DEBTORS CREDIT APPLICATION FORM

What is the debtors credit application form

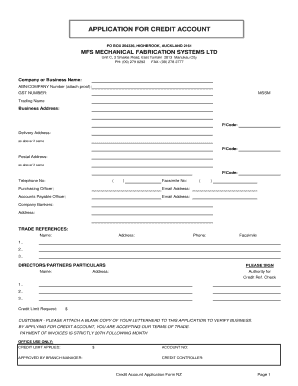

The debtors credit application form is a crucial document used by businesses to assess the creditworthiness of potential clients or customers. This form collects essential information about the applicant's financial history, credit references, and business operations. By filling out this form, businesses can make informed decisions regarding extending credit, setting payment terms, and managing risk. The information gathered typically includes the applicant's name, address, contact information, and details about their financial status and credit history.

Steps to complete the debtors credit application form

Completing the debtors credit application form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including business details and financial records. Next, accurately fill in the form, ensuring that all sections are completed. Pay special attention to providing truthful and comprehensive financial information, as this will impact the credit decision. Once completed, review the form for any errors or omissions before submitting it. Finally, ensure that the form is signed and dated, as this is essential for its validity.

Key elements of the debtors credit application form

The debtors credit application form contains several key elements that are vital for evaluating credit risk. These elements typically include:

- Applicant Information: Name, address, and contact details.

- Business Structure: Type of business entity, such as LLC, corporation, or partnership.

- Financial Information: Details about income, assets, liabilities, and credit history.

- Trade References: Contact information for other businesses that can provide insight into the applicant's payment history.

- Signature: The applicant's signature is required to validate the information provided.

Legal use of the debtors credit application form

The legal use of the debtors credit application form hinges on the accuracy and honesty of the information provided. It is essential that the applicant understands that submitting false information can lead to legal consequences and denial of credit. Additionally, businesses must comply with relevant laws and regulations regarding data protection and privacy when handling the information collected through this form. Properly executed, the form serves as a binding agreement that outlines the terms under which credit is extended.

How to obtain the debtors credit application form

The debtors credit application form can typically be obtained directly from the business seeking to extend credit. Many companies provide this form on their websites for easy access. Alternatively, businesses may request the form via email or in person. It is important to ensure that the most current version of the form is being used, as outdated forms may not comply with current legal standards or company policies.

Form submission methods

Submitting the debtors credit application form can be done through various methods, depending on the preferences of the business requesting the application. Common submission methods include:

- Online Submission: Many businesses allow applicants to fill out and submit the form electronically through secure online portals.

- Email Submission: Completed forms can be scanned and emailed to the appropriate department for processing.

- Mail Submission: Applicants may also choose to print the form and send it via postal mail.

- In-Person Submission: Some businesses may require applicants to deliver the form in person for verification purposes.

Quick guide on how to complete debtors credit application form

Effortlessly Prepare DEBTORS CREDIT APPLICATION FORM on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, enabling you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents promptly and without complications. Manage DEBTORS CREDIT APPLICATION FORM on any device with the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

How to Modify and eSign DEBTORS CREDIT APPLICATION FORM with Ease

- Obtain DEBTORS CREDIT APPLICATION FORM and click on Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive data with tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select how you'd like to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about missing or lost documents, tiresome form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from your preferred device. Modify and eSign DEBTORS CREDIT APPLICATION FORM and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the debtors credit application form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a DEBTORS CREDIT APPLICATION FORM?

A DEBTORS CREDIT APPLICATION FORM is a document used by businesses to evaluate the creditworthiness of potential debtors. It collects essential information regarding the debtor's financial history, credit references, and other relevant data. This form is crucial for minimizing financial risk when extending credit.

-

How can I access a DEBTORS CREDIT APPLICATION FORM through airSlate SignNow?

You can easily create and access a DEBTORS CREDIT APPLICATION FORM using airSlate SignNow's intuitive platform. Simply sign up for an account, and you can either customize our built-in templates or create a new form from scratch. This user-friendly process saves your business time and effort.

-

What are the benefits of using airSlate SignNow for the DEBTORS CREDIT APPLICATION FORM?

Using airSlate SignNow for your DEBTORS CREDIT APPLICATION FORM provides multiple benefits, such as faster turnaround times and enhanced security. Our digital platform allows you to send and eSign documents easily, saving valuable resources. Moreover, you can track the status of applications in real time, ensuring prompt follow-ups.

-

Is there a cost associated with using airSlate SignNow for a DEBTORS CREDIT APPLICATION FORM?

Yes, airSlate SignNow offers a range of pricing plans tailored to meet the needs of various businesses. Our plans ensure you have access to all the necessary features for managing your DEBTORS CREDIT APPLICATION FORM efficiently. We recommend checking our pricing page for detailed information about each plan.

-

Can I integrate the DEBTORS CREDIT APPLICATION FORM with other business tools?

Absolutely! airSlate SignNow supports numerous third-party integrations, allowing you to streamline your workflows. You can connect your DEBTORS CREDIT APPLICATION FORM to tools such as CRM systems, accounting software, and more for seamless data management.

-

How secure is the information collected in the DEBTORS CREDIT APPLICATION FORM?

Security is a top priority at airSlate SignNow. We use advanced encryption and security protocols to protect the data collected in your DEBTORS CREDIT APPLICATION FORM. This ensures that sensitive information remains confidential and safeguarded against unauthorized access.

-

Can I customize the DEBTORS CREDIT APPLICATION FORM to fit my business needs?

Yes, airSlate SignNow allows you to fully customize your DEBTORS CREDIT APPLICATION FORM. You can add your company logo, adjust fields, and include specific questions relevant to your business requirements. This customization ensures that the form aligns with your brand identity.

Get more for DEBTORS CREDIT APPLICATION FORM

Find out other DEBTORS CREDIT APPLICATION FORM

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself