A1 Qrt Form

What is the A1 Qrt?

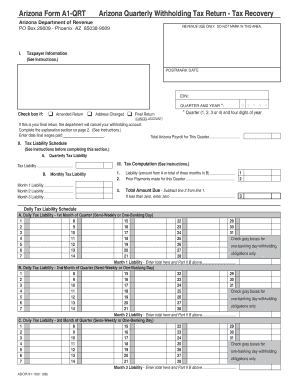

The A1 Qrt is a specific form used in various administrative and legal processes. It is essential for individuals and businesses to understand its purpose and implications. This form is often utilized in contexts that require official documentation and compliance with state regulations. Understanding the A1 Qrt can help ensure that all necessary information is accurately provided, reducing the risk of delays or legal issues.

How to use the A1 Qrt

Using the A1 Qrt involves several steps to ensure proper completion and submission. First, gather all required information, including personal details and any relevant documentation. Next, fill out the form carefully, ensuring that all fields are completed accurately. It is crucial to review the form for any errors before submission. Once completed, the A1 Qrt can be submitted electronically or via traditional mail, depending on the specific requirements outlined by the issuing authority.

Steps to complete the A1 Qrt

Completing the A1 Qrt requires attention to detail. Follow these steps for successful completion:

- Begin by downloading the form from the official source or accessing it through a digital platform.

- Fill in your personal information, including name, address, and any other required details.

- Provide any necessary supporting documents as specified in the form instructions.

- Review the completed form for accuracy, ensuring all information is correct.

- Submit the form according to the guidelines provided, either online or by mail.

Legal use of the A1 Qrt

The legal use of the A1 Qrt is paramount for ensuring compliance with relevant laws and regulations. This form may be required for various legal transactions and must be filled out accurately to avoid potential legal complications. Understanding the legal implications of the A1 Qrt helps individuals and businesses maintain compliance and protect their interests in formal proceedings.

Key elements of the A1 Qrt

Several key elements are essential for the A1 Qrt to be considered valid. These include:

- Accurate personal information of the individual or entity submitting the form.

- Signature or digital signature, which verifies the authenticity of the submission.

- Any required attachments or supporting documents that substantiate the information provided.

- Compliance with specific state regulations that may apply to the form.

Who Issues the Form

The A1 Qrt is typically issued by a designated government agency or authority. It is important to identify the correct issuing body to ensure that the form is completed and submitted according to the appropriate guidelines. This may vary by state or jurisdiction, so verifying the issuing authority is a crucial step in the process.

Quick guide on how to complete a1 qrt 73555767

Complete A1 Qrt easily on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the required form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage A1 Qrt on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to edit and electronically sign A1 Qrt effortlessly

- Find A1 Qrt and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs with just a few clicks from any device you choose. Edit and electronically sign A1 Qrt and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the a1 qrt 73555767

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a1 qrt and how does it work with airSlate SignNow?

A1 qrt is our unique solution that enables users to quickly create and manage electronic signatures through airSlate SignNow. It streamlines the signing process, ensuring that documents are handled efficiently and securely. With a1 qrt, businesses can send, sign, and store documents all in one platform, enhancing productivity and simplifying workflows.

-

How much does it cost to use a1 qrt with airSlate SignNow?

Pricing for the a1 qrt solution within airSlate SignNow varies based on your organization's needs and the scale of usage. airSlate SignNow offers several subscription plans, including monthly and yearly options, to accommodate different business sizes. To find the best fit, you can explore our pricing page for a detailed breakdown of plans that include a1 qrt features.

-

What features are included with a1 qrt in airSlate SignNow?

The a1 qrt feature in airSlate SignNow includes customizable templates, automated workflows, and real-time tracking capabilities. Users can easily create and send documents for eSigning, ensuring compliance and security at every step. Additionally, a1 qrt allows for seamless integration with other applications, making it an invaluable tool for efficient document management.

-

What are the benefits of using airSlate SignNow with a1 qrt?

Using a1 qrt in airSlate SignNow provides numerous benefits, including cost savings, greater efficiency, and enhanced security. Businesses can drastically reduce turnaround times for document signing while maintaining compliance with legal standards. Moreover, the user-friendly interface of a1 qrt makes onboarding seamless for teams of all sizes.

-

Can a1 qrt integrate with other tools and applications?

Yes, a1 qrt can easily integrate with various apps and software that your business may already be using. airSlate SignNow supports popular integration platforms, allowing for smoother workflows and comprehensive document management. This means you can connect a1 qrt with CRM systems, project management tools, and more, tailoring the solution to your specific needs.

-

Is a1 qrt secure for handling sensitive documents?

Absolutely! a1 qrt within airSlate SignNow adheres to the highest security standards, ensuring that all sensitive documents are protected. We implement advanced encryption technologies and strict compliance measures to safeguard user data. When using a1 qrt, you can confidently sign and manage documents without worrying about security bsignNowes.

-

How can I get started with a1 qrt on airSlate SignNow?

Getting started with a1 qrt on airSlate SignNow is easy! Simply create an account on our website, choose the plan that suits your needs, and start exploring the features of a1 qrt. We also provide comprehensive resources, including tutorials and customer support, to help you make the most of your experience.

Get more for A1 Qrt

- Application form 65395004

- Affidavit of memorandum 77849130 form

- World history final exam pdf form

- Mspa insurance cancelation aggrement form

- Assignment of contract 2587822 form

- Aic residential appraisal report aci form

- Publication 463 travel gift and car expenses form

- Form 5471 overview who what and how

Find out other A1 Qrt

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors