Form 8812

What is the Form 8812

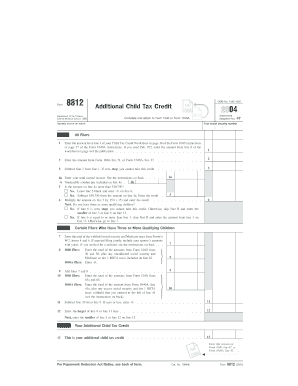

The Form 8812, officially known as the "Additional Child Tax Credit," is a tax form used by eligible taxpayers in the United States to claim a refundable credit for qualifying children. This form is especially important for taxpayers who may not receive the full Child Tax Credit due to their income level. By completing Form 8812, individuals can potentially receive a refund even if they do not owe any taxes. This form is typically filed along with the taxpayer's annual income tax return.

How to use the Form 8812

Using Form 8812 involves a few straightforward steps. Taxpayers must first determine their eligibility based on the number of qualifying children and their income level. After confirming eligibility, the next step is to fill out the form accurately, providing necessary information such as the taxpayer's filing status and the details of each qualifying child. Once completed, the form should be attached to the taxpayer's Form 1040 or 1040-SR when filing their annual tax return.

Steps to complete the Form 8812

Completing Form 8812 requires careful attention to detail. Here are the key steps:

- Gather necessary documents, including Social Security numbers for all qualifying children.

- Determine your eligibility based on income and the number of children.

- Fill out the form, ensuring all sections are completed accurately.

- Calculate the credit amount based on the information provided.

- Attach Form 8812 to your Form 1040 or 1040-SR before submission.

Legal use of the Form 8812

Form 8812 is legally recognized by the IRS as a valid means for claiming the Additional Child Tax Credit. To ensure its legal use, taxpayers must comply with all IRS guidelines and provide accurate information. Misrepresentation or failure to meet eligibility criteria can lead to penalties or disqualification from receiving the credit. It is crucial to keep copies of all submitted forms and supporting documents for future reference.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with Form 8812. Typically, the deadline for submitting individual tax returns, including Form 8812, is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the IRS website for any updates or changes to deadlines, as well as to ensure timely submission to avoid penalties.

Eligibility Criteria

To qualify for the Additional Child Tax Credit using Form 8812, taxpayers must meet specific criteria. These include:

- Having one or more qualifying children under the age of 17 at the end of the tax year.

- Meeting the income limits set by the IRS, which can vary based on filing status.

- Filing a federal income tax return, even if no tax is owed.

Form Submission Methods (Online / Mail / In-Person)

Form 8812 can be submitted through various methods, depending on the taxpayer's preference. The most common methods include:

- Online filing through tax preparation software, which often includes e-filing options for convenience.

- Mailing a paper copy of the completed form along with the tax return to the appropriate IRS address.

- In-person submission at designated IRS offices, although this option may require an appointment.

Quick guide on how to complete form 8812

Complete Form 8812 effortlessly on any device

Online document administration has become favored by companies and individuals alike. It offers an ideal eco-friendly option to traditional printed and signed documents, as you can find the necessary form and securely keep it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your files swiftly without delays. Manage Form 8812 on any system with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign Form 8812 with ease

- Find Form 8812 and then click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device of your choice. Modify and eSign Form 8812 and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8812

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8812 and why is it important?

Form 8812, also known as the Additional Child Tax Credit form, is crucial for taxpayers who wish to claim the additional child tax credits. It allows families to benefit from potential refunds if they qualify. Understanding how to fill out Form 8812 accurately can maximize tax refunds, making it essential for many households.

-

How can airSlate SignNow help with Form 8812?

airSlate SignNow streamlines the signing and submission of Form 8812 by providing an intuitive electronic signature solution. This not only saves time but ensures that your documents are securely signed and submitted electronically. Using airSlate SignNow for Form 8812 reduces paperwork and simplifies the tax filing process.

-

What are the main features of airSlate SignNow for managing Form 8812?

Key features of airSlate SignNow include customizable templates, the ability to track document status, and seamless integrations with various platforms. These tools enhance user experience when preparing and signing Form 8812. With powerful features, airSlate SignNow helps users manage their tax documents with ease.

-

Is airSlate SignNow cost-effective for filing Form 8812?

Yes, airSlate SignNow offers a cost-effective solution for businesses and individuals looking to manage Form 8812. With flexible pricing plans, users can choose options that fit their budget while still accessing comprehensive features. This pricing model ensures that everyone can benefit from efficient document handling.

-

What integrations does airSlate SignNow offer for Form 8812?

airSlate SignNow integrates seamlessly with popular applications like Google Drive, Dropbox, and Salesforce, facilitating easy access to your documents when preparing Form 8812. These integrations allow users to pull in necessary documents effortlessly. Such connectivity enhances efficiency, saving time during the tax filing process.

-

Can I use airSlate SignNow on mobile devices for Form 8812?

Absolutely! airSlate SignNow is optimized for mobile use, allowing users to fill out and sign Form 8812 on their smartphones and tablets. This flexibility ensures that you can work on your taxes from anywhere. Plus, mobile access makes it easy to stay organized and keep track of your submissions.

-

How secure is airSlate SignNow for submitting Form 8812?

Security is a priority at airSlate SignNow, especially for sensitive documents like Form 8812. The platform employs end-to-end encryption and complies with industry standards to protect your data. You can confidently submit your Form 8812 knowing that your information is safe.

Get more for Form 8812

Find out other Form 8812

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online