Virginia Exemption Application Charitable Civic Organization Form

What is the Virginia Exemption Application Charitable Civic Organization Form

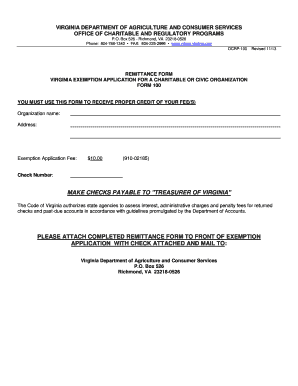

The Virginia Exemption Application Charitable Civic Organization Form is a legal document used by nonprofit organizations in Virginia to apply for exemption from certain state taxes. This form is essential for organizations that qualify as charitable or civic entities under Virginia law. By submitting this application, organizations can demonstrate their eligibility for tax-exempt status, which can significantly reduce their financial burdens and enhance their ability to serve the community.

How to use the Virginia Exemption Application Charitable Civic Organization Form

To use the Virginia Exemption Application Charitable Civic Organization Form, organizations must first ensure they meet the eligibility criteria established by the state. After confirming eligibility, organizations should carefully complete the form, providing accurate and detailed information about their operations, mission, and financial status. Once the form is filled out, it should be submitted according to the instructions provided, ensuring all required documentation is included to avoid delays in processing.

Steps to complete the Virginia Exemption Application Charitable Civic Organization Form

Completing the Virginia Exemption Application Charitable Civic Organization Form involves several key steps:

- Review eligibility criteria to ensure your organization qualifies.

- Gather necessary documentation, including financial statements and organizational bylaws.

- Fill out the application form accurately, providing all required information.

- Double-check the form for completeness and accuracy.

- Submit the form along with any required attachments to the appropriate state agency.

Legal use of the Virginia Exemption Application Charitable Civic Organization Form

The legal use of the Virginia Exemption Application Charitable Civic Organization Form is crucial for organizations seeking tax-exempt status. The form must be completed in compliance with Virginia state laws and regulations governing nonprofit organizations. Proper use of the form ensures that the organization can operate without the burden of certain taxes, which is vital for maintaining financial health and fulfilling its mission.

Eligibility Criteria

To qualify for the Virginia Exemption Application Charitable Civic Organization Form, organizations must meet specific eligibility criteria. Generally, this includes being organized for charitable, educational, or civic purposes, and not operating for profit. Additionally, organizations must demonstrate that their activities benefit the public or a significant segment of the community. It is important for applicants to review the detailed eligibility requirements provided by the state to ensure compliance.

Required Documents

When submitting the Virginia Exemption Application Charitable Civic Organization Form, organizations must include several required documents to support their application. These may include:

- Financial statements for the previous fiscal year.

- Bylaws or governing documents of the organization.

- Evidence of the organization’s charitable activities.

- List of board members and their roles within the organization.

Form Submission Methods

The Virginia Exemption Application Charitable Civic Organization Form can be submitted through various methods, depending on the preferences of the organization. Common submission methods include:

- Online submission via the appropriate state agency’s website.

- Mailing a hard copy of the form and supporting documents to the designated office.

- In-person submission at the local government office responsible for processing nonprofit applications.

Quick guide on how to complete virginia exemption application charitable civic organization form

Complete Virginia Exemption Application Charitable Civic Organization Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly and efficiently. Handle Virginia Exemption Application Charitable Civic Organization Form on any device using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

How to modify and eSign Virginia Exemption Application Charitable Civic Organization Form with ease

- Locate Virginia Exemption Application Charitable Civic Organization Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to finalize your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies of documents. airSlate SignNow caters to all your document management needs in just a few clicks from any device you choose. Modify and eSign Virginia Exemption Application Charitable Civic Organization Form and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the virginia exemption application charitable civic organization form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Virginia Exemption Application Charitable Civic Organization Form?

The Virginia Exemption Application Charitable Civic Organization Form is a document required for nonprofits in Virginia to apply for tax exemption status. This form helps organizations recognize their charitable status and enjoy various tax benefits, which can assist in their mission and funding efforts.

-

How can airSlate SignNow help with the Virginia Exemption Application Charitable Civic Organization Form?

airSlate SignNow offers a seamless platform for preparing and eSigning the Virginia Exemption Application Charitable Civic Organization Form. With its user-friendly interface, you can fill out the form efficiently, secure the necessary signatures, and submit it electronically, streamlining the process.

-

Is there a cost associated with using airSlate SignNow for the Virginia Exemption Application Charitable Civic Organization Form?

Yes, airSlate SignNow provides various pricing plans that cater to different organizational needs, including nonprofits. These plans offer affordable options to help you manage the completion and signing of your Virginia Exemption Application Charitable Civic Organization Form without breaking your budget.

-

What features does airSlate SignNow offer for nonprofit organizations?

airSlate SignNow includes features such as document templates, customizable workflows, and secure cloud storage, which are beneficial for nonprofit organizations. These tools specifically enhance the management of important documents like the Virginia Exemption Application Charitable Civic Organization Form, enabling smoother operations.

-

Can I integrate airSlate SignNow with other software systems I use?

Absolutely! airSlate SignNow supports integrations with a variety of applications, including CRM and accounting tools. This compatibility allows you to connect your existing systems for a more cohesive workflow and simplifies the process when managing the Virginia Exemption Application Charitable Civic Organization Form.

-

What are the benefits of using airSlate SignNow for eSigning documents?

Using airSlate SignNow for eSigning documents like the Virginia Exemption Application Charitable Civic Organization Form offers several benefits, such as enhanced security, faster turnaround times, and reduced paperwork. This not only streamlines the signing process but also protects sensitive information within your organization.

-

How does airSlate SignNow ensure the security of my documents?

airSlate SignNow places a high priority on security, employing end-to-end encryption and compliance with industry standards. This ensures that your Virginia Exemption Application Charitable Civic Organization Form and other documents remain secure and confidential throughout the signing process.

Get more for Virginia Exemption Application Charitable Civic Organization Form

Find out other Virginia Exemption Application Charitable Civic Organization Form

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe