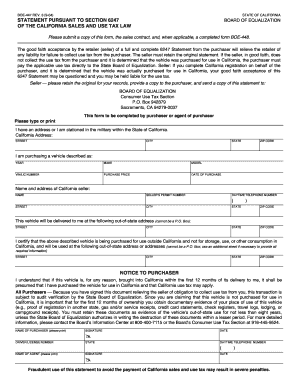

Boe447 Form

What is the Boe447

The Boe447 is a specific form used primarily in the context of business and taxation in the United States. It is essential for organizations to accurately report certain financial information to the relevant authorities. This form plays a crucial role in ensuring compliance with federal regulations and helps maintain transparency in business operations.

How to use the Boe447

Using the Boe447 involves several straightforward steps. First, gather all necessary information related to your business activities and financial transactions. Next, fill out the form with accurate data, ensuring that all sections are completed. Once the form is filled, review it for any errors or omissions before submission. It is important to keep a copy for your records, as it may be required for future reference or audits.

Steps to complete the Boe447

Completing the Boe447 requires careful attention to detail. Follow these steps:

- Gather required documents, including financial statements and identification numbers.

- Fill in the form with accurate and up-to-date information.

- Double-check all entries for accuracy.

- Sign and date the form where indicated.

- Submit the form through the appropriate channel, whether online, by mail, or in person.

Legal use of the Boe447

The legal use of the Boe447 is governed by various federal regulations. To ensure that the form is legally binding, it must be completed accurately and submitted within the specified deadlines. Compliance with the relevant laws, such as the Internal Revenue Code, is crucial to avoid penalties or legal issues. Additionally, using a trusted platform for electronic submission can enhance the validity of the document.

Key elements of the Boe447

Several key elements are critical when completing the Boe447. These include:

- Accurate identification of the business entity.

- Detailed financial information relevant to the reporting period.

- Signatures from authorized representatives.

- Compliance with all applicable laws and regulations.

Form Submission Methods

The Boe447 can be submitted through various methods, providing flexibility for users. Options typically include:

- Online submission via a secure platform, which is often the fastest method.

- Mailing the completed form to the designated office, ensuring it is postmarked by the deadline.

- In-person submission at specified locations, which may be required for certain types of businesses.

Quick guide on how to complete boe447

Complete Boe447 effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Boe447 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to adjust and eSign Boe447 effortlessly

- Find Boe447 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to submit your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Boe447 and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the boe447

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is boe447 and how does it relate to airSlate SignNow?

Boe447 is a specific identifier that can enhance your experience with airSlate SignNow. It signifies our dedicated features or integrations that are tailored for seamless document management and eSigning solutions. Understanding boe447 can help you leverage our tools for maximum efficiency.

-

What features does airSlate SignNow offer related to boe447?

AirSlate SignNow boasts numerous features associated with boe447, including user-friendly document editing, secure eSigning, and cloud storage options. These features are designed to simplify your workflow and ensure that your documents are managed efficiently. Explore these capabilities to fully utilize the potential of boe447.

-

How does pricing work for airSlate SignNow with boe447 functionality?

Pricing for airSlate SignNow that includes boe447 capabilities is designed to be cost-effective and transparent. We offer various subscription plans to fit different business needs, providing access to all features related to boe447. Check our pricing page for specific plans tailored for your requirements.

-

Can I integrate boe447 with other software applications?

Yes, airSlate SignNow supports various integrations with popular software applications, including those that utilize boe447. This allows for a streamlined workflow where you can combine multiple tools to enhance productivity. Check our integrations page for a complete list of compatible applications.

-

What benefits does boe447 bring to my document signing process?

The inclusion of boe447 in your document signing process offers enhanced security, ease of use, and quick turnaround times. By utilizing boe447 features, you can signNowly reduce the time spent on document management while ensuring your agreements are signed promptly. This makes your business operations more efficient.

-

Is there a trial period available for airSlate SignNow with boe447 features?

Absolutely! airSlate SignNow offers a trial period that allows prospective customers to explore the boe447 features free of charge. During this trial, you can test all functionalities and see how boe447 can benefit your document signing needs before committing to a subscription.

-

How does airSlate SignNow handle security concerning boe447?

Security is a priority for airSlate SignNow, especially with features related to boe447. We implement strong encryption protocols and adhere to industry standards to protect your documents and sensitive information. You can trust that your data is secure while using our services.

Get more for Boe447

- Modified fatigue impact scale form

- Section 31 certificate form

- Peu membership form online

- Sacsa primary netball score sheets form

- Kalamazoo county clerk marriage license form

- Co operative society application form pdf 398383503

- New process with respect to form 8802 application

- Form 2290 sp rev july heavy vehicle use tax return spanish version

Find out other Boe447

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now