Department of Taxation Va Form Edc

What is the Department Of Taxation Va Form Edc

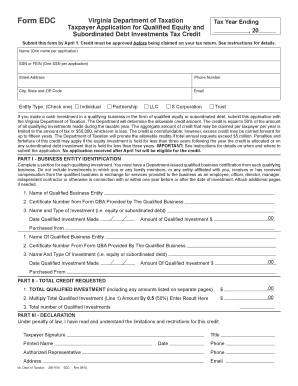

The Department Of Taxation Va Form Edc is a crucial document used for tax purposes in Virginia. This form is specifically designed for businesses and individuals to report certain tax-related information to the Virginia Department of Taxation. It serves as a means for taxpayers to comply with state tax regulations and ensure accurate reporting of their financial activities. Understanding the purpose of this form is essential for maintaining compliance with state tax laws.

How to use the Department Of Taxation Va Form Edc

Using the Department Of Taxation Va Form Edc involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents and information relevant to the tax period in question. This may include income statements, expense reports, and any other pertinent financial records. Next, fill out the form carefully, ensuring that all fields are completed accurately. After completing the form, review it for any errors or omissions before submitting it to the Virginia Department of Taxation.

Steps to complete the Department Of Taxation Va Form Edc

Completing the Department Of Taxation Va Form Edc requires attention to detail. Follow these steps for successful completion:

- Gather all relevant financial documents.

- Access the form through the Virginia Department of Taxation's official website.

- Fill in your personal and business information as required.

- Provide accurate financial data, including income and deductions.

- Review the form for accuracy and completeness.

- Submit the form either electronically or via mail, following the submission guidelines provided.

Legal use of the Department Of Taxation Va Form Edc

The legal use of the Department Of Taxation Va Form Edc is governed by state tax laws. It is essential for the form to be filled out accurately and submitted on time to avoid penalties. The form must be signed and dated by the taxpayer or an authorized representative to be considered valid. Compliance with the legal requirements ensures that the taxpayer's reporting is recognized by the Virginia Department of Taxation, thereby avoiding potential legal issues.

Required Documents

To complete the Department Of Taxation Va Form Edc, specific documents are required. These typically include:

- Income statements, such as W-2s or 1099s.

- Expense receipts and documentation.

- Previous tax returns for reference.

- Any additional forms related to deductions or credits.

Having these documents ready will facilitate a smoother completion process and help ensure accuracy in reporting.

Form Submission Methods

The Department Of Taxation Va Form Edc can be submitted through various methods. Taxpayers have the option to submit the form online via the Virginia Department of Taxation's electronic filing system, which is a convenient and efficient way to ensure timely submission. Alternatively, the form can be printed and mailed to the appropriate address provided by the department. In-person submission may also be available at designated tax offices, allowing for direct interaction with tax officials if needed.

Quick guide on how to complete department of taxation va form edc

Complete Department Of Taxation Va Form Edc effortlessly on any gadget

Web-based document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Department Of Taxation Va Form Edc on any gadget with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Department Of Taxation Va Form Edc effortlessly

- Obtain Department Of Taxation Va Form Edc and click on Get Form to initiate.

- Take advantage of the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes moments and carries the same legal authority as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, exhausting form searches, or errors necessitating the printing of new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Department Of Taxation Va Form Edc and guarantee outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the department of taxation va form edc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Department Of Taxation Va Form Edc?

The Department Of Taxation Va Form Edc is a document required for certain business tax filings in Virginia. This form allows businesses to report various tax information accurately and efficiently. Using airSlate SignNow, you can easily manage and eSign this form to ensure compliance with state regulations.

-

How can airSlate SignNow help with the Department Of Taxation Va Form Edc?

AirSlate SignNow streamlines the process of completing the Department Of Taxation Va Form Edc by allowing users to fill out, send, and eSign the document online. Its user-friendly interface simplifies document management and reduces time spent on paperwork. With airSlate SignNow, businesses can ensure that their forms are submitted quickly and correctly.

-

Is airSlate SignNow cost-effective for businesses needing the Department Of Taxation Va Form Edc?

Yes, airSlate SignNow offers competitive pricing tailored for businesses that need to manage the Department Of Taxation Va Form Edc and other documents. Our solution is designed to save time and reduce costs associated with manual processing and printing. Subscribe today to see how we can streamline your documentation process.

-

What features does airSlate SignNow offer for managing the Department Of Taxation Va Form Edc?

AirSlate SignNow provides features like template creation, secure eSigning, and real-time status tracking for the Department Of Taxation Va Form Edc. Users can also store documents securely in the cloud and collaborate with team members seamlessly. These features enhance productivity and ensure that submissions are timely and accurate.

-

Can airSlate SignNow integrate with other tools for processing the Department Of Taxation Va Form Edc?

Yes, airSlate SignNow offers a variety of integrations with popular business tools and software, making it easier to manage the Department Of Taxation Va Form Edc. Users can connect with CRMs, cloud storage solutions, and other applications to streamline their workflows. This capability enhances the overall efficiency of document handling.

-

What are the benefits of using airSlate SignNow for the Department Of Taxation Va Form Edc?

Using airSlate SignNow for the Department Of Taxation Va Form Edc provides numerous benefits, including faster processing times, reduced error rates, and enhanced security. By utilizing our eSigning platform, businesses can ensure compliance while maintaining a professional image. Additionally, the ease of use reduces training time for staff.

-

How secure is airSlate SignNow when handling the Department Of Taxation Va Form Edc?

Security is a priority at airSlate SignNow when it comes to handling sensitive documents like the Department Of Taxation Va Form Edc. We utilize advanced encryption protocols and secure servers to protect your data. Furthermore, our platform complies with industry standards to ensure that your documents remain confidential and secure.

Get more for Department Of Taxation Va Form Edc

Find out other Department Of Taxation Va Form Edc

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document