Form 3556

What is the Form 3556

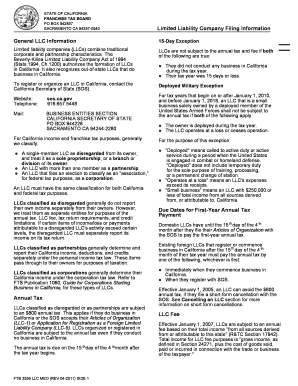

The FTB Form 3556, also known as the California form 3556, is a document used by businesses and individuals for specific tax-related purposes in California. This form is essential for reporting certain financial information to the California Franchise Tax Board. It is particularly relevant for those who need to declare income or expenses related to business activities within the state. Understanding the purpose and requirements of this form is crucial for compliance with California tax laws.

How to use the Form 3556

Using the FTB Form 3556 involves several key steps. First, ensure that you have the correct version of the form, which can be obtained from the California Franchise Tax Board's website or through authorized channels. Next, gather all necessary financial documents that pertain to your business activities, as this information will be needed to complete the form accurately. Fill out the form by following the instructions provided, ensuring that all sections are completed thoroughly to avoid delays or issues with processing.

Steps to complete the Form 3556

Completing the FTB Form 3556 requires a systematic approach:

- Begin by entering your personal or business information at the top of the form.

- Provide detailed financial information, including income, deductions, and any relevant credits.

- Review the instructions for any specific calculations or additional information required.

- Double-check all entries for accuracy to minimize the risk of errors.

- Sign and date the form before submission to validate your entries.

Legal use of the Form 3556

The legal use of the FTB Form 3556 is governed by California tax regulations. To ensure that the form is legally binding, it must be filled out accurately and submitted by the specified deadlines. Additionally, utilizing a reliable electronic signature solution, such as signNow, can enhance the legal validity of the document. Adhering to the guidelines set forth by the California Franchise Tax Board ensures compliance and protects against potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the FTB Form 3556 are crucial to avoid penalties. Typically, the form must be submitted by the due date for your tax return, which is usually April 15 for individuals and the 15th day of the fourth month following the end of the taxable year for corporations. It is important to stay informed about any changes to these deadlines, as they can vary based on specific circumstances or legislative updates.

Form Submission Methods (Online / Mail / In-Person)

The FTB Form 3556 can be submitted through various methods, providing flexibility for users. Options include:

- Online submission via the California Franchise Tax Board's e-file system, which is often the fastest method.

- Mailing the completed form to the appropriate address indicated in the form instructions.

- In-person submission at designated Franchise Tax Board offices, which may be beneficial for those who prefer direct interaction.

Quick guide on how to complete publication 3556

Effortlessly Prepare publication 3556 on Any Device

Digital document management has gained signNow traction among companies and individuals. It offers a superb environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and without delays. Manage ftb 3556 on any platform using airSlate SignNow Android or iOS applications and simplify any paper-based process today.

How to Modify and eSign form 3556 with Ease

- Locate ftb form 3556 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive details with tools designed specifically for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal authority as a conventional wet ink signature.

- Verify all information and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Make changes and eSign ca form 3556 to ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to ca form 3556

Create this form in 5 minutes!

How to create an eSignature for the publication 3556

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask form 3556

-

What is the FTB 3556 form and why is it important?

The FTB 3556 form is a vital document for businesses in California that need to report certain income-related information. Understanding how to fill out this form is crucial for compliance with state tax regulations. Using airSlate SignNow can streamline the eSigning process for this document, ensuring that your submissions are accurate and timely.

-

How can airSlate SignNow help with the FTB 3556 form?

airSlate SignNow simplifies the process of eSigning and managing the FTB 3556 form. With its intuitive interface, you can easily prepare, send, and track your documents. This not only saves time but also enhances productivity by reducing paperwork and minimizing errors.

-

Is there a cost associated with using airSlate SignNow for FTB 3556?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is affordable, especially considering the efficiency gains when handling documents like the FTB 3556 form. You can choose a plan that suits your budget and volume of document transactions.

-

What features does airSlate SignNow offer for managing the FTB 3556 form?

airSlate SignNow includes features such as document templates, automated reminders, and real-time tracking for the FTB 3556 form. These tools help streamline your workflow and ensure that you never miss a deadline. Additionally, the platform provides robust compliance and security features for peace of mind.

-

Can I integrate airSlate SignNow with other platforms for FTB 3556 management?

Absolutely! airSlate SignNow is designed to integrate seamlessly with various software applications, enhancing your document management capabilities for the FTB 3556 form. Whether you use CRM systems, cloud storage, or accounting software, you can connect them easily to optimize your workflow.

-

What benefits can I expect from using airSlate SignNow for the FTB 3556 form?

Using airSlate SignNow for the FTB 3556 form can signNowly reduce the time and effort involved in document management. The platform enables efficient eSigning, which minimizes delays and speeds up your processes. Ultimately, you'll enjoy increased accuracy and compliance with state regulations.

-

How secure is my information when using airSlate SignNow for the FTB 3556?

Security is a top priority at airSlate SignNow. When handling sensitive information like the FTB 3556 form, all data is encrypted, and strict access controls are in place. You can trust that your documents are handled securely and in compliance with applicable regulations.

Get more for ftb form 3556

- Pos software download with crack download form

- Transfer from traditional ira to roth divorce vanguard form

- Format of conveyance deed

- Nursing virginia evans pdf form

- Employcraft form

- Mc 354 0507 medi cal contact update california department dhcs ca form

- Floridadmvbooklet com english form

- Therabreath ozonator form

Find out other ca form 3556

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form