Regulation 1533 1 Form

What is the Regulation 1533 1

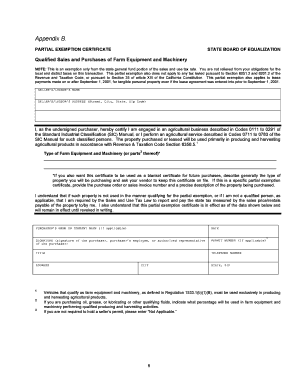

The Regulation 1533 1 form is a crucial document used in various legal and administrative processes. It serves to ensure compliance with specific regulatory requirements, often related to financial disclosures or operational guidelines. Understanding the purpose and implications of this form is essential for individuals and businesses alike, as it can impact legal standing and regulatory compliance.

How to use the Regulation 1533 1

Using the Regulation 1533 1 form involves several key steps to ensure proper completion and submission. First, gather all necessary information and documentation required to fill out the form accurately. Next, follow the instructions provided with the form, paying close attention to any specific requirements outlined for your situation. Once completed, review the form for accuracy before submitting it to the appropriate authority, whether that be electronically or via mail.

Steps to complete the Regulation 1533 1

Completing the Regulation 1533 1 form requires a systematic approach. Begin by reading the instructions carefully to understand the information needed. Fill in the required fields with accurate data, ensuring that all entries are clear and legible. After completing the form, double-check for any errors or omissions. If necessary, consult with a legal or compliance expert to verify that the form meets all regulatory standards before submission.

Legal use of the Regulation 1533 1

The legal use of the Regulation 1533 1 form is governed by specific laws and regulations that dictate its applicability. For the form to be considered valid, it must be completed in accordance with these legal standards, ensuring that all required signatures and certifications are included. Non-compliance with these regulations can lead to legal repercussions, making it essential to understand the legal context surrounding this form.

Key elements of the Regulation 1533 1

Key elements of the Regulation 1533 1 form include the identification of the parties involved, the purpose of the form, and any specific disclosures required. Additionally, the form may require signatures from authorized individuals, along with dates and other pertinent information. Understanding these elements is vital for ensuring that the form is filled out correctly and meets all necessary legal requirements.

Required Documents

When completing the Regulation 1533 1 form, certain documents may be required to support the information provided. These documents can include identification, financial statements, or other relevant materials that substantiate the claims made within the form. It is important to gather all necessary documentation beforehand to facilitate a smooth completion process.

Penalties for Non-Compliance

Failing to comply with the requirements associated with the Regulation 1533 1 form can result in significant penalties. These may include fines, legal action, or other consequences that can adversely affect individuals or businesses. Understanding the potential repercussions of non-compliance underscores the importance of accurately completing and submitting the form in a timely manner.

Quick guide on how to complete regulation 1533 1

Complete Regulation 1533 1 effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Regulation 1533 1 on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign Regulation 1533 1 seamlessly

- Obtain Regulation 1533 1 and select Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Select your preferred method to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of missing or lost files, tedious form navigation, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Edit and eSign Regulation 1533 1 and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the regulation 1533 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is regulation 1533 1 and how does it affect businesses?

Regulation 1533 1 refers to specific compliance standards that businesses must adhere to when handling digital signatures. Understanding this regulation is crucial for organizations to ensure their eSigning processes are legally binding and secure. By aligning with regulation 1533 1, businesses can avoid legal issues and maintain customer trust.

-

How does airSlate SignNow comply with regulation 1533 1?

airSlate SignNow is designed to comply with regulation 1533 1 by utilizing industry-standard encryption and security protocols. The platform ensures that all eSigned documents are legally valid and safeguarded against unauthorized access. Compliance with regulation 1533 1 allows users to confidently manage their documents in a trustworthy environment.

-

What pricing options does airSlate SignNow offer for meeting regulation 1533 1 requirements?

airSlate SignNow offers flexible pricing plans tailored to fit different business needs while ensuring compliance with regulation 1533 1. Customers can choose from various subscription tiers, each providing essential features that facilitate regulatory compliance. These plans are designed to be cost-effective, making it easier for organizations to comply without breaking the bank.

-

What features does airSlate SignNow provide to support regulation 1533 1 compliance?

airSlate SignNow includes features such as secure document storage, audit trails, and customizable workflows that support regulation 1533 1 compliance. These tools help businesses track the entire signing process, ensuring that every action is documented and aligns with regulatory standards. Such features provide peace of mind that your eSigning practices are secure and compliant.

-

Can airSlate SignNow integrate with other tools to help maintain regulation 1533 1 compliance?

Yes, airSlate SignNow supports integrations with various business applications, making it easier to maintain compliance with regulation 1533 1. Integrating with CRM, ERP, and other solutions enhances workflow efficiency and ensures that all documents processed through these systems are legally compliant. This interoperability helps streamline business operations while adhering to important regulations.

-

What are the benefits of using airSlate SignNow for regulation 1533 1 compliance?

Using airSlate SignNow to comply with regulation 1533 1 offers several benefits, including enhanced security, improved efficiency, and legal validity of eSignatures. The platform automates document workflows, reducing the time and resources spent on manual processes. Additionally, businesses can confidently ensure that their online transactions are secure and compliant with necessary regulations.

-

How intuitive is the user interface of airSlate SignNow when meeting regulation 1533 1?

airSlate SignNow features a user-friendly interface that makes it easy for users to manage documents while complying with regulation 1533 1. The straightforward navigation allows users to send and eSign documents quickly without extensive training. This ensures that more employees can participate in eSigning without compromising compliance or security.

Get more for Regulation 1533 1

Find out other Regulation 1533 1

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure