Form D 1040L Detroitmi

What is the Form D 1040L Detroitmi

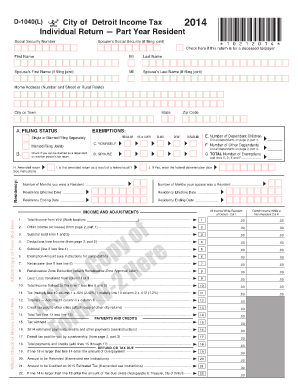

The Form D 1040L Detroitmi is a specific tax form utilized by individuals and businesses in Detroit, Michigan, for reporting income and calculating tax obligations. This form is essential for ensuring compliance with local tax regulations and is part of the broader tax filing process. It is designed to collect pertinent financial information, enabling the local tax authority to assess tax liabilities accurately.

How to use the Form D 1040L Detroitmi

Using the Form D 1040L Detroitmi involves several steps. First, gather all necessary financial documents, such as income statements, deductions, and credits. Next, accurately fill out the form, ensuring that all information is complete and correct. After completing the form, review it for accuracy before submission. It is crucial to follow the specific instructions provided for the form to avoid any errors that could lead to delays or penalties.

Steps to complete the Form D 1040L Detroitmi

Completing the Form D 1040L Detroitmi requires careful attention to detail. Here are the steps to follow:

- Gather all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Begin filling out the form by entering personal information, such as name, address, and Social Security number.

- Report all sources of income accurately, including wages, interest, and dividends.

- Include any deductions and credits you qualify for, as these can significantly impact your tax liability.

- Review the completed form for any errors or omissions.

- Sign and date the form before submission.

Legal use of the Form D 1040L Detroitmi

The legal use of the Form D 1040L Detroitmi is governed by local tax laws and regulations. To ensure that the form is legally valid, it must be filled out accurately and submitted by the designated deadline. Additionally, electronic signatures are accepted, provided they comply with the relevant eSignature laws, such as ESIGN and UETA. It is essential to retain a copy of the submitted form for your records, as it may be required for future reference or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Form D 1040L Detroitmi are crucial for compliance. Typically, the form must be submitted by April 15 of each year, aligning with the federal tax filing deadline. However, it is advisable to check for any local extensions or changes that may apply. Missing the deadline can result in penalties and interest on any unpaid taxes, so staying informed about these important dates is essential for all filers.

Required Documents

To complete the Form D 1040L Detroitmi, several documents are required. These typically include:

- W-2 forms from employers, detailing wages and withholdings.

- 1099 forms for any freelance or contract work.

- Records of any other income sources, such as interest or dividends.

- Documentation for deductions, such as receipts for business expenses or charitable contributions.

Having these documents ready will streamline the process and help ensure accuracy when filling out the form.

Quick guide on how to complete form d 1040l detroitmi

Effortlessly Prepare Form D 1040L Detroitmi on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools needed to create, modify, and electronically sign your documents swiftly without any delays. Handle Form D 1040L Detroitmi on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and Electronically Sign Form D 1040L Detroitmi with Ease

- Obtain Form D 1040L Detroitmi and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, cumbersome form navigation, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form D 1040L Detroitmi to ensure exceptional communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form d 1040l detroitmi

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form D 1040L Detroitmi?

Form D 1040L Detroitmi is a key document required for tax filing in Detroit, Michigan. It is essential for individuals to accurately complete this form to ensure compliance with local tax regulations. Knowing how to fill out Form D 1040L Detroitmi can help you avoid penalties and streamline your filing process.

-

How much does filing Form D 1040L Detroitmi cost?

The cost of filing Form D 1040L Detroitmi can vary depending on whether you use tax software or a professional service. With airSlate SignNow, you can save on costs by utilizing our affordable eSignature solution. We offer flexible pricing options to suit your budget and needs.

-

What features does airSlate SignNow offer for Form D 1040L Detroitmi?

airSlate SignNow provides an array of features designed to simplify the handling of Form D 1040L Detroitmi. These include easy document uploads, customizable templates, and secure eSignatures. Our platform ensures that you can complete your forms quickly and efficiently.

-

How can airSlate SignNow benefit me when filing Form D 1040L Detroitmi?

Using airSlate SignNow for Form D 1040L Detroitmi allows for a seamless eSigning experience, saving you valuable time. Our user-friendly interface means you can quickly navigate through the process, making sure all necessary signatures are obtained. This enhances accuracy and compliance in your filings.

-

Does airSlate SignNow integrate with other tools for handling Form D 1040L Detroitmi?

Yes, airSlate SignNow offers integrations with various productivity tools to streamline your work with Form D 1040L Detroitmi. Whether it’s CRM systems or cloud storage solutions, our platform ensures you can access and manage your documents efficiently. This flexibility supports your overall workflow.

-

Is airSlate SignNow secure for Form D 1040L Detroitmi filing?

Absolutely! airSlate SignNow prioritizes security, ensuring that all data related to Form D 1040L Detroitmi is protected. We employ industry-standard encryption and compliance protocols to safeguard your information. You can confidently manage and send your tax documents through our platform.

-

Can I use airSlate SignNow on mobile for Form D 1040L Detroitmi?

Yes, airSlate SignNow is fully optimized for mobile use, allowing you to handle Form D 1040L Detroitmi on the go. Whether you're using a smartphone or tablet, our app provides a seamless experience for eSigning and documenting. Stay productive wherever you are!

Get more for Form D 1040L Detroitmi

- Hang out 4 student book pdf form

- How to be interesting jessica hagy pdf form

- Pa angler award form

- Uniform washington state tow impound

- Fire claim form 271213 reliance general insurance

- Vision report form

- Cdn portofportland compdfssecurity badgingpdx security badge renewal application port of portland form

- Parent or guardian consent form

Find out other Form D 1040L Detroitmi

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe