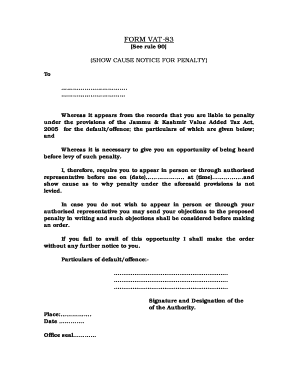

Vat 83 Form

What is the VAT 83?

The VAT 83 form is a critical document used in the United States for tax purposes, specifically related to the Value Added Tax (VAT). This form is essential for businesses that need to report their VAT obligations accurately. It serves as a declaration of the VAT collected and paid, ensuring compliance with federal and state tax regulations. Understanding the purpose and requirements of the VAT 83 is vital for businesses to maintain their tax standing and avoid penalties.

How to use the VAT 83

Using the VAT 83 form involves several steps to ensure accurate completion and submission. First, gather all necessary financial records that pertain to VAT transactions. This includes sales invoices, purchase receipts, and any previous VAT filings. Next, accurately fill out the form with the required information, detailing the VAT collected and paid during the reporting period. Once completed, the form should be submitted to the appropriate tax authority, either electronically or via mail, depending on the specific guidelines provided by the IRS.

Steps to complete the VAT 83

Completing the VAT 83 form requires careful attention to detail. Follow these steps for successful completion:

- Gather all relevant documentation, including sales and purchase records.

- Fill in your business information, including name, address, and tax identification number.

- Report the total sales and the corresponding VAT collected during the reporting period.

- Detail the VAT paid on purchases and any adjustments that may apply.

- Review the form for accuracy before submission.

- Submit the completed form to the appropriate tax authority by the deadline.

Legal use of the VAT 83

The legal use of the VAT 83 form is governed by federal and state tax regulations. It is crucial for businesses to ensure that the information provided is accurate and truthful. Misrepresentation or errors on the VAT 83 can lead to legal repercussions, including fines and audits. To maintain compliance, businesses should regularly review their VAT practices and ensure that they are following the latest guidelines set forth by tax authorities.

Key elements of the VAT 83

Several key elements must be included when completing the VAT 83 form. These elements include:

- Business identification details, such as name and tax identification number.

- Reporting period for the VAT obligations.

- Total sales and VAT collected from customers.

- VAT paid on purchases and any applicable deductions.

- Signature of the authorized representative certifying the accuracy of the information.

Filing Deadlines / Important Dates

Filing deadlines for the VAT 83 form can vary based on the reporting period and the specific requirements set by the IRS. Typically, businesses must submit their VAT 83 forms on a quarterly or annual basis. It is important to stay informed about these deadlines to avoid late fees or penalties. Marking these dates on a calendar can help ensure timely submissions and maintain compliance with tax regulations.

Quick guide on how to complete vat 83

Effortlessly Prepare Vat 83 on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly and efficiently. Manage Vat 83 on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to Edit and eSign Vat 83 with Ease

- Obtain Vat 83 and click Get Form to begin.

- Use the tools we provide to complete your form.

- Select important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and has the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose how you would like to deliver your form—via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tiresome form searches, or errors that require new copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Vat 83 and ensure excellent communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat 83

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is VAT 83 and how does it relate to airSlate SignNow?

VAT 83 is a regulation that affects how businesses manage value-added tax documents. airSlate SignNow provides an efficient way to eSign and send necessary VAT 83 documents electronically, ensuring compliance and saving time.

-

How can airSlate SignNow help with the VAT 83 form submission?

airSlate SignNow streamlines the submission of VAT 83 forms by allowing users to complete and eSign documents digitally. This eliminates the need for printing and mailing, making the process more efficient and compliant.

-

What pricing options are available for airSlate SignNow when dealing with VAT 83 documents?

airSlate SignNow offers various pricing plans to cater to businesses of all sizes needing to manage VAT 83 documents. These plans are designed to be cost-effective while providing the essential features required for document management and eSigning.

-

What features of airSlate SignNow are particularly useful for VAT 83 processing?

Key features of airSlate SignNow that aid in processing VAT 83 include customizable templates, secure eSigning, and automated workflows. These tools help users manage their VAT documents efficiently with minimal hassle.

-

Are there any integrations available with airSlate SignNow for handling VAT 83?

Yes, airSlate SignNow integrates seamlessly with various applications that businesses commonly use, which can facilitate handling VAT 83 documents. This includes software for accounting, CRM, and other business management tools, enhancing overall productivity.

-

What are the benefits of using airSlate SignNow for VAT 83 document management?

Using airSlate SignNow for VAT 83 document management offers numerous benefits including reduced processing time, improved accuracy, and enhanced security. The platform ensures that all electronic documents comply with current regulations, protecting your business.

-

Is it secure to eSign VAT 83 forms with airSlate SignNow?

Absolutely! airSlate SignNow employs advanced security measures such as encryption and multi-factor authentication to protect your eSigned VAT 83 forms. This ensures that your sensitive tax documents are secure and compliant with legal standards.

Get more for Vat 83

- Npma forms 2004

- Benefits termination form

- Volunteer application arca arcaopeningdoors form

- Notice and authorization pertaining to consumer reports fdic fdic form

- Ham radio fannie mae form

- Hirsch zipf form

- Experience verification form state of iowa board of educational examiners

- Application for license form 184

Find out other Vat 83

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure