Beneficiary Form

What is the change of beneficiary form?

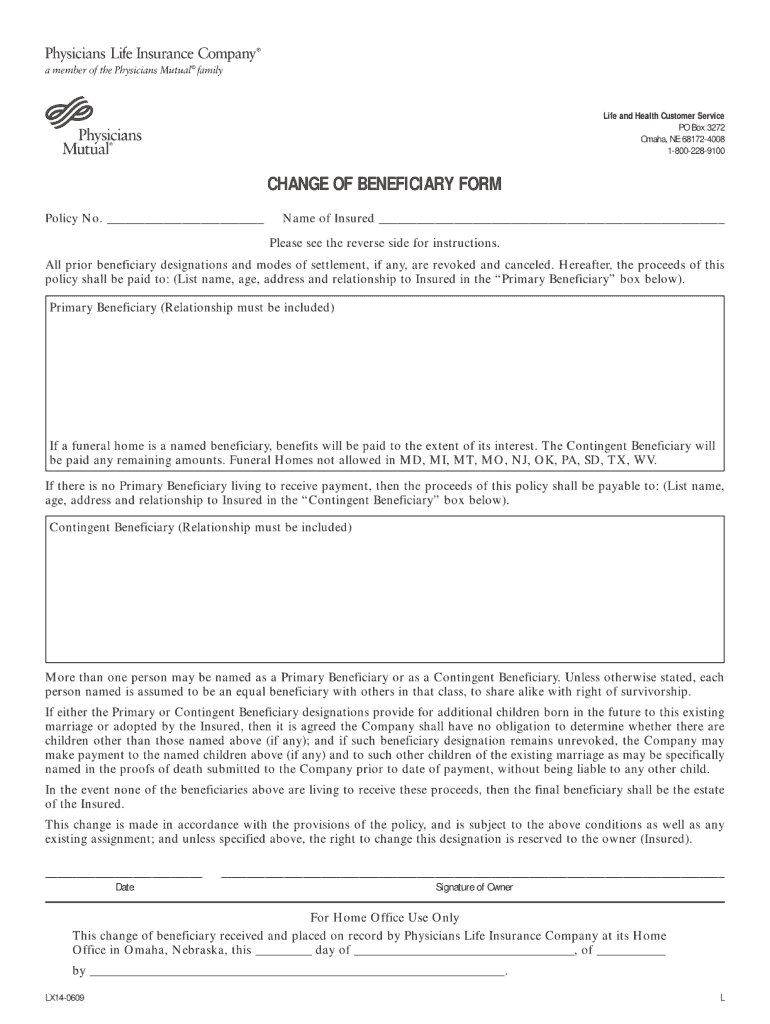

The change of beneficiary form is a crucial document used to update the designated beneficiaries of various financial accounts, such as life insurance policies, retirement accounts, and other financial instruments. This form allows individuals to specify who will receive benefits upon their passing, ensuring that their assets are distributed according to their wishes. It is essential for individuals to regularly review and update this form, especially after significant life events such as marriage, divorce, or the birth of a child.

Steps to complete the change of beneficiary form

Completing the change of beneficiary form involves several key steps to ensure accuracy and compliance. Here is a straightforward process:

- Obtain the form: Access the change of beneficiary form from your insurance company, financial institution, or online resources.

- Fill in your information: Provide your full name, address, and account number to identify the policy or account.

- List the new beneficiaries: Clearly state the names, relationships, and contact information of the new beneficiaries.

- Specify the percentage: Indicate the percentage each beneficiary will receive, ensuring the total equals one hundred percent.

- Sign and date the form: Your signature is required to validate the changes; include the date of signing.

- Submit the form: Follow the submission instructions provided, whether online, via mail, or in person.

Legal use of the change of beneficiary form

The change of beneficiary form is legally binding when completed correctly. To ensure its validity, it must comply with relevant laws and regulations, including the Employee Retirement Income Security Act (ERISA) for retirement accounts. Additionally, the form should be signed and dated by the account holder, and in some cases, may require notarization or witness signatures. It is advisable to keep a copy of the completed form for personal records and to confirm that the financial institution has processed the changes.

Key elements of the change of beneficiary form

Several key elements must be included in the change of beneficiary form to ensure it is complete and effective:

- Account holder information: Full name, address, and account number.

- Beneficiary details: Names, relationships, and contact information of all beneficiaries.

- Distribution percentages: Clear indication of how assets will be divided among beneficiaries.

- Signature and date: Required to validate the form.

- Instructions for submission: Guidance on how to submit the form to the appropriate institution.

How to obtain the change of beneficiary form

Obtaining the change of beneficiary form is typically straightforward. Most financial institutions provide access to this form through their websites, customer service centers, or physical branches. Additionally, some institutions may allow you to complete the form online. If you are unsure where to find the form, contacting customer service for guidance can be helpful. Ensure you are using the correct version of the form specific to your account type.

Form submission methods

Once the change of beneficiary form is completed, it can be submitted through various methods, depending on the institution's policies:

- Online submission: Many institutions offer an online portal for submitting forms securely.

- Mail: You may send the completed form via postal mail to the designated address provided by your institution.

- In-person submission: Visiting a local branch can allow for immediate processing and confirmation of the changes.

Quick guide on how to complete beneficiary form

Prepare Beneficiary Form effortlessly on any device

Online document organization has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed documents, as you can access the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without any delays. Handle Beneficiary Form on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to edit and eSign Beneficiary Form with ease

- Find Beneficiary Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your preference. Modify and eSign Beneficiary Form and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

If an insured parent dies without filling out a beneficiary form and the will is silent on the insurance proceeds, to whom do the benefits go to? Does the situation need go to probate court?

A policy in the United States cannot and should not be issued without a beneficiary. It is a legal requirement that 1) impedes speculation in human life and 2) reduces the likelihood/incidence of Stranger Originated Life Insurance (a.k.a Stoli).So, what is the real situation here? Are you saying a company actually issued coverage leaving that crucial part of the form blank?If so, depending on the size of the policy and the litigation costs that will ensue to straighten up the mess, you might consider legal action against the insurance company and/or the agent for dereliction of duty.One of the strengths of life insurance is its rapid provision of liquidity, which it accomplishes by paying proceeds according to contract as opposed to by Will or Trust. It's as simple as verifying the death, submitting the claim, and then a check gets cut from the insurance company to the beneficiary. Nothing needs to go through probate or the estate settlement process, which can take months.If this valuable convenience was lost due to a failure of the agent and/or the insurance company, I think legal action should be considered.

-

What are the advantages of having an attorney prepare your will rather than writing your own using an online program?

I’m a retired probate attorney who, during my practice, was involved in thousands of probate estates, the majority of them with Wills, so I’ve seen a lot of Wills in my life and their results, when the Will “matures.” Rather than discuss the advantages of an attorney-drawn Will, I’d like to consider the circumstances where that’s probably a good idea.If your estate at death is subject to federal estate tax. That value currently is $11.4 million. By all means, if you are so fortunate to have an estate taxable estate, you should obtain professional estate planning advice, for no other reason than to attempt to lessen your potential estate tax “bite.”If your estate at death is subject to estate or inheritance tax in your home state. That’s going to depend on the laws of your home state, and a professional should be able to advise you about that if you can’t determine that yourself, for example, through the Internet. The estate tax exemption amount in Washington is currently $2,193,000 —- signNowly less than the federal estate tax exemption amount —- and Washington has no inheritance tax.If at death, you leave minor children. One problem is that minors cannot receive assets, so if you want to provide for them, you will need to do so indirectly, probably most simply with a trust in your Will for them (a testamentary trust) or through a guardianship or custodianship for their estate. Another problem is naming a guardian for their person, to assist with their living conditions, their health needs, and their care in general.If at death, you want to provide for a disabled person. Disability law is hugely complicated, so if you want to provide for a disabled person, you should seek the advice of an elder law attorney.If at death, you have unusual or complicated assets. In the great majority of probates in which I was involved, most estates consisted of a home, some financial accounts, a car, and other usual personal properties (eg, personal effects and household furniture and furnishings). If your estate has other major assets, such as an interest in a business or valuable collectibles, you should consider obtaining professional advice regarding their disposition.If at death, you have assets subject to multiple jurisdictions, such as a vacation home in another state. That practically guarantees a domiciliary (home state) probate for your home state assets plus an ancillary probate for your real property in another state. That “double probate” is avoidable with professional advice.If at death, you live in a state where probate is complicated and expensive. I began my probate practice in California, where probate is truly complicated and expensive far beyond reason. There, it was almost attorney malpractice not to advise an estate planning client to use a revocable living trust as one’s estate planning vehicle. Yes, creating, funding, and managing a living trust is more expensive and complicated that using a Will, except that used properly, living trusts avoid probate, and in California and many other states, that’s a big deal. I moved to Washington, whose probate laws are simple and probate costs are modest, usually far less than the cost of creating and funding a living trust, so in Washington, there are few reasons to prefer a living trust over a Will as one’s estate planning vehicle. So if you are determined to “avoid probate” for whatever reason, your should obtain professional advice. And, yes, I’ve had lots of probates where the Decedent wanted to “avoid probate,” attempted to do so as a “do-it-yourself” project, and failed. Chances are seeking and following professional advice would have avoided that outcome.If at death, your estate has substantial debt or, worse, may be insolvent (having insufficient assets to pay all your debts, taxes, and probate costs).If you want your estate to pass other than to your heirs, those persons who would receive your estate if you died without a Will —- typically, your surviving spouse and children —- or, worse, if you want to exclude one or more of them from receiving any portion of your estate. There is substantial law favoring a person’s surviving spouse and children as the recipients of one’s estate at death. One consequence of that is that there are legal hurdles to overcome if you want your estate to pass otherwise; professional advice would be especially helpful so you may achieve your objectives to vary the disposition of your estate from the norm.Well, these are some of the reasons why seeking professional advice for your estate planning might be helpful, and I’m sure there are many more. That having been said, I’ve successfully probated tons of “do-it-yourself” Wills, typically, for Decedents in typical families with typical assets who want their estates to pass in the typical way, “all to the wife or husband and then to the kids,” and if that is your situation, a “do-it-yourself” Will should likely suffice.Richard Wills, retired probate attorney originally licensed in CA & WA

-

If polygamy were legalized in the United States, how would or should it work?

First, I would eliminate normal civil marriage. We need to start everyone out on a level playing field. I would eliminate a lot of the federal benefits of marriage; there is no reason why that one lifestyle should be privileged over others.Then, I would take the most important marriage rights; medical power of attorney, financial power of attorney, inheritance, hospital visits, financial sharing, benefits beneficiaries, etc., and list them on a long piece of paper with check boxes. People who want to get "married" could go to a clerk and fill out the boxes with the rights they want to designate to that person. They would be able to fill out multiple boxes for multiple people; for those rights that could come into conflict (like power of attorney), the form with the most recent date would overrule others if the bearers disagreed on something. Forms could also be voided at the grantee's discretion. Children should be handled completely separately from marriage. Biological parents (who are on the birth certificate) already have certain established rights and I think that works well. I think that the biological parents should also be able to designate secondary custodians (similar to how grandparents have certain rights with regards to their grandchildren in some states) as they choose; it would take both parents to grant such rights, but they should not be able to revoke them without proving the association is harmful to the children.

-

What is a military beneficiary form, and how much does it cost?

If it costs anything, it is a scam. Military families receive their benefits by virtue of their spouse/parent registering them at the Personnel Office. The military member is the sponsor for his family members; he must initiate any action, generally by taking the family members to the base to get an ID card. These cards are issued free of charge and will entitle the family member to any benefit they are entitled to, such as PX/commissary use or medical care. Anyone who tries to sell you a form or charge you to apply for benefits is just stealing your money.

-

What people should do on their first day of a new job?

How my employees can make a first impression:Know where to report. You don’t know how many times I have had an employee show up late the first day because they never bothered to read the email we sent telling them where to show up the first day. This is especially important in large facilities or places where the interview took place at a different location than the place you are working (no one at the other location will know where you need to be - they don’t even work in the same building).Be early. Not on time - early. Showing up right on the dot shows me you’ll be a problem employee who ‘works to the rule’ and expects their day to always be 9 - 5. These people grumble about leaving at 5:05 and complain the loudest about not being compensated for those five minutes.Bring your lunch. Sure, there might be a cafeteria in the building, but do you want to find out your first day on the job that you can’t afford the food and have to settle for an overpriced bag of chips and bottle of water because you don’t have enough money for a ‘real’ lunch? And you won’t be late getting back from lunch because the cafeteria line was too long.Bring a bottle or cup for water - you’ll need something to get your drink in and don’t want to have to purchase a $2 bottle of water from the drink machine so you’ll have a container to use for water and not have to leave your desk every few minutes to go drink from the water fountain.Be ready to ask questions. I’ve done my job for many years, so I forget that other people aren’t familiar with things like I am, so I sometimes forget to mention things I consider ‘old hat.’ Be sure to ask where the bathroom is - you don’t want to find out it is really far away when you need it in a hurry.Make notes - even of the petty things. My first day in my current job, my predecessor whisked me around the building but I couldn’t recall where the copier room was. I had to ask someone where it was located and felt embarrassed that I hadn’t made a note of the location when she rushed me through the tour of the building.Don’t be afraid to read things back to your boss. If you are not sure if you have it right, say, “So, making sure i got this right, this is how we double check the payroll.” Better safe than sorry.Dress appropriately. Find out the dress code before your first day. You don’t want to be the only person without a tie.Do what you can in advance. I’ve had employees who were sent the paperwork for payroll and benefits in advance, then they show up the first day and expect to fill it all out during their payroll visit. Fill out whatever you can in advance - the payroll person has too much to do to sit and watch you fill out your beneficiary form while you try to remember your kids’ social security numbers.Don’t bring any ‘homey touches’ from home - until later. You may not have a desk yet and you’ll have to lug around your framed diploma and photos of your family because you’re sharing a desk with the person you replace until their final day of work.Bring a blue ink pen. You’ll have it if you need it, so you don’t have to pester your boss for a pen to get right to work.Be ready to get right to work. There may be a bunch of HR paperwork to fill out, but there might also be a backlog of work that you can at least sort through your first day so it is ready for when you have access to the computer programs you’ll use.Turn off your cellphone and only check it while you are on your break. So many times a new employee will interrupt training because their friends are checking to see how their first day at work is going. So just turn off the phone to avoid interruptions - your friends and family will understand if you get back to them later.Do more listening than talking. I’ve had new employees tell me their life stories or spill their guts about how long they have been unemployed. This information is best shared in little pieces after you get to know your co-workers and know who can and who cannot be trusted with your personal information.

-

Do United States MIA soldiers still get paid? Are POWs paid during the time they are imprisoned?

Yes they get paid, but where it goes depends on how they filled out their paperwork. One of the forms you fill out is what happens to your pay and allowances if you are:KilledDeclared POW/MIAThe general guidance given when I joined was to put 100% of it to your designated beneficiary if you were killed and 80% of it (you could select whatever percent you want) if you were MIA. Reason was that some people were POW/MIA for an extended period of time (years) in Vietnam. Their wives kept collecting all that money and then left them/divorced. The servicemember returned and had no money because the now ex-wife had spent it all. So what we were told (July 1985) was to select 80% so that you’d at least have something if this happened.Bottom line is that while MIA/POW, the servicemember keeps getting paid. Period. Where it goes/who can access it depends on the elections the servicemember made when they joined the military/last updated the paperwork.

-

How do I split a life insurance policy in a divorce?

You cannot technically split a life insurance policy. The best you can do is agree upon the economic value of the policy and have one party buy out the other.If the insured is young and in good health, this could be as simple as dividing the policy's cash value in half.If the insured is very old and/or in very poor health, the valuation becomes more complex. Depending on the size of the policy, it might be worthwhile to hire an expert to provide an appraisal.I would expect that appraisal to cost anywhere from $300 (for an informal opinion of value) to $1,000 or more (if a full life expectancy analysis is purchased in connection with the appraisal).As a matter of practical, relational, and emotional advice, I think it is unwise to try to maintain life insurance coverage on the life of one's former spouse. It takes a great level of emotional maturity to do so. Overcoming the bitternesses and deep hurts that accompany a divorce is hard enough without having a vested financial interest in the premature death of that former spouse. And while it might feel good for a while to “hope that blankety-blank-blank dies as soon as possible,” in the end, owning a life insurance policy on a former spouse will probably just add another barrier to the forgiveness needed to move on with one’s life.It's best to have a clean break.Similarly, it should be noted that large sums of money have tempted many people to make poor choices with their own lives and the lives of others. There is a statistically documented positive correlation between life insurance ownership and suicide. And the stories of one person killing the other in order to “collect the death benefit” are so common in the news they are almost cliche. It's one of the first questions any investigator will ask when looking for the murderer. “Who owned life insurance on the deceased? Let's start there.”Best to remove oneself from both the temptation and the potential suspicion.So, just divide the economic value and have the non-insured spouse buy out the insured spouse's interests in the policy.

-

Is Canada like America’s little brother? I've heard that if an Army tried to invade Canada, that America would attack them.

Is Canada like America’s little brother? I've heard that if an Army tried to invade Canada, that America would attack them.This question begs the question, HOW? The only land border Canada has with anyone is The United States of America. Using conventional methods and weapons, an invading country would have to make landfall and under those conditions, they are very restrictive and exposes the invader to great risks.If it did happen, America would not come to Canada’s aid as a friend. It would come to protect its national security. The Americans use Canada as a buffer state between Russia and China.So as much as Canadians would like to think that America is their big brother, it isn’t so.Actually, after having been attacked by the United States in 1775 and 1812–14, and subject to invasion plans by the 1930s infamous Red War Plan, Canada has come to America’s rescue a number of times. America, just once and limited to private donations.Canada is no little brother to anyone. I would like to paste this quote from the UK Telegraph article that was published shortly after a number of Canadian infantrymen were, in my opinion, murdered by a reckless American fighter pilot who acted against orders.The country the world forgot - againBy Kevin Myers The Telegraph-UK 12:01AM BST 21 Apr 2002UNTIL the deaths last week of four Canadian soldiers accidentally killed by a US warplane in Afghanistan, probably almost no one outside their home country had been aware that Canadian troops were deployed in the region. And as always, Canada will now bury its dead, just as the rest of the world as always will forget its sacrifice, just as it always forgets nearly everything Canada ever does.It seems that Canada's historic mission is to come to the selfless aid both of its friends and of complete strangers, and then, once the crisis is over, to be well and truly ignored. Canada is the perpetual wallflower that stands on the edge of the hall, waiting for someone to come and ask her for a dance. A fire breaks out, she risks life and limb to rescue her fellow dance-goers, and suffers serious injuries. But when the hall is repaired and the dancing resumes, there is Canada, the wallflower still, while those she once helped glamorously cavort across the floor, blithely neglecting her yet again.That is the price which Canada pays for sharing the North American Continent with the US, and for being a selfless friend of Britain in two global conflicts. For much of the 20th century, Canada was torn in two different directions: it seemed to be a part of the old world, yet had an address in the new one, and that divided identity ensured that it never fully got the gratitude it deserved.–– ADVERTISEMENT ––Yet its purely voluntary contribution to the cause of freedom in two world wars was perhaps the greatest of any democracy. Almost 10 per cent of Canada's entire population of seven million people served in the armed forces during the First World War, and nearly 60,000 died. The great Allied victories of 1918 were spearheaded by Canadian troops, perhaps the most capable soldiers in the entire British order of battle.Canada was repaid for its enormous sacrifice by downright neglect, its unique contribution to victory being absorbed into the popular memory as somehow or other the work of the "British". The Second World War provided a re-run. The Canadian navy began the war with a half dozen vessels, and ended up policing nearly half of the Atlantic against U-boat attack. More than 120 Canadian warships participated in the Normandy landings, during which 15,000 Canadian soldiers went ashore on D-Day alone. Canada finished the war with the third largest navy and the fourth largest air force in the world.The world thanked Canada with the same sublime indifference as it had the previous time. Canadian participation in the war was acknowledged in film only if it was necessary to give an American actor a part in a campaign which the US had clearly not participated - a touching scrupulousness which, of course, Hollywood has since abandoned, as it has any notion of a separate Canadian identity.So it is a general rule that actors and film-makers arriving in Hollywood keep their nationality - unless, that is, they are Canadian. Thus Mary Pickford, Walter Huston, Donald Sutherland, Michael J Fox, William Shatner, Norman Jewison, David Cronenberg and Dan Aykroyd have in the popular perception become American, and Christopher Plummer British. It is as if in the very act of becoming famous, a Canadian ceases to be Canadian, unless she is Margaret Atwood, who is as unshakeably Canadian as a moose, or Celine Dion, for whom Canada has proved quite unable to find any takers.Moreover, Canada is every bit as querulously alert to the achievements of its sons and daughters as the rest of the world is completely unaware of them. The Canadians proudly say of themselves - and are unheard by anyone else - that 1 per cent of the world's population has provided 10 per cent of the world's peace-keeping forces. Canadian soldiers in the past half century have been the greatest peace-keepers on earth - in 39 missions on UN mandates, and six on non-UN peace-keeping duties, from Vietnam to East Timor, from Sinai to Bosnia.Yet the only foreign engagement which has entered the popular non-Canadian imagination was the sorry affair in Somalia, in which out-of-control paratroopers murdered two Somali infiltrators. Their regiment was then disbanded in disgrace - a uniquely Canadian act of self-abasement for which, naturally, the Canadians received no international credit.So who today in the US knows about the stoic and selfless friendship its northern neighbour has given it in Afghanistan? Rather like Cyrano de Bergerac, Canada repeatedly does honourable things for honourable motives, but instead of being thanked for it, it remains something of a figure of fun. It is the Canadian way, for which Canadians should be proud, yet such honour comes at a high cost.This weekend four shrouds, red with blood and maple leaf, head homewards; and four more grieving Canadian families know that cost all too tragically well.

-

How do I change a registered mobile number in HDFC bank?

You can change registered mobile number in HDFC Bank account online by following the steps given below:Step-1: Go to official website of HDFC BankStep-2: Login to HDFC Net Banking PageStep-3: Click on Update Email ID and Landline NumberStep-4: Edit the number you want to changeStep-4: Confirm the number by typing it once againAfter following the steps mentioned in above articles, you can change or update mobile nimber registered in your HDFC Bank Account Online without visiting the bank branch.Your New Mobile Number will be Updated within 24 Hours!!!Point to be NotedIt is true that you can change your mobile number in HDFC Bank Account online still I recommend you to get this done personally by visiting the bank branch. It will eliminate risk( although very rare) of hacking confidential information.Hope this works for you.

Create this form in 5 minutes!

How to create an eSignature for the beneficiary form

How to create an electronic signature for your Beneficiary Form in the online mode

How to create an eSignature for your Beneficiary Form in Chrome

How to generate an electronic signature for signing the Beneficiary Form in Gmail

How to create an eSignature for the Beneficiary Form right from your mobile device

How to generate an eSignature for the Beneficiary Form on iOS

How to create an eSignature for the Beneficiary Form on Android

People also ask

-

What is a Beneficiary Form and why is it important?

A Beneficiary Form is a legal document that designates who will receive benefits from a financial account or insurance policy upon the owner's death. It is crucial because it helps ensure that your assets are distributed according to your wishes, avoiding probate and potential disputes among heirs.

-

How can I create a Beneficiary Form using airSlate SignNow?

Creating a Beneficiary Form with airSlate SignNow is easy and efficient. Simply select the template for the Beneficiary Form, fill in the required details, and send it for electronic signature. Our platform ensures that your document is secure and legally binding.

-

Is there a cost associated with using the Beneficiary Form template on airSlate SignNow?

airSlate SignNow offers various pricing plans that include access to customizable templates like the Beneficiary Form. You can choose a plan that fits your needs, whether you are an individual or a business looking for a cost-effective solution.

-

What features does airSlate SignNow offer for managing Beneficiary Forms?

With airSlate SignNow, you can easily create, send, and manage Beneficiary Forms from any device. Features include customizable templates, real-time tracking of document status, and secure cloud storage to keep your forms organized and accessible.

-

Can I integrate airSlate SignNow with other software for managing Beneficiary Forms?

Yes, airSlate SignNow seamlessly integrates with popular software such as Google Workspace, Salesforce, and Dropbox. This allows you to streamline the process of creating and managing your Beneficiary Forms within your existing workflows.

-

How secure is my information when using a Beneficiary Form with airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and comply with industry standards to ensure that your information, including any Beneficiary Forms, is protected from unauthorized access.

-

Can multiple people sign a Beneficiary Form through airSlate SignNow?

Absolutely! airSlate SignNow allows multiple recipients to sign your Beneficiary Form. You can easily set the signing order and send the document to all necessary parties for their signatures, making the process efficient and straightforward.

Get more for Beneficiary Form

- Volleyball line up sheet form

- Notice of intent to operate ottawa county michigan miottawa form

- Electrical load calculation worksheet form

- Ddm service agreement elap services form

- Coordination of benefits cob questionnaire allegiance form

- Birthday party application cecil county government ccgov form

- Oh garnishment answer form

- Special events application village of glenview glenview il form

Find out other Beneficiary Form

- Remove eSign PDF Mobile

- How To Remove eSign PDF

- Remove eSign PDF Simple

- Remove eSign Document Now

- Remove eSign Form Online

- Remove eSign Form Now

- Remove eSign Form Easy

- Remove eSign Form Android

- Certify eSign Document Free

- Validate eSign PDF Secure

- Validate eSign PDF iOS

- How Do I Validate eSign PDF

- Certify eSign PPT Online

- Certify eSign PPT Mobile

- How To E-mail eSign PDF

- E-mail eSign Word Now

- E-mail eSign Form Online

- E-mail eSign PPT Secure

- E-mail eSign Form Free

- E-mail eSign Form Android