Federal Form 1099 MISC Data Input Sheet

What is the Federal Form 1099 MISC Data Input Sheet

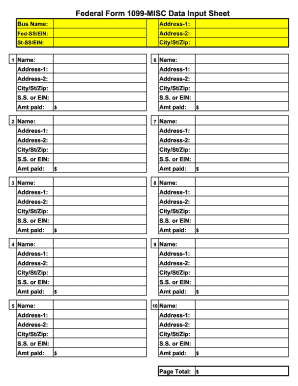

The Federal Form 1099 MISC Data Input Sheet is a crucial document used in the United States to report various types of income other than wages, salaries, and tips. It is primarily utilized by businesses and individuals to report payments made to non-employees, such as independent contractors, freelancers, and vendors. This form helps the Internal Revenue Service (IRS) track income that may not be subject to withholding tax, ensuring accurate tax reporting and compliance.

Steps to complete the Federal Form 1099 MISC Data Input Sheet

Completing the Federal Form 1099 MISC Data Input Sheet involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the recipient's name, address, and taxpayer identification number (TIN). Next, determine the type of payment made to the recipient, as this will dictate which box to fill in on the form. Enter the total amount paid in the appropriate box, and ensure all details are correct before submitting. It is essential to review the form for any errors, as inaccuracies can lead to penalties.

Legal use of the Federal Form 1099 MISC Data Input Sheet

The legal use of the Federal Form 1099 MISC Data Input Sheet is governed by IRS regulations. To be considered valid, the form must be filled out accurately and submitted by the designated deadlines. The recipient must receive a copy of the form, and the issuer must file it with the IRS. Failure to comply with these regulations can result in penalties, including fines for late submissions or inaccuracies. It is important to maintain records of all issued forms for at least three years for audit purposes.

Filing Deadlines / Important Dates

Filing deadlines for the Federal Form 1099 MISC Data Input Sheet are critical for compliance. The form must be submitted to the IRS by January thirty-first of the year following the tax year in which payments were made. If filing electronically, the deadline may extend to March thirty-first. Recipients must also receive their copies by January thirty-first. Adhering to these deadlines helps avoid penalties and ensures timely reporting of income.

Examples of using the Federal Form 1099 MISC Data Input Sheet

There are various scenarios in which the Federal Form 1099 MISC Data Input Sheet is utilized. For instance, a business may issue this form to an independent contractor who provided services throughout the year, reporting the total payments made. Another example includes a company that rents property and pays a landlord over a certain threshold, necessitating the use of this form. These examples illustrate the form's role in accurately reporting non-employee compensation and ensuring compliance with tax regulations.

Who Issues the Form

The responsibility for issuing the Federal Form 1099 MISC Data Input Sheet typically falls on businesses and organizations that make qualifying payments. This includes corporations, partnerships, and sole proprietors who pay independent contractors, freelancers, or other non-employees. It is essential for these entities to understand their obligations regarding the issuance of the form to ensure compliance with IRS requirements and avoid potential penalties.

Quick guide on how to complete federal form 1099 misc data input sheet

Effortlessly Prepare Federal Form 1099 MISC Data Input Sheet on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can obtain the required form and securely store it in the cloud. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Manage Federal Form 1099 MISC Data Input Sheet on any device with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Modify and eSign Federal Form 1099 MISC Data Input Sheet with Ease

- Locate Federal Form 1099 MISC Data Input Sheet and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional hand-signed signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, laborious form searches, or mistakes that require new copies. airSlate SignNow simplifies all your document management needs in just a few clicks from any device you choose. Revise and eSign Federal Form 1099 MISC Data Input Sheet and ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the federal form 1099 misc data input sheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Federal Form 1099 MISC Data Input Sheet?

The Federal Form 1099 MISC Data Input Sheet is a document used to report various types of income other than wages, salaries, and tips. It is essential for businesses to accurately fill out this sheet to comply with IRS regulations, ensuring proper reporting of payments made to contractors and vendors.

-

How does airSlate SignNow simplify the process of filling out the Federal Form 1099 MISC Data Input Sheet?

airSlate SignNow provides a user-friendly interface that allows businesses to easily fill out the Federal Form 1099 MISC Data Input Sheet electronically. Our solution ensures that all required fields are included and helps avoid common errors, making the filing process efficient and straightforward.

-

Is airSlate SignNow cost-effective for businesses needing the Federal Form 1099 MISC Data Input Sheet?

Yes, airSlate SignNow offers competitive pricing plans tailored to suit various business sizes. With our cost-effective solution, your team can handle the Federal Form 1099 MISC Data Input Sheet without wasting resources on complex software or excessive paperwork.

-

What features does airSlate SignNow offer for managing the Federal Form 1099 MISC Data Input Sheet?

Our platform includes features such as easy document uploads, collaborative editing, e-signatures, and custom templates for the Federal Form 1099 MISC Data Input Sheet. These functionalities enhance efficiency and accuracy, ensuring that your documents are professionally handled.

-

Can I integrate airSlate SignNow with other software for managing my Federal Form 1099 MISC Data Input Sheet?

Absolutely! airSlate SignNow integrates seamlessly with various popular software systems such as CRM and accounting tools. This enables businesses to synchronize information efficiently while managing the Federal Form 1099 MISC Data Input Sheet and other important documents.

-

What benefits can businesses expect from using airSlate SignNow for the Federal Form 1099 MISC Data Input Sheet?

By using airSlate SignNow for the Federal Form 1099 MISC Data Input Sheet, businesses can experience reduced paperwork, improved accuracy, and time savings. Additionally, our electronic signature feature enhances compliance and ensures documents are legally binding.

-

How secure is my data when using airSlate SignNow for the Federal Form 1099 MISC Data Input Sheet?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your data related to the Federal Form 1099 MISC Data Input Sheet, ensuring that sensitive information is well guarded against unauthorized access.

Get more for Federal Form 1099 MISC Data Input Sheet

Find out other Federal Form 1099 MISC Data Input Sheet

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed