Fair Credit Reporting Act Section 609 Form

What is the Fair Credit Reporting Act Section 609

The Fair Credit Reporting Act (FCRA) Section 609 provides consumers with the right to request information about their credit reports. This section allows individuals to obtain a copy of their credit report and ensures they have access to the data that influences their creditworthiness. Understanding this section is essential for anyone looking to manage their credit effectively and rectify any inaccuracies that may exist in their reports.

How to use the Fair Credit Reporting Act Section 609

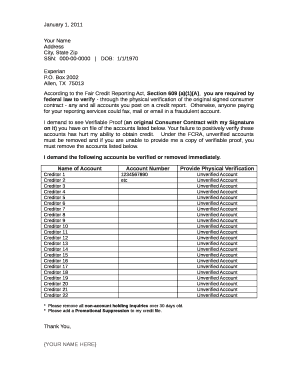

Using Section 609 involves submitting a formal request to credit reporting agencies. Consumers can write a 609 letter to request their credit report, specifying the information they seek. This letter should include personal identification details, such as name, address, and Social Security number, to verify identity. By utilizing this section, individuals can ensure they are aware of what is reported about them, which is crucial for maintaining healthy credit.

Steps to complete the Fair Credit Reporting Act Section 609

Completing a request under Section 609 requires several steps:

- Gather necessary personal information, including full name, address, and Social Security number.

- Draft a 609 letter that clearly states your request for your credit report.

- Send the letter to the appropriate credit reporting agencies via certified mail for tracking.

- Wait for a response, which should come within thirty days, as mandated by the FCRA.

Following these steps ensures that the process is smooth and compliant with legal requirements.

Key elements of the Fair Credit Reporting Act Section 609

Key elements of Section 609 include the consumer's right to access their credit report, the obligation of credit reporting agencies to provide this information, and the timeline for response. Additionally, Section 609 emphasizes the need for accuracy in reporting and allows consumers to dispute any inaccuracies found in their reports. This section is vital for protecting consumer rights in the credit reporting process.

Examples of using the Fair Credit Reporting Act Section 609

Examples of using Section 609 include situations where individuals notice discrepancies in their credit reports, such as incorrect account balances or accounts that do not belong to them. By sending a 609 letter, they can formally request the removal of such inaccuracies. Another example is when consumers want to check their credit report before applying for a loan or mortgage, ensuring they are aware of their credit standing.

Legal use of the Fair Credit Reporting Act Section 609

The legal use of Section 609 is grounded in the consumer's rights to access and dispute information in their credit reports. It is important to follow the proper procedures when requesting reports to ensure compliance with the FCRA. Misuse of this section, such as providing false information in a request, can lead to legal repercussions. Therefore, understanding the legal framework surrounding Section 609 is essential for effective credit management.

Quick guide on how to complete fair credit reporting act section 609

Effortlessly Prepare Fair Credit Reporting Act Section 609 on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a perfect eco-friendly substitute for traditional printed forms, allowing you to access the necessary template and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly and without delays. Manage Fair Credit Reporting Act Section 609 on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

How to Modify and eSign Fair Credit Reporting Act Section 609 with Ease

- Find Fair Credit Reporting Act Section 609 and select Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure confidential information with tools that airSlate SignNow offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to share your form: via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors necessitating the printing of new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and eSign Fair Credit Reporting Act Section 609 to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fair credit reporting act section 609

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 609 dispute letter, and how can it benefit me?

A 609 dispute letter is a formal request that consumers can send to credit bureaus to challenge inaccuracies on their credit reports. Utilizing this tool can help you improve your credit score by removing misleading information. airSlate SignNow enables you to create and send a 609 dispute letter easily, streamlining your path to better credit.

-

How do I create a 609 dispute letter using airSlate SignNow?

Creating a 609 dispute letter with airSlate SignNow is straightforward. Simply use our customizable templates to draft your letter, fill in your details, and eSign it. Our platform ensures that your letter is professionally formatted and legally binding, making the entire process seamless.

-

Is there a cost associated with using airSlate SignNow to send a 609 dispute letter?

Yes, airSlate SignNow offers competitive pricing plans tailored to fit various business needs. You can choose a plan that suits you, allowing you to send unlimited documents, including 609 dispute letters, at a cost-effective rate. Additionally, our trial option allows you to explore features before committing.

-

What features does airSlate SignNow provide for handling 609 dispute letters?

airSlate SignNow offers a range of features, including customizable templates, secure eSigning, and document tracking. These features ensure that your 609 dispute letter is sent efficiently and received promptly. Furthermore, our user-friendly interface simplifies the document management process.

-

Can I integrate airSlate SignNow with other applications for managing my 609 dispute letters?

Absolutely! airSlate SignNow seamlessly integrates with various applications, allowing you to manage your 609 dispute letters alongside your workflow. Integrations with CRM systems, cloud storage, and email platforms enhance the overall functionality and efficiency of managing your documents.

-

How long does it take to send a 609 dispute letter through airSlate SignNow?

Sending a 609 dispute letter through airSlate SignNow is quick and efficient. Once you have completed your letter and eSigned it, it can be sent immediately to the credit bureau. Typically, recipients can expect to receive your document within a few hours, depending on the delivery method chosen.

-

What should I include in my 609 dispute letter?

A 609 dispute letter should include your personal information, specific details of the dispute, and any supporting documentation. It’s essential to clearly state which items you're disputing and why. Utilizing airSlate SignNow’s templates helps ensure that you don’t miss any critical elements in your letter.

Get more for Fair Credit Reporting Act Section 609

- Dpr 208h form

- Social work client contract template form

- Ca 1108 form

- Iso claimsearch third party request form

- The rise of oxygen in the earths atmosphere questions answer key form

- Da form 3034

- Www sciencedirect comjournaljournal ofjournal of clinical virologyvol 95 pages 1 96 october form

- Corporate wellness contract template form

Find out other Fair Credit Reporting Act Section 609

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter

- eSign Indiana Car Dealer Separation Agreement Simple

- eSign Iowa Car Dealer Agreement Free

- eSign Iowa Car Dealer Limited Power Of Attorney Free