099g nh documents?

Yes, airSlate SignNow is legally compliant and complies with eSignature laws, making it safe and reliable for signing 1099g nh documents electronically. You can trust that your signed forms are valid and compliant with New Hampshire tax requirements.

-

Can I integrate airSlate SignNow with other tools to handle my 1099g nh documents?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications, enabling you to streamline your workflow for 1099g nh documents. This integration ensures you can consolidate tasks and maintain an efficient document management system.

-

What features does airSlate SignNow offer for managing 1099g nh documents?

airSlate SignNow provides features like customizable templates, automated workflows, and real-time tracking for 1099g nh documents. These tools help enhance productivity by simplifying the process of creating, sending, and signing important tax forms.

-

How secure is my information when using airSlate SignNow for 1099g nh forms?

Security is a top priority at airSlate SignNow; your information is protected by robust encryption and compliance with industry standards. This ensures that your sensitive data related to 1099g nh forms remains confidential and secure throughout the signing process.

Get more for Nh 1099 Irs

Find out other Nh 1099 Irs

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement