Pinellas County Form Pc 405 Fillable

What is the Pinellas County Form PC 405 Fillable

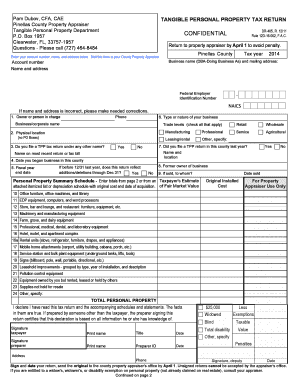

The Pinellas County Form PC 405 is a crucial document used for reporting tangible personal property in Pinellas County, Florida. This form is essential for businesses and individuals who own personal property that is subject to taxation. The form collects information about the property, including its value and location, which is necessary for the county property appraiser to assess taxes accurately. Completing the form correctly ensures compliance with local tax regulations and helps avoid potential penalties.

How to use the Pinellas County Form PC 405 Fillable

Using the Pinellas County Form PC 405 fillable is straightforward. First, download the form from the official Pinellas County website or access it through a trusted digital platform. Once you have the form, fill in the required fields, including your name, address, and details about the personal property. Ensure that all information is accurate and complete to prevent any issues during processing. After filling out the form, you can submit it electronically or print it for mailing.

Steps to complete the Pinellas County Form PC 405 Fillable

To complete the Pinellas County Form PC 405 fillable, follow these steps:

- Download the form from a reliable source.

- Enter your personal information, including your name and address.

- Provide details about the tangible personal property, such as its description and estimated value.

- Review all entries for accuracy.

- Sign the form digitally or manually, depending on your submission method.

- Submit the completed form as directed, either online or by mail.

Legal use of the Pinellas County Form PC 405 Fillable

The Pinellas County Form PC 405 fillable is legally binding when completed and submitted according to the regulations set forth by the Pinellas County Property Appraiser's Office. It is important to provide truthful and accurate information, as any discrepancies can lead to legal repercussions or penalties. The form must be submitted by the specified deadline to ensure compliance with local tax laws.

Required Documents

When filling out the Pinellas County Form PC 405, you may need to gather several supporting documents. These can include:

- Proof of ownership for the personal property, such as purchase receipts.

- Previous tax returns or assessments related to the property.

- Any relevant financial statements that may assist in determining the property’s value.

Form Submission Methods

The Pinellas County Form PC 405 can be submitted in various ways to accommodate different preferences. You can choose to submit the form electronically through a designated online portal, which often provides a faster processing time. Alternatively, you can print the completed form and mail it to the appropriate office. In-person submissions may also be accepted at designated locations, allowing for direct interaction with county officials.

Quick guide on how to complete pinellas county form pc 405 fillable

Complete Pinellas County Form Pc 405 Fillable effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without interruptions. Manage Pinellas County Form Pc 405 Fillable on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to edit and eSign Pinellas County Form Pc 405 Fillable without any hassle

- Locate Pinellas County Form Pc 405 Fillable and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Edit and eSign Pinellas County Form Pc 405 Fillable and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pinellas county form pc 405 fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PC 405, and how does it work?

The PC 405 is a versatile electronic signature software offered by airSlate SignNow that enables businesses to manage their document signing process seamlessly. It allows users to send, sign, and track important documents with ease, ensuring compliance and security throughout. With its intuitive interface, the PC 405 simplifies the workflow for users across various industries.

-

How much does the PC 405 cost?

Pricing for the PC 405 is competitive and designed to cater to businesses of all sizes. Depending on the chosen plan, the cost can vary; however, airSlate SignNow provides affordable options without compromising on features. Visit our pricing page for detailed information and to find a plan that fits your budget.

-

What features are included in the PC 405?

The PC 405 includes a suite of powerful features such as customizable templates, advanced analytics, and integrations with popular productivity tools. Additionally, it offers robust security measures like encryption and access controls to protect your sensitive documents. These features are designed to enhance your document management experience.

-

Can the PC 405 integrate with other software?

Yes, the PC 405 seamlessly integrates with a variety of third-party applications, including CRM and project management tools. This integration capability streamlines your workflow by allowing you to manage documents directly within your existing software ecosystem. Enhance productivity by connecting the PC 405 with your favorite apps.

-

What are the benefits of using the PC 405 for my business?

Using the PC 405 can signNowly enhance your business's efficiency and save time on document processing. It allows for faster transaction times and reduces reliance on paper, which is both cost-effective and environmentally friendly. Furthermore, the PC 405 ensures secure and legally binding electronic signatures.

-

Is the PC 405 user-friendly for non-technical users?

Absolutely! The PC 405 is designed with a user-friendly interface, making it accessible for non-technical users. With easy navigation and straightforward functions, anyone can quickly adapt to the software, facilitating smoother workflows across teams without the need for advanced training.

-

What support options are available for PC 405 users?

airSlate SignNow offers a range of support options for PC 405 users, including detailed documentation, video tutorials, and a dedicated customer support team. Whether you have technical questions or need assistance with features, help is readily available through multiple channels. Our goal is to ensure you maximize the benefits of the PC 405.

Get more for Pinellas County Form Pc 405 Fillable

Find out other Pinellas County Form Pc 405 Fillable

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later