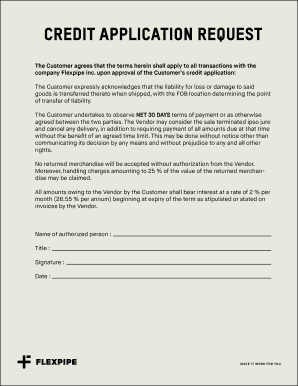

CREDIT APPLICATION REQUEST Form

What is the credit application request?

A credit application request is a formal document that a business submits to a supplier to request credit terms for purchasing goods or services. This letter outlines the company’s financial status and creditworthiness, allowing the supplier to assess the risk of extending credit. Typically, it includes information such as the business name, contact details, tax identification number, and a brief description of the goods or services needed on credit. This request is vital for establishing a credit relationship with suppliers, facilitating smoother transactions in the future.

Key elements of the credit application request

When drafting a credit application request, several key elements should be included to ensure clarity and completeness:

- Business Information: Include the legal name of the business, address, and contact information.

- Tax Identification Number: Provide the business's tax ID or employer identification number (EIN).

- Credit Amount Requested: Specify the amount of credit being requested and any terms you are willing to accept.

- Business Background: Briefly describe the nature of your business and its financial stability.

- References: Offer references from other suppliers or financial institutions that can vouch for your creditworthiness.

Steps to complete the credit application request

Completing a credit application request involves several important steps to ensure it is thorough and effective:

- Gather Information: Collect all necessary information about your business, including financial statements and references.

- Draft the Letter: Write a clear and concise letter that includes all key elements, ensuring it is professional in tone.

- Review for Accuracy: Double-check all information for accuracy and completeness before submission.

- Submit the Request: Send the letter to the supplier via email or traditional mail, depending on their preferred method.

- Follow Up: After submission, follow up with the supplier to confirm receipt and inquire about the status of your request.

Legal use of the credit application request

The credit application request holds legal significance as it serves as a formal request for credit terms. To ensure its legal standing, it is important to comply with relevant laws governing credit transactions. This includes providing accurate information and ensuring that the letter is signed by an authorized representative of the business. Additionally, using a reliable digital signature solution can enhance the document's legal validity, ensuring it meets the requirements set forth by the ESIGN Act and UETA, which govern electronic signatures in the United States.

How to obtain the credit application request

Obtaining a credit application request template is straightforward. Many suppliers provide their own forms, which can be requested directly from them. Alternatively, businesses can create their own template by using online resources or document creation software. When creating a custom template, it is important to include all necessary elements to ensure it meets the supplier's requirements and facilitates a smooth credit application process.

Examples of using the credit application request

Businesses often use credit application requests in various scenarios, such as:

- When establishing a new relationship with a supplier for bulk purchases.

- When a company seeks to expand its purchasing capacity to improve cash flow.

- When a business needs to manage inventory levels without upfront payment.

Each of these examples highlights the importance of a well-structured credit application request in securing favorable credit terms from suppliers.

Quick guide on how to complete credit application request

Achieve CREDIT APPLICATION REQUEST effortlessly on any device

Digital document management has become widely embraced by businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely save it online. airSlate SignNow equips you with everything you need to craft, edit, and electronically sign your documents quickly and without delays. Manage CREDIT APPLICATION REQUEST on any device using airSlate SignNow applications for Android or iOS, and streamline any document-related process today.

The simplest way to modify and electronically sign CREDIT APPLICATION REQUEST without hassle

- Access CREDIT APPLICATION REQUEST and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or hide sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal authority as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), or shareable link, or download it to your computer.

Say goodbye to lost or misfiled documents, cumbersome form searching, and mistakes that necessitate printing out new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you select. Modify and electronically sign CREDIT APPLICATION REQUEST to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the credit application request

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a sample credit request letter to supplier and when should I use it?

A sample credit request letter to supplier is a template that businesses can use to formally request credit from their suppliers. This letter is best utilized when a company needs to request a return or credit for defective products or when facing financial challenges. Using this sample can help ensure your request is clear and professional.

-

How can airSlate SignNow assist with sending a sample credit request letter to supplier?

airSlate SignNow streamlines the process of sending a sample credit request letter to supplier by allowing you to create, edit, and send documents quickly. With its eSign feature, you can gather required signatures in a secure and efficient manner. This reduces turnaround time and ensures you receive timely responses from your suppliers.

-

What features does airSlate SignNow offer for managing sample credit request letters?

airSlate SignNow offers features such as customizable templates, document tracking, and secure cloud storage that are perfect for managing sample credit request letters to suppliers. Additionally, its user-friendly interface enables easy navigation, allowing you to focus on writing effective requests instead of complicated processes. These capabilities enhance productivity and organization.

-

Are there any costs associated with using airSlate SignNow for sample credit request letters?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost depends on factors such as the number of users and additional features. However, many users find the investment worthwhile due to the time-saving capabilities, especially when handling documents like sample credit request letters to suppliers.

-

Can I integrate airSlate SignNow with other applications for credit request letters?

Absolutely! airSlate SignNow integrates seamlessly with popular applications such as Google Drive, Microsoft Office, and CRM systems. This interoperability allows you to efficiently manage your sample credit request letter to supplier alongside other business operations, streamlining your workflow.

-

How secure is airSlate SignNow when sending a sample credit request letter to supplier?

airSlate SignNow prioritizes security, employing advanced encryption methods to protect your documents during transmission and storage. This ensures that your sample credit request letter to supplier is safeguarded from unauthorized access, allowing you to send sensitive information with confidence.

-

What benefits can I expect from using a sample credit request letter to supplier?

Utilizing a sample credit request letter to supplier ensures clarity and professionalism in your communication. This can lead to more favorable responses from suppliers, thus enhancing business relationships. Additionally, it demonstrates your company's commitment to proper documentation and encourages effective negotiation.

Get more for CREDIT APPLICATION REQUEST

Find out other CREDIT APPLICATION REQUEST

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter