Form 2290 Sp Rev July Heavy Vehicle Use Tax Return Spanish Version 2024-2026

Understanding the Heavy Vehicle Use Tax Return

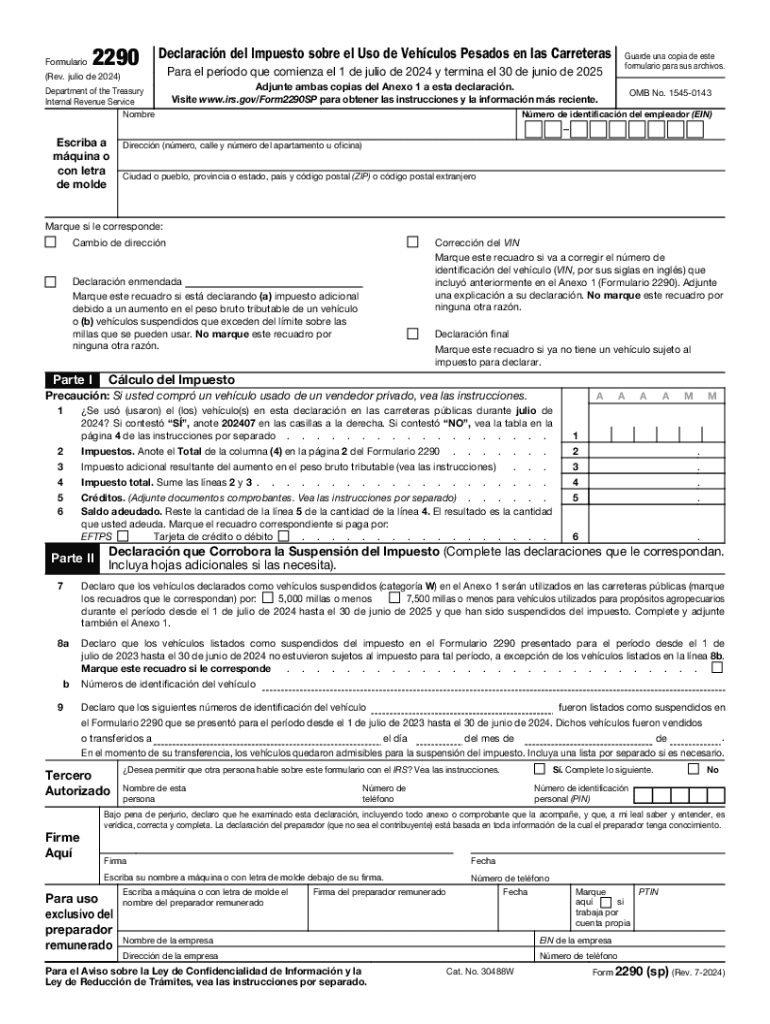

The Form 2290 sp Rev July, known as the Heavy Vehicle Use Tax Return, is a crucial document for individuals and businesses operating heavy vehicles in the United States. This form is specifically designed for vehicles with a gross weight of 55,000 pounds or more. It allows taxpayers to report and pay the heavy vehicle use tax, which is essential for maintaining roads and highways. Understanding this form is vital for compliance with federal regulations and avoiding penalties.

Steps to Complete the Heavy Vehicle Use Tax Return

Completing the Form 2290 sp Rev July involves several key steps:

- Gather Required Information: Collect details about your vehicle, including the Vehicle Identification Number (VIN), gross weight, and the date of first use.

- Calculate Your Tax: Determine the amount of tax owed based on the vehicle's weight and usage. The IRS provides a tax table to assist with this calculation.

- Fill Out the Form: Accurately complete the form, ensuring all information is correct to avoid delays or issues.

- Submit the Form: Choose your submission method, whether online, by mail, or in person, and ensure it is sent before the deadline.

Obtaining the Heavy Vehicle Use Tax Return

The Form 2290 sp Rev July can be obtained through various channels. The IRS website provides downloadable versions of the form in both English and Spanish. Additionally, tax preparation software may offer this form as part of their services. It is essential to ensure you have the most current version of the form to comply with any updates or changes in tax law.

Filing Deadlines for the Heavy Vehicle Use Tax Return

Timely filing of the Form 2290 sp Rev July is crucial to avoid penalties. The IRS requires that this form be filed annually, with the deadline typically falling on the last day of the month following the end of the tax period. For example, if your vehicle was first used in July, the form must be filed by August 31st of the same year. Keeping track of these deadlines helps ensure compliance and avoids unnecessary fees.

Penalties for Non-Compliance

Failure to file the Form 2290 sp Rev July on time can result in significant penalties. The IRS imposes a penalty of up to five percent of the unpaid tax for each month the return is late, with a maximum penalty of 25 percent. Additionally, interest may accrue on any unpaid taxes. Understanding these penalties emphasizes the importance of timely filing and accurate reporting.

Legal Use of the Heavy Vehicle Use Tax Return

The Form 2290 sp Rev July serves a legal purpose in the taxation of heavy vehicles. It is used to report and pay the heavy vehicle use tax, which is mandated by federal law. Proper completion and submission of this form ensure that vehicle owners comply with regulations and contribute to the maintenance of public roads. It is essential for taxpayers to understand their legal obligations regarding this form to avoid potential legal issues.

Create this form in 5 minutes or less

Find and fill out the correct form 2290 sp rev july heavy vehicle use tax return spanish version

Create this form in 5 minutes!

How to create an eSignature for the form 2290 sp rev july heavy vehicle use tax return spanish version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the declaracion uso vehiculos feature in airSlate SignNow?

The declaracion uso vehiculos feature in airSlate SignNow allows users to easily create, send, and eSign vehicle usage declarations. This feature streamlines the process, ensuring that all necessary documentation is completed efficiently and securely.

-

How does airSlate SignNow help with the declaracion uso vehiculos process?

airSlate SignNow simplifies the declaracion uso vehiculos process by providing templates and automated workflows. Users can quickly fill out forms, gather signatures, and manage documents all in one platform, saving time and reducing errors.

-

Is there a cost associated with using the declaracion uso vehiculos feature?

Yes, there is a cost associated with using airSlate SignNow, but it offers a cost-effective solution for managing the declaracion uso vehiculos. Pricing plans are designed to fit various business needs, ensuring you get the best value for your investment.

-

Can I integrate airSlate SignNow with other tools for my declaracion uso vehiculos?

Absolutely! airSlate SignNow offers integrations with various applications, making it easy to incorporate the declaracion uso vehiculos into your existing workflows. This flexibility enhances productivity and ensures seamless document management.

-

What are the benefits of using airSlate SignNow for declaracion uso vehiculos?

Using airSlate SignNow for declaracion uso vehiculos provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform ensures that your documents are legally binding and easily accessible, improving overall workflow.

-

How secure is the declaracion uso vehiculos process with airSlate SignNow?

The declaracion uso vehiculos process with airSlate SignNow is highly secure, utilizing advanced encryption and authentication measures. This ensures that your sensitive information remains protected throughout the entire document lifecycle.

-

Can I track the status of my declaracion uso vehiculos documents?

Yes, airSlate SignNow allows you to track the status of your declaracion uso vehiculos documents in real-time. You will receive notifications when documents are viewed, signed, or completed, giving you full visibility into the process.

Get more for Form 2290 sp Rev July Heavy Vehicle Use Tax Return Spanish Version

- Reinigungsplan toilette kostenlos form

- Observations inferences t chart recording sheet form

- The prince and the pauper worksheets pdf form

- Abundance cheque template form

- Rapid rehousing forms

- Korn ferry interview architect interview guide pdf form

- Final expense script rebuttals form

- Mi csclcd 515 form

Find out other Form 2290 sp Rev July Heavy Vehicle Use Tax Return Spanish Version

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free