Form 2151

What is the Form 2151

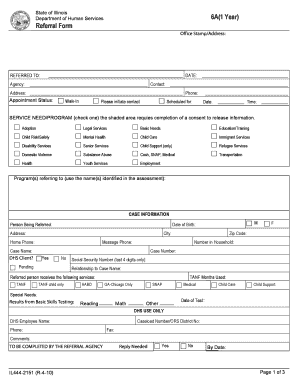

The Form 2151 is a specific document used in various administrative and legal processes within the United States. It serves as a formal request or declaration, often required by governmental agencies or institutions. The form is designed to collect essential information from the individual or entity submitting it, ensuring compliance with applicable regulations and standards. Understanding the purpose and requirements of Form 2151 is crucial for accurate completion and submission.

How to use the Form 2151

Using the Form 2151 involves several key steps to ensure that it is completed correctly and submitted on time. First, gather all necessary information and documents that may be required to fill out the form accurately. Next, carefully read the instructions provided with the form to understand each section's requirements. After filling out the form, review it for any errors or omissions. Finally, submit the completed Form 2151 according to the specified submission methods.

Steps to complete the Form 2151

Completing the Form 2151 requires a systematic approach. Follow these steps:

- Obtain the latest version of the Form 2151 from a reliable source.

- Read the instructions thoroughly to understand the information needed.

- Fill out the form with accurate and complete information, ensuring clarity.

- Double-check all entries for correctness, paying attention to details.

- Sign and date the form as required, confirming your submission.

Legal use of the Form 2151

The legal use of the Form 2151 is governed by specific regulations that dictate how it should be filled out and submitted. To be considered legally binding, the form must be completed in accordance with these regulations, which may include proper signatures, dates, and any necessary supporting documentation. Compliance with these legal standards is essential to ensure that the form is accepted by the relevant authorities.

Key elements of the Form 2151

Several key elements are essential when completing the Form 2151. These include:

- Personal Information: Name, address, and contact details of the individual or entity submitting the form.

- Purpose of Submission: A clear statement outlining the reason for submitting the form.

- Signature: The form must be signed by the appropriate person to validate the submission.

- Date: The date of submission, which may be relevant for compliance and processing timelines.

Form Submission Methods

The Form 2151 can typically be submitted through various methods, depending on the requirements set forth by the issuing authority. Common submission methods include:

- Online Submission: Many agencies allow for electronic submission of the form through their websites.

- Mail: Physical copies of the form can be mailed to the designated address.

- In-Person: Some forms may need to be submitted directly at a local office or agency.

Quick guide on how to complete form 2151

Complete Form 2151 effortlessly on any gadget

Digital document administration has become increasingly favored by businesses and individuals alike. It presents an ideal environmentally-friendly substitute to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your files swiftly without hindrances. Handle Form 2151 on any device with airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to edit and electronically sign Form 2151 without any hassle

- Locate Form 2151 and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent portions of the documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device of your liking. Edit and electronically sign Form 2151 to guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 2151

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 2151 and how can airSlate SignNow help?

Form 2151 is a specific document often used in various business processes. airSlate SignNow enhances your experience with form 2151 by providing a seamless eSigning solution, allowing users to easily complete, send, and sign this document digitally.

-

Is there a cost associated with using airSlate SignNow for form 2151?

Yes, airSlate SignNow offers competitive pricing plans to cater to different business needs. Whether you’re sending form 2151 frequently or occasionally, our pricing is designed to provide a cost-effective solution that fits any budget.

-

What features does airSlate SignNow provide for managing form 2151?

AirSlate SignNow provides various features to streamline the management of form 2151, including customizable templates, real-time tracking, and automated workflows. These features empower you to efficiently handle your documents and reduce turnaround times.

-

How secure is airSlate SignNow when signing form 2151?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents like form 2151. We utilize bank-level encryption and adhere to the highest compliance standards to ensure your data remains safe and confidential.

-

Can I integrate airSlate SignNow with other tools for form 2151 processing?

Yes, airSlate SignNow offers seamless integrations with popular tools and applications, enhancing your ability to manage form 2151 efficiently. This means you can connect it with CRM systems, cloud storage, and more for a cohesive workflow.

-

What benefits can I expect from using airSlate SignNow for form 2151?

Using airSlate SignNow for form 2151 provides numerous benefits, including increased efficiency in document processing, reduced paper usage, and faster turnaround times. You’ll also enjoy the convenience of managing your documents from anywhere, at any time.

-

Is there customer support available for questions regarding form 2151?

Absolutely! AirSlate SignNow offers dedicated customer support to assist you with any inquiries related to form 2151. Our team is available through various channels to ensure you have the help you need when managing your documents.

Get more for Form 2151

Find out other Form 2151

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT