Form 9783t

What is the Form 9783t

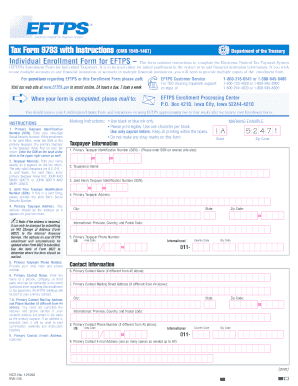

The Form 9783t is a specific document used within the context of electronic funds transfer for tax purposes. This form is part of the Electronic Federal Tax Payment System (EFTPS), which allows taxpayers to pay federal taxes electronically. The form is specifically designed to facilitate the submission of payment instructions and ensure compliance with federal tax regulations. Understanding the purpose and function of the Form 9783t is essential for individuals and businesses looking to manage their tax obligations efficiently.

How to use the Form 9783t

Using the Form 9783t involves several straightforward steps. First, ensure you have access to the EFTPS system, as this form is submitted electronically. Next, gather the necessary information, including your taxpayer identification number and payment details. Once you have all required information, fill out the form accurately and review it for any errors. After completing the form, submit it through the EFTPS platform to initiate your payment. It's important to keep a record of your submission for future reference.

Steps to complete the Form 9783t

Completing the Form 9783t requires careful attention to detail. Follow these steps for accurate completion:

- Log into your EFTPS account or create one if you do not have it.

- Navigate to the section for submitting the Form 9783t.

- Input your taxpayer identification number and select the type of tax payment you are making.

- Provide the payment amount and the date you wish for the payment to be processed.

- Review all entered information for accuracy before submission.

- Submit the form electronically and save a confirmation of your submission.

Legal use of the Form 9783t

The Form 9783t is legally binding when completed and submitted in accordance with the applicable laws governing electronic signatures and tax payments. Compliance with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA) ensures that electronic submissions are treated as valid as traditional paper forms. It is crucial for users to understand these legal frameworks to ensure their submissions are recognized by the IRS and other relevant authorities.

Key elements of the Form 9783t

When filling out the Form 9783t, several key elements must be included to ensure its validity:

- Taxpayer identification number: This unique identifier is essential for processing your payment.

- Payment amount: Clearly state the amount you intend to pay.

- Payment date: Specify the date you want the payment to be processed.

- Contact information: Provide your email or phone number for any necessary follow-up.

Form Submission Methods

The Form 9783t is primarily submitted electronically through the EFTPS platform. This method ensures a secure and efficient way to manage tax payments. Users can also access their payment history and receive confirmations of their submissions directly through the system. While electronic submission is the preferred method, it is important to be aware of any specific guidelines or requirements set forth by the IRS regarding electronic payments.

Quick guide on how to complete form 9783t 1659511

Complete Form 9783t seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Form 9783t on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Form 9783t effortlessly

- Obtain Form 9783t and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, cumbersome form navigation, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Form 9783t and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 9783t 1659511

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 9783t and how does it work?

Form 9783t is a critical document utilized in various business processes for eSigning and secure document handling. With airSlate SignNow, users can easily create, send, and manage form 9783t electronically, ensuring a quick and efficient workflow.

-

What features does airSlate SignNow offer for form 9783t?

airSlate SignNow provides multiple features for managing form 9783t, including customizable templates, real-time collaboration, and automated workflows. These features streamline the signing process and enhance the overall user experience.

-

How much does it cost to use airSlate SignNow for form 9783t?

Pricing for using airSlate SignNow to handle form 9783t varies based on the chosen plan, with several affordable options designed for businesses of all sizes. Each plan includes essential features that facilitate document management and eSigning.

-

Can I integrate form 9783t with other applications?

Yes, airSlate SignNow allows integration of form 9783t with various applications such as CRM systems, cloud storage services, and collaboration tools. This integration supports a seamless workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for form 9783t?

Utilizing airSlate SignNow for form 9783t offers several benefits, including reduced turnaround time for document signing and enhanced security measures. Businesses can save resources and improve efficiency by adopting this digital solution.

-

Is airSlate SignNow secure for handling form 9783t?

Absolutely, airSlate SignNow employs advanced encryption and security protocols to protect form 9783t and other sensitive documents. Users can trust that their data is safe and complies with industry standards.

-

Can multiple users collaborate on form 9783t in airSlate SignNow?

Yes, airSlate SignNow facilitates collaboration by allowing multiple users to work on form 9783t simultaneously. This feature is particularly useful for teams that need to review and approve documents in real-time.

Get more for Form 9783t

Find out other Form 9783t

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online