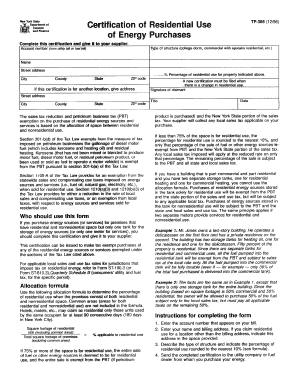

Tp385 Form

What is the TP385?

The TP385 form is a specific document used for various administrative purposes, often related to tax or legal matters. It serves as a means for individuals or businesses to provide necessary information to governmental agencies. Understanding the TP385 is essential for ensuring compliance with relevant regulations and for fulfilling reporting requirements.

How to use the TP385

Using the TP385 involves several steps to ensure that the form is completed accurately. First, gather all necessary information that is required by the form. This may include personal identification details, financial information, or other relevant data. Next, fill out the form carefully, ensuring that all sections are completed as required. Once completed, review the form for accuracy before submission.

Steps to complete the TP385

Completing the TP385 can be broken down into a series of straightforward steps:

- Gather all required documents and information.

- Access the TP385 form online or obtain a physical copy.

- Fill in the form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions.

- Submit the completed form according to the specified submission methods.

Legal use of the TP385

The TP385 form must be used in accordance with applicable laws and regulations. It is important to ensure that the information provided is truthful and accurate, as any discrepancies may lead to legal consequences. The form may be subject to audits, and maintaining compliance with legal standards is crucial for its validity.

Filing Deadlines / Important Dates

Filing deadlines for the TP385 can vary depending on the specific purpose of the form. It is essential to be aware of these deadlines to avoid penalties or complications. Generally, deadlines may align with tax filing seasons or specific regulatory requirements. Always check for the latest updates regarding important dates related to the TP385.

Form Submission Methods

The TP385 can typically be submitted through various methods, including:

- Online submission via designated government portals.

- Mailing the completed form to the appropriate agency.

- In-person submission at designated offices or agencies.

Key elements of the TP385

Understanding the key elements of the TP385 is vital for its successful completion. Important components may include:

- Identification information of the individual or business.

- Specific details related to the purpose of the form.

- Signature and date fields to validate the submission.

Quick guide on how to complete tp385

Effortlessly Prepare Tp385 on Any Device

Digital document management has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the necessary format and securely save it online. airSlate SignNow provides you with all the resources needed to generate, modify, and electronically sign your documents swiftly without delays. Manage Tp385 on any device with airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The easiest way to alter and eSign Tp385 seamlessly

- Find Tp385 and click on Get Form to begin.

- Utilize the tools available to finalize your document.

- Emphasize important sections of your documents or obscure sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal value as a conventional wet signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced papers, tedious document searches, or mistakes that require new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and eSign Tp385 and guarantee excellent communication at every step of your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tp385

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is tp385 and how does it integrate with airSlate SignNow?

The tp385 refers to a specific feature within the airSlate SignNow platform that enhances the eSigning process. It allows seamless integration with various applications, making document management efficient. This feature is designed to improve workflow and streamline the signing process for users.

-

How much does airSlate SignNow cost, and does it support tp385?

airSlate SignNow offers competitive pricing plans that cater to different business needs, including support for the tp385 feature. You can choose from various subscription levels based on your expected usage and required functionalities. This cost-effective solution allows businesses to manage their document signing needs without breaking the bank.

-

What are the key features of tp385 in airSlate SignNow?

tp385 includes numerous features designed for efficient document signing. It allows users to customize workflows, send reminders, and track document status. These features enhance the user experience, ensuring that signing and document management are convenient and straightforward.

-

How does tp385 benefit businesses using airSlate SignNow?

The tp385 feature offers signNow benefits for businesses by streamlining the eSigning process, reducing turnaround times, and improving overall efficiency. Companies can enjoy faster document completion and enhanced collaboration. Additionally, it aids in maintaining compliance with legal standards.

-

Can I integrate tp385 with other applications besides airSlate SignNow?

Yes, tp385 is designed to integrate seamlessly with other popular applications and platforms. This flexibility allows businesses to connect their existing tools with airSlate SignNow for a more comprehensive workflow. Integration capabilities ensure that your eSigning process is tailored to your unique business needs.

-

What types of businesses typically use tp385 with airSlate SignNow?

Various types of businesses utilize tp385 with airSlate SignNow, ranging from small startups to large corporations. It is particularly useful for industries that rely heavily on document signing, like real estate, legal, and finance. The adaptable nature of the tp385 feature makes it suitable for any business looking to streamline their document management.

-

How secure is tp385 in airSlate SignNow for handling sensitive documents?

tp385 within airSlate SignNow prioritizes security, employing encryption and secure authentication methods to protect sensitive documents. Business owners can confidently send and store important documents, knowing that security protocols are in place. This commitment to safety helps users maintain trust in their document signing processes.

Get more for Tp385

- The hippocrates code pdf form

- Western union form 453714552

- Michigan dept of state disability placard application form

- Sample case notes for case managers form

- Straightforward pre intermediate progress test 1 form

- New inside out upper intermediate review a flashcards form

- Payment options bandera electric cooperative form

- Field trip request form pdf args

Find out other Tp385

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself