Closing a Health Savings Account Form

What is the Closing A Health Savings Account

A Health Savings Account (HSA) is a tax-advantaged account designed for individuals with high-deductible health plans (HDHPs) to save for medical expenses. Closing an HSA involves formally terminating the account, which may be necessary for various reasons, such as switching to a different health plan or no longer needing the account. When closing an HSA, it is essential to follow the specific procedures outlined by the financial institution managing the account to ensure compliance with IRS regulations.

Steps to complete the Closing A Health Savings Account

Closing a Health Savings Account requires several steps to ensure a smooth process:

- Contact your HSA provider to request the account closure.

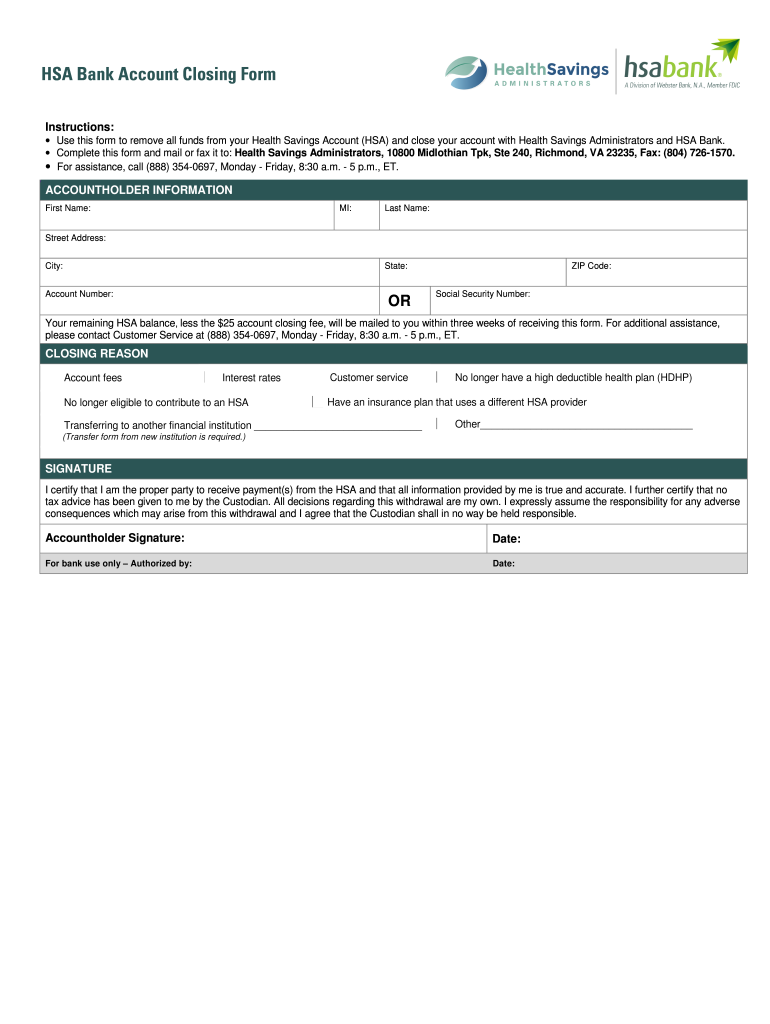

- Complete any required forms, often referred to as the HSA bank account closing form.

- Transfer any remaining funds to another HSA or withdraw them for eligible medical expenses.

- Confirm that all transactions are completed and obtain a confirmation of the account closure.

Following these steps helps to avoid any potential tax implications or penalties associated with improper closure.

Required Documents

To close a Health Savings Account, you typically need to provide specific documentation, which may include:

- The completed HSA bank account closing form.

- Identification documents to verify your identity.

- Any additional forms required by your HSA provider.

Ensuring that you have all necessary documents ready can expedite the closure process and help prevent delays.

Legal use of the Closing A Health Savings Account

Closing a Health Savings Account must comply with IRS regulations to avoid penalties. It is crucial to understand that funds in an HSA can only be used for qualified medical expenses. If the account is closed and funds are withdrawn for non-qualified expenses, taxes and penalties may apply. Additionally, the account holder should retain records of all transactions for tax purposes, as these may be needed to substantiate the use of funds in the event of an audit.

IRS Guidelines

The IRS provides specific guidelines regarding the closure of Health Savings Accounts. It is essential to be aware of the following:

- Funds must be used for qualified medical expenses to avoid tax penalties.

- Account holders should report any distributions on their tax returns.

- Closing an HSA does not affect the tax benefits of contributions made in previous years.

Consulting IRS publications or a tax professional can provide additional clarity on these guidelines.

Form Submission Methods (Online / Mail / In-Person)

When closing a Health Savings Account, you may have several options for submitting the necessary forms:

- Online submission through your HSA provider's secure portal.

- Mailing the completed forms to the address provided by your HSA provider.

- Visiting a local branch of your HSA provider to submit the forms in person.

Choosing the most convenient method can help ensure that your account is closed efficiently.

Quick guide on how to complete hsa bank account closing form

The optimal method to locate and endorse Closing A Health Savings Account

On a company-wide level, ineffective workflows concerning paper authorization can consume signNow work hours. Signing documents like Closing A Health Savings Account is an inherent aspect of operations in any organization, which is why the efficiency of each agreement’s lifecycle signNowly impacts the enterprise’s overall productivity. With airSlate SignNow, endorsing your Closing A Health Savings Account is as straightforward and quick as possible. You’ll discover on this platform the most recent version of nearly any form. Moreover, you can sign it directly without needing to install third-party software on your computer or printing anything as physical copies.

Steps to obtain and endorse your Closing A Health Savings Account

- Explore our collection by category or utilize the search bar to find the document you require.

- Examine the form preview by clicking Learn more to ensure it’s the correct one.

- Click Get form to begin editing immediately.

- Fill out your form and add any essential details using the toolbar.

- Once finished, click the Sign tool to endorse your Closing A Health Savings Account.

- Choose the signature method that suits you best: Draw, Generate initials, or upload an image of your handwritten signature.

- Click Done to finish editing and proceed to document-sharing options as necessary.

With airSlate SignNow, you possess everything required to manage your documents efficiently. You can find, complete, modify, and even send your Closing A Health Savings Account in one tab effortlessly. Optimize your workflows with a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

How do I fill out the Andhra Bank account opening form?

Follow the step by step process for filling up the Andhra Bank account opening form.Download Account Opening FormIf you don't want to read the article, watch this video tutorial or continue the post:Andhra Bank Account Opening Minimum Balance:The minimum amount required for opening Savings Account in Andhra Bank isRs. 150Andhra Bank Account Opening Required Documents:Two latest passport size photographsProof of identity - Passport, Driving license, Voter’s ID card, etc.Proof of address - Passport, Driving license, Voter’s ID card, etc. If temporary address and permanent address are different, then both addresses will have to submitted.PAN cardForm 16 (only if PAN card is not available)See More Acceptable Documents for Account OpeningNow Finally let's move to filling your Andhra Bank Account Opening Form:Step 1:Step 2:Read More…

-

How do I fill out the Axis Bank account closure form?

How To Fill Axis Bank Account Closure FormTo close your axis bank account, first you have to download the bank account closure form then submit it to your bank branch.Click the link and download the form:http://bit.ly/accntclosurepdfAfter downloading the account closure form, you have to fill up exactly as I have show below with detail. Kindly go through the filled form below and after filling the form, take all the kit like credit card, debit card, passbook and etc and submit it to your bank with the filled form.Source: How To Fill Axis Bank Account Closure Form

-

How do I fill out the Allahabad Bank account opening form?

Follow the step by step process for filling up the Allahabad Bank account opening form.Download Account Opening FormIf you don't want to read the article, watch this video tutorial or continue the post:Allahabad Bank Account Opening Minimum Balance:The minimum amount required to open a savings account is as follows: The minimum balance to open an account in rural and sub-urban branches isRs.500The minimum balance to open an account in all other branches isRs.1,000For issue of cheque book, an additional Rs.100 is to be paid in rural and sub-urban branches.Allahabad Bank Account Opening Required Documents:Two latest passport size photographsProof of identity - Passport, Driving license, Voter’s ID card, etc.Proof of address - Passport, Driving license, Voter’s ID card, etc. If temporary address and permanent address are different, then both addresses will have to submitted.PAN cardForm 16 (only if PAN card is not available)Step 1:Continue Reading…

-

Do I need a bank account to fill out the MHT CET application form?

To apply, you need to pay through online mode. This doesn't necessarily need you to have a bank account. You can ask anyone kind-hearted who is having a bank account to pay and handover the hard cash to that person.Hope this helps.

-

Why do you have to fill out an application to close a bank account?

Question: WHY DO YOU HAVE TO FILL OUT AN APPLICATION TO CLOSE A BANK ACCOUNT? (Photo credit: warren currier) _______________________________________________________ Answer: "YOU REMAIN RESPONSIBLE FOR THE ACCOUNT AS LONG AS IT REMAINS OPEN, THEREFORE, UNTIL YOU CLOSE A BANK ACCOUNT PROPERLY, YOU OWN IT! CLOSING THE ACCOUNT PROPERLY IS THE ONLY WAY TO ENSURE THE ACCOUNT CAN NOT BE USED IN SOME ILLEGAL WAY IN THE FUTURE. REMEMBER, WHETHER OR NOT YOU'RE INVOLVED OR WHETHER OR NOT YOU HAVE ANY KNOWLEDGE OF ANY ILLEGAL ACTIVITY, IT IS YOUR ACCOUNT AND YOU ARE RESPONSIBLE FOR THE ACCOUNT UNTIL IT HAS BEEN CLOSED ACCORDING TO CURRENT LAWS"____________________________________________________ (see ZERO HEDGE article at bottom of this page)____________________________________________________MONEY LAUNDERING ____________________________________________________Money Laundering: A Banker’s Guide to Avoiding Problems*Office of the Comptroller of the CurrencyWashington, DCDecember 2002. (link below)___________________________________________________ Background: "On February 12, 2002, the U.S. House Financial ServicesSubcommittee on Oversight and Investigations heard testimony regarding terrorist financing and the implementation of the USA PATRIOT Act. The testimony discusses what the Federal Bureauof Investigation (FBI) has learned since the September 11, 2001,terrorist attacks about the patterns of financing associated with terrorist networks. The FBI also described the extent to which U.S. anti-money laundering statutes provide the necessary tools to detect and disrupt these patterns of financing. An interagency Financial Review Group devoted signNow resources toidentifying and following the money trail""The international community has long recognized that the problems of money laundering and terrorism require a coordinated approach. For many years, a number of international organizations have developed standards for combating money laundering, terrorism, and terrorist financing.These standards contain common themes of promoting actionsto deny criminals, terrorists, and those who assist them access to their funds and the world’s financial services industries. Many international agreements and resolutions outline similar standards or build upon each other"http://www.occ.gov/topics/bank-o...____________________________________________________ WHAT ARE BANKS LOOKING FOR? Money Laundering Information for BanksTransactions involving Accounts:Opening accounts when the customer’s address is outside the local service area.Opening accounts in other people’s names.Attempting to open or operating accounts under a false name.Accounts with a large number of small cash deposits and small number of large cash withdrawals.Funds are deposited into several accounts, consolidated into one and transferred outside the country.Customer frequently uses many deposit locations outside of the home branch location.Multiple transactions are carried out on the same day at the same branch but with an apparent attempt to use different tellers.Establishment of multiple accounts, some of which appear to remain dormant for extended periods.Account that was reactivated from inactive or dormant status suddenly sees signNow activity.Reactivated dormant account containing a minimal sum suddenly receives a deposit or series of deposits followed by frequent cash withdrawals until the transferred sum has been removed.Deposit and/or withdrawals of multiple monetary instruments, particularly if the instruments are sequentially numbered.Multiple personal and business accounts are used to collect and then funnel funds to a small number of foreign beneficiaries, particularly when they are in locations of concern, such as countries known or suspected to facilitate money laundering activities.____________________________________________________ "A question of control: Whoever's in charge of the money will ultimately be the one in charge of everything!"(warren currier, april 17, 2016)____________________________________________________ ____________________________________________________ Why is there all of this new interest in governing crypto-currencies?("Whoever's in charge of the money will ultimately be the one in charge of everything!")____________________________________________________ LEARN TO READ BETWEEN THE LINES ____________________________________________________ Excerpt from STRATFOR GLOBAL INTELLIGENCE paragraph seven, below: "Governments have struggled to stop decentralized networks in the past, but with each evolution of government crackdowns on file-sharing programs, the programmers become more sophisticated"____________________________________________________ to wit: STRATFOR Examining the Future of Bitcoin"Editor's Note: This foundational analysis on bitcoin was originally published Feb. 28. 2014. In light of the U.S. Commodity Futures Trading Commission's (CFTC) Sept. 17 decision to change its regulation governing crypto-currencies, we are republishing it. Stratfor asserted that the underlying technology behind bitcoin will have wide-ranging applications in a number of areas, including finance and computer science. The CFTC has decided to consider bitcoin a commodity rather than a currency, which means it will fall under the commission's jurisdiction. While somewhat disruptive in the interim, this ruling does allow for bitcoin to be used as an asset class similar to gold or oil. From now on, companies seeking to operate as trading platforms for cryptocurrency derivatives or futures must register and comply with regulations laid out by the CFTC.Bitcoin is a relatively new and unregulated electronic currency that enables the owner to buy, sell and trade anonymously without incurring high transaction charges. Since its creation in 2009, Bitcoin has become the most prevalent of a number of so-called cryptocurrencies. Some have heralded cryptocurrencies as potential challengers to financial institutions, especially in developing markets and regions where traditional banking infrastructure is underdeveloped. But despite a positive reaction to Bitcoin from the U.S. Federal Reserve Bank, multiple nations have refused to acknowledge the currency. Thailand, Russia, Iceland and Vietnam have all rejected or banned it.Bitcoin experienced a tumultuous February as Mt. Gox, an exchange that converted conventional legal tender into bitcoins and vice versa, on Feb. 7 stopped withdrawals from accounts and ultimately shut down Feb. 24. Finally, on Feb. 28 it was revealed that most of the bitcoins deposited into the exchange — approximately $475 million worth — had disappeared. Electronic currencies such as bitcoin are susceptible to cyberattack, as the Mt. Gox incident shows. Chief among other concerns about electronic currencies is their existence beyond governments' capital controls, making illegal activities such as money laundering relatively straightforward. Financial regulators and many observers say that cryptocurrencies are a speculative bubble waiting to collapse. But no amount of opposition can erase electronic currencies or the technology behind them.AnalysisCentral to the idea of currency is ownership, the fact that money can only belong to (and therefore be spent by) one person or entity at a time. In the digital era, electronic money is no different than any other computer file, which means that unlike physical money, it can be endlessly copied. Bitcoin is not the first attempt at creating an electronic currency, but it is the first digital tender to gain serious interest and backing. This is largely due to the efforts of Satoshi Nakamoto, a fictitious name or group, responsible for the "Bitcoin protocol." Prior to Bitcoin, electronic currencies required a third party, such as PayPal, to determine if one party still owned the money or had previously spent it, thus transferring ownership to someone else. The Bitcoin protocol solved this problem by creating a publicly viewable global ledger, showing the sequential transactions of all accounts using bitcoin.Bitcoins are bought and sold on the Internet at places known as exchanges. Bitcoins are generally stored in a digital wallet and transactions are recorded in a shared public ledger known as the "blockchain." The currency is not controlled by a central bank but is instead managed by an online community. Members with powerful computers are encouraged to maintain the transactional register by "verifying the blockchain" — solving complex mathematical equations and adding another "block" of transactions to the existing chain. The process is known as "mining" because the verifier is rewarded with new bitcoins. The way the system works, new bitcoins will not be created after there are 21 million in circulation, which is projected to happen in the year 2140.Bitcoin has both strengths and weaknesses as a currency. Accounts themselves are anonymous, but determining ownership through regulating exchanges or IP addresses is possible. Bitcoin also enables merchants to escape expensive transaction fees that are often the consequence of fraud protection. This is because bitcoin transactions are not reversible and, from the point of view of the merchant, there is little inherent risk of fraud. But due to skepticism and the fact that this is a relatively new concept entirely, few merchants accept bitcoins. Potential markets are also being shuttered by some countries that are fearful of the unique opportunities that cryptocurrencies offer compared to traditional state-sanctioned money.Decentralized currencies such as Bitcoin remain in their infancy. To achieve mainstream longevity, cryptocurrencies will need to become popular and user friendly or find acceptance with a gigantic corporation such as Amazon. Governments have struggled to stop decentralized networks in the past, but with each evolution of government crackdowns on file-sharing programs, the programmers become more sophisticated. For example, when Napster became popular for file sharing and was taken down, Kazaa, another file-sharing application, was created instead. This has led to peer-to-peer networks that are so decentralized that they are nearly impossible to stop.This will not prevent governments from trying to monitor, disrupt and partially regulate cryptocurrencies — in extreme cases governments could also physically move to shut down exchanges — so the programmers behind cryptocurrencies have to improve the reliability and security of their networks. Hardening exchanges against cyberattacks, or at least limiting their frequency, will be critical in instilling confidence.Bitcoin as a TechnologyBitcoin is far more than a currency; it is a new technological platform. Currency is just one of many potential applications. While bitcoin itself may fail, its technological breakthrough — the Bitcoin protocol — can be used for other applications in computer science. Though observers have pointed to the Mt. Gox shutdown as proof bitcoin will fail, having one exchange shut down is not a big deal, and bitcoins' value on other exchanges has yet to collapse since Mt. Gox's problems began in early February.Over the last year, venture capitalists have been quick to invest money in startup businesses that approach bitcoin with unique ideas. One company envisions "colored coins," essentially a Bitcoin-like cryptocurrency where each individual coin represents another physical commodity. Colored coins would then act as a surrogate to trade anything from stocks to securities, traditional money or anything else. Other companies are attempting to connect Wall Street to digital currencies, planning to trade bitcoins or derivatives based on them. To do so would require oversight from the U.S. Securities and Exchange Commission. There is an ongoing movement to get the Securities and Exchange Commission to approve an exchange-traded fund for bitcoins, which are being looked at not just as a currency, but as an asset class all by themselves. Unlike gold, however, Bitcoin is also a currency in the sense that it is easily divisible as well as relatively fluid.Geopolitically, the use of Bitcoin by financial institutions and venture capitalists is of secondary importance, but they do provide a growing user base. The first five years of Bitcoin saw an exponential growth in value as well as popularity. Like any new, free-floating currency, the worth of bitcoins has remained volatile. In order for Bitcoin — or any other cryptocurrency — to be widely adopted, there will need to be an increase in the number of outlets and potential users, and there must be overall confidence in the value and stability of the tender. All of this can come only with time.Cryptocurrencies in the Developing WorldThe relative ease of moving bitcoins in and out of countries with harsh capital controls was demonstrated during the recent financial crises in Cyprus, Argentina and Russia. Even more recently, Bitcoin addresses have been used on protesters' posters in Ukraine as a way to find financial support from abroad. Banking sectors can impose restrictions and limit the movement of conventional funds, but no such regulatory system exists for digital currencies. For frontier and developing markets, digital currencies provide a way for individuals to gain access to dollars and other more stable currencies. The underlying volatility of national currencies is a driver toward alternative tender.Digital money has already revolutionized local economies in some developing countries, providing a functional way to escape capital controls or bypass technologies. M-Pesa is a mobile money transfer system that has become popular in several African countries. The system debuted in Kenya in 2007, and to date roughly one-third of all Kenyans have an M-Pesa account. As a result, the equivalent value of about one-third of Kenya's gross domestic product is now spent via phone. In July 2013, a technology known as Kipochi was developed to connect M-Pesa accounts with Bitcoin accounts. Currently, anyone in the world can send bitcoins directly to a third of people in Kenya with zero transaction costs. This becomes important when considering the number of workers employed outside their home country. Traditional remittances — when foreign workers send money home — are very expensive, with transaction costs upward of 30 percent. Cryptocurrencies such as Bitcoin provide a signNowly cheaper alternative.Kenya's successful adoption of mobile payment methods is a reminder of the fact that bitcoins can be transferred as easily as sending an SMS message on a phone. Much of the developing world does not have access to financial institutions or traditional bank accounts, but even the poorest countries invest in robust telecommunications network architecture, and almost everyone has a cellphone. The proliferation of cellphones and a digital tender such as Bitcoin could enable societies to skip technological phases, such as the need to construct a massive and intricate network of landlines.On top of the impact on remittances, cryptocurrencies encourage innovative financial markets, for both the developed and the developing world. Cryptocurrencies enable a mechanism for global peer-to-peer lending, a concept made popular through companies like Kickstarter. Digital transactions can be used to finance projects anywhere on the planet. This is especially important for developing countries because it allows access to informal capital markets in the developed world. Securing enough credit through traditional channels to start a small business in Zambia is difficult, but obtaining multiple instances of smaller amounts from the fringes of a developed economy is achievable.Cryptocurrencies in the Developed WorldMost countries that eschew stringent capital controls (such as the United States and Japan) are adopting a wait-and-see approach to Bitcoin, monitoring the currency but not yet taking strong action to regulate it. Other governments with more restricted financial systems are moving to regulate Bitcoin more severely. However, should cryptocurrencies gain prominence in a country's economy to the point that they undermine a central bank's monetary policy, the government of that country would have a problem. Jeopardizing one of the primary methods a nation-state uses to direct its economy — and finance its government — is unacceptable to any authority. By then, assuming a broad citizen investment in the new currency, any attempt to outlaw it or affect the exchanges would be politically difficult, leading to social tension, even unrest.A more likely government strategy to circumvent the impact of digital currencies and preserve the integrity of the treasury would be to employ pre-emptive action at the emergence of cryptocurrency, most likely through regulating the online exchanges. Such regulation would enable government officials to identify online accounts, make connections and thus limit or monitor tax evasion and other illicit activity. Bitcoins are incredibly transparent. Tracking money-flow using the blockchain is just one method agencies may already be using to monitor illegal activities.Bitcoin was initially popularized by libertarians, who saw a digital currency as a way to avoid central banks and state control of the financial sector. As Bitcoin's popularity has grown, so has the interest of venture capitalists, attempting to bring cryptocurrencies into legal and regulated circles. Although Bitcoin may not survive, cryptocurrencies will. While there are enough residual problems to prevent them from going mainstream in the short term, digital currencies are likely to remain popular in specific niche markets"___________________________________________________ THE WAR ON CASH: OFFICIALLY SANCTIONED THEFT By: Tyler Durden, 2015, 06, 15 (complete ARTICLE below)The War On Cash: Officially Sanctioned Theft_______________________________________________________ WHAT DOES IT ALL REALLY MEAN?"It means governments are limiting the use of cash and a variety of official-mouthpiece economists are calling for the outright abolition of cash. Authorities are both restricting the amount of cash that can be withdrawn from banks, and limiting what can be purchased with cash"(tyler durden, june 15, 2015)______________________________________________________ "A question of control: Whoever's in charge of the money will ultimately be the one in charge of everything!"(warren currier, april 17, 2016)______________________________________________________ The War On Cash: Officially Sanctioned Theft ZeroHedge The War On Cash: Officially Sanctioned Theftby Tyler Durden on 06/13/2015 22:15 -0400While the benefits to banks and governments of banning physical cash are self-evident, there are downsides to the real economy and to household resilience.You've probably read that there is a war on cash being waged on various fronts around the world. What exactly does a war on cash mean? It means governments are limiting the use of cash and a variety of official-mouthpiece economists are calling for the outright abolition of cash. Authorities are both restricting the amount of cash that can be withdrawn from banks, and limiting what can be purchased with cash. These limits are broadly called capital controls. The War On Cash: Why Now? Why are governments suddenly acting as if cash money is a bad thing that must be severely limited or eliminated? Before we get to that, let’s distinguish between physical cash—currency and coins in your possession—and digital cash in the bank. The difference is self-evident: cash in hand cannot be confiscated by a “bail-in” (i.e. officially sanctioned theft) in which the government or bank expropriates a percentage of cash deposited in the bank. Cash in hand cannot be chipped away by negative interest rates or fees like cash held in a bank. Cash in the bank cannot be withdrawn in a financial emergency that shutters the banks, i.e. a bank holiday. When pundits suggest cash is “obsolete,” they mean physical paper money and coins, not cash in a bank. Cash in the bank is perfectly fine with the government and its well-paid yes-men (paging Mr. Rogoff and Mr. Buiter) because this cash can be expropriated by either “bail-ins” or by negative interest rates. Mr. Buiter, for example, recently opined that the spot of bother in 2008-09 (the Global Financial Meltdown) could have been avoided if banks had only charged a 6% negative interest rate on cash: in effect, taking 6% of the depositor’s cash to force everyone to spend what cash they might have. Both cash in hand and cash in the bank are subject to one favored method of expropriation, inflation. Inflation—the single most cherished goal of every central bank—steals purchasing power from physical cash and digital cash alike. Inflation punishes holders of cash and benefits those with debt, as debt becomes cheaper to service. The beneficial effect of inflation on debt has been in play for decades, so it can’t be the cause of governments’ recent interest in eliminating physical cash. So now we return to the question: Why are governments suddenly declaring war on physical cash, the oldest officially issued form of money? The first reason: physical cash has the potential to evade both taxes as well as officially sanctioned theft via bail-ins and negative interest rates. In short, physical cash is extremely difficult for governments to steal. Some of you may find the word theft harsh or even offensive. But we must differentiate between taxes—which are levied to pay for the state’s programs that in principle benefit all citizens—and bail-ins, i.e. the taking of depositors’ cash to bail out banks that became insolvent through the actions of the banks’ management, not the actions of depositors. Bail-ins are theft, pure and simple. Since the government enforces the taking, it is officially sanctioned theft, but theft nonetheless. Negative interest rates are another form of officially sanctioned theft. In a world without the financial repression of zero-interest rates (ZIRP—central banks’ most beloved policy), lenders would charge borrowers enough interest to pay depositors for the use of their cash and earn the lender a profit. If borrowers are paying interest, negative interest rates are theft, pure and simple. Why are governments suddenly so keen to ban physical cash? The answer appears to be that the banks and government authorities are anticipating bail-ins, steeply negative interest rates and hefty fees on cash, and they want to close any opening regular depositors might have to escape these forms of officially sanctioned theft. The escape from bail-ins and fees on cash deposits is physical cash, and hence the sudden flurry of calls to eliminate cash as a relic of a bygone age—that is, an age when commoners had some way to safeguard their money from bail-ins and bankers’ control.Forcing Those With Cash To Spend Or Gamble Their CashNegative interest rates (and fees on cash, which are equivalently punitive to savers) raise another question: why are governments suddenly obsessed with forcing owners of cash to either spend it or gamble it in the financial-market casinos? The conventional answer voiced by Mr. Buiter is that recession and credit contraction result from households and enterprises hoarding cash instead of spending it. The solution to recession is thus to force all those stingy cash hoarders to spend their money.There are three enormous flaws in this thinking.One is that households and businesses have cash to hoard. The reality is the bottom 90% of households have less income now than they did 15 years ago, which means their spending has declined not from hoarding but from declining income. While Corporate America has basked in the glory of sharply rising profits, small business has not prospered in the same fashion. Indeed, by some measures, small business has been in a 6-year recession. The bottom 90% has less income and faces higher living expenses, so only the top slice of households has any substantial cash. This top slice may see few safe opportunities to invest their savings, so they choose to keep their savings in cash rather than gamble it in a rigged casino (i.e. the stock market). The second flaw is that hoarding cash is the only rational, prudent response in an era of financial repression and economic insecurity. What central banks are demanding--that we spend every penny of our earnings rather than save some for investments we control or emergencies—is counter to our best interests. This leads to the third flaw: capital -- which begins its life as savings -- is the foundation of capitalism. If you attack savings as a scourge, you are attacking capitalism and upward mobility, for only those who save capital can invest it to build wealth. By attacking cash, the central banks and governments are attacking capital and upward mobility. Those who already own the majority of productive assets are able to borrow essentially unlimited sums at near-zero interest rates, which they can use to buy more productive assets, while everyone else--the bottom 99.5%--is reduced to consumer-serfdom: you are not supposed to accumulate productive capital, you are supposed to spend every penny you earn on interest payments, goods and services. This inversion of capitalism dooms an economy to all the ills we are experiencing in abundance: rising income inequality, reduced opportunities for entrepreneurship, rising debt burdens and a short-term perspective that voids the longer-term planning required to build sustainable productivity and wealth.Physical Cash: Only $1.36 TrillionAccording to the Federal Reserve, total outstanding physical cash amounts to $1.36 trillion.Given that a substantial amount of this cash is held overseas, physical cash is a tiny part of the domestic economy and the nation’s total assets. For context: the U.S. economy is $17.5 trillion, total financial assets of households and nonprofit organizations total $68 trillion, base money is around $4 trillion, and total money (currency in circulation and demand deposits) is over $10 trillion (source). Given the relatively modest quantity of physical cash, claims that eliminating it will boost the economy ring hollow. Following the principle of cui bono—to whose benefit?--let’s ask: What are the benefits of eliminating physical cash to banks and the government? Benefits To Banks And The Government Of Eliminating Physical Cash The benefits to banks and governments by eliminating cash are self-evident:Every financial transaction can be taxedEvery financial transaction can be charged a feeBank runs are eliminatedIn fractional reserve systems such as ours, banks are only required to hold a fraction of their assets in cash. Thus a bank might only have 1% of its assets in cash. If customers fear the bank might be insolvent, they crowd the bank and demand their deposits in physical cash. The bank quickly runs out of physical cash and closes its doors, further fueling a panic.The federal government began insuring deposits after the Great Depression triggered the collapse of hundreds of banks, and that guarantee limited bank runs, as depositors no longer needed to fear a bank closing would mean their money on deposit was lost.But since people could conceivably sense a disturbance in the Financial Force and decide to turn digital cash into physical cash as a precaution, eliminating physical cash also eliminates the possibility of bank runs, as there will be no form of cash that isn’t controlled by banks.While the benefits to banks and governments of banning physical cash are self-evident, there are downsides to the real economy and to household resilience.In Part 2: What To Do With Your Cash Savings, we'll look at the most influential forces in play in this war, and consider strategies for preserving purchasing power, avoiding bail-ins, fees and other threats to cash savings.Click here to read Part 2 of this report (free executive summary, enrollment required for full access)____________________________________________________ end.

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

Create this form in 5 minutes!

How to create an eSignature for the hsa bank account closing form

How to generate an electronic signature for your Hsa Bank Account Closing Form online

How to generate an eSignature for your Hsa Bank Account Closing Form in Google Chrome

How to generate an electronic signature for signing the Hsa Bank Account Closing Form in Gmail

How to generate an electronic signature for the Hsa Bank Account Closing Form from your mobile device

How to generate an eSignature for the Hsa Bank Account Closing Form on iOS

How to create an eSignature for the Hsa Bank Account Closing Form on Android

People also ask

-

What is account closing health in relation to airSlate SignNow?

Account closing health refers to the status and efficiency of managing and finalizing account-related documents securely and promptly. With airSlate SignNow, you can enhance your account closing health by streamlining the eSignature process, ensuring that all necessary documents are signed and stored securely.

-

How does airSlate SignNow improve account closing health?

AirSlate SignNow enhances account closing health by offering a simple interface for sending and eSigning crucial documents. The platform enables quick turnaround times, reducing delays that can negatively impact account closures, while also providing secure storage to ensure compliance and safety.

-

What are the pricing options for airSlate SignNow to improve account closing health?

AirSlate SignNow offers various pricing plans tailored to meet diverse business needs, aiming to improve account closing health affordably. Each plan provides access to essential features that streamline document management and eSigning processes, ensuring you find a suitable option for your team.

-

Can I integrate airSlate SignNow with other tools to boost account closing health?

Yes, airSlate SignNow allows seamless integration with numerous popular tools and platforms. These integrations can enhance your account closing health by connecting your document workflows with CRM systems, project management software, and more, ensuring cohesive and efficient operations.

-

What features of airSlate SignNow support account closing health?

Key features of airSlate SignNow that promote account closing health include customizable templates, team collaboration tools, and real-time status tracking. These features simplify the signing process and foster team efficiency, all vital for achieving successful account closures.

-

How secure is airSlate SignNow in maintaining account closing health?

AirSlate SignNow prioritizes security to ensure optimal account closing health. With robust encryption protocols, user authentication, and secure storage solutions, you can trust that sensitive account documents are protected throughout the eSigning process.

-

What benefits can I expect from using airSlate SignNow for account closing health?

Utilizing airSlate SignNow enhances account closing health by providing increased efficiency, reduced turnaround times, and improved document accuracy. These benefits collectively lead to smoother transactions and a more satisfying experience for your clients and stakeholders.

Get more for Closing A Health Savings Account

- American fidelity request for continuing disability benefits supplemental form

- Bi form 00 005 rev 0

- Transportation request form

- Example dd2475 form

- Mf rent increase request form

- The city of wildwood parks and recreation department is organizing its second annual youth basketball form

- Hall rental agreement template 787742992 form

- Heavy equipment equipment rental agreement template form

Find out other Closing A Health Savings Account

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form