Kw 2 Form

What is the KW-2?

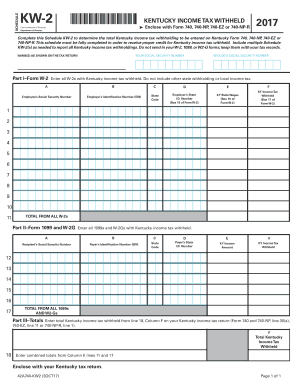

The KW-2 form, also known as the Kentucky Schedule KW-2, is a tax document used by employers in Kentucky to report wages paid to employees and the taxes withheld from those wages. This form is essential for both employers and employees as it provides a summary of income and tax deductions for the year. Understanding the KW-2 is crucial for accurate tax reporting and compliance with state regulations.

Steps to Complete the KW-2

Completing the KW-2 form involves several key steps to ensure accuracy and compliance. First, gather all necessary employee wage information, including total earnings and taxes withheld. Next, fill out the form by entering the employer's details, such as name, address, and identification number. Then, input the employee's information, including their name, Social Security number, and total wages. Finally, review the completed form for any errors before submission.

Legal Use of the KW-2

The KW-2 form is legally binding and must be filed in accordance with Kentucky state tax laws. It serves as an official record of wages and tax withholdings, which can be used by employees when filing their personal income tax returns. Compliance with the legal requirements surrounding the KW-2 is essential to avoid penalties and ensure that both employers and employees fulfill their tax obligations.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the KW-2 form. Typically, employers must provide the completed KW-2 to their employees by January 31 of the following year. Additionally, the form must be submitted to the Kentucky Department of Revenue by the same date. Staying informed about these deadlines helps prevent late filing penalties and ensures timely tax reporting.

Who Issues the Form

The KW-2 form is issued by the Kentucky Department of Revenue. Employers are responsible for completing and distributing this form to their employees, as well as submitting it to the state. This ensures that the state has accurate records of wages paid and taxes withheld, which is vital for maintaining compliance with tax laws.

Required Documents

To complete the KW-2 form accurately, employers need several key documents. These include payroll records that detail employee earnings, tax withholding information, and any relevant state tax identification numbers. Having these documents on hand will streamline the process of filling out the KW-2 and ensure that all information is accurate and complete.

Quick guide on how to complete kw 2

Easily Prepare Kw 2 on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, as you can obtain the right form and securely keep it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents quickly without any holdups. Handle Kw 2 on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and Electronically Sign Kw 2 Effortlessly

- Find Kw 2 and click on Get Form to commence.

- Use the tools we provide to complete your paperwork.

- Highlight important sections of your documents or redact confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

No more lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Kw 2 to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kw 2

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to kw2?

airSlate SignNow is a powerful eSignature solution that enables businesses to send and eSign documents quickly and securely. By integrating kw2 into your document workflow, you can enhance productivity and streamline processes, making it easier than ever to manage agreements.

-

How much does airSlate SignNow cost?

airSlate SignNow offers flexible pricing plans to fit various business needs and budgets. Our pricing structure for kw2 is designed to provide maximum value, ensuring that you get the most out of your investment in eSignature capabilities.

-

What features does airSlate SignNow offer?

airSlate SignNow includes a variety of features such as customizable templates, real-time tracking, and advanced authentication options. These features work collaboratively with kw2 to provide a comprehensive solution for efficient document management.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow can seamlessly integrate with numerous third-party applications, enhancing your workflow. By using kw2, you can connect with popular platforms, streamlining processes and ensuring data consistency across systems.

-

What are the benefits of using airSlate SignNow with kw2?

Utilizing airSlate SignNow alongside kw2 allows businesses to automate their document processes, reduce turnaround time, and improve compliance. These benefits translate into more efficient operations and happier customers.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely, airSlate SignNow employs industry-leading security protocols to ensure the safety of your documents. By integrating kw2, you can leverage additional security features that protect your sensitive information during the eSigning process.

-

How can I get started with airSlate SignNow and kw2?

Getting started with airSlate SignNow is simple! You can sign up for a free trial to explore our features, including kw2 integrations. Our user-friendly interface will guide you through the setup process, making it easy to begin eSigning documents in no time.

Get more for Kw 2

- Equipment transfer form leeschoolsk12 org

- 13848 ventura blvd sherman oaks ca 91423p tauber arons azdor form

- Ca 1 form epsb

- Endo advantage form

- Runwal foundation form

- Selbstauskunftverm gensauskunft frankfurter sparkasse frankfurter sparkasse form

- Alabama school bus driver record ampamp report book form

- Prism bc cancer agency bccancer bc form

Find out other Kw 2

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement