Credit Card Payoff Spreadsheet Form

What is the Credit Card Payoff Spreadsheet

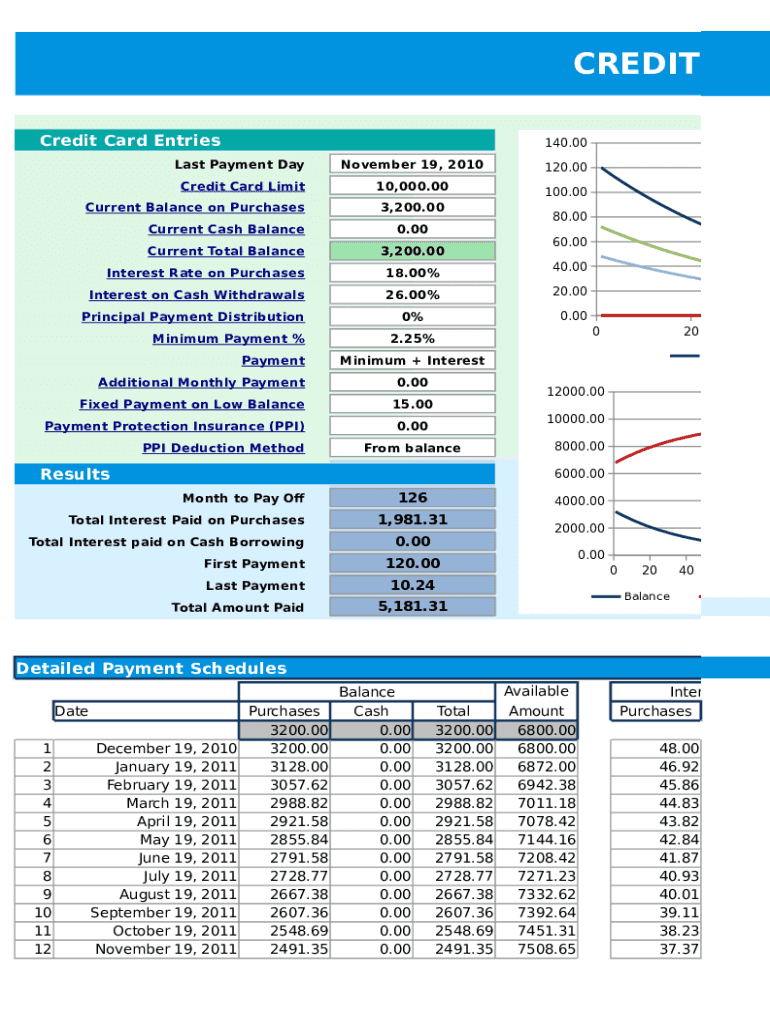

The credit card payoff spreadsheet is a financial tool designed to help individuals manage and eliminate credit card debt efficiently. This spreadsheet allows users to input their current credit card balances, interest rates, and monthly payments to visualize their debt repayment journey. By using this template, users can track their progress, calculate the time it will take to pay off their debts, and determine potential savings on interest payments. The structured format of the spreadsheet makes it easy to update and modify as financial situations change.

How to use the Credit Card Payoff Spreadsheet

Using the credit card payoff spreadsheet involves several straightforward steps. First, gather all relevant information about your credit cards, including balances, interest rates, and minimum monthly payments. Next, input this data into the designated fields of the spreadsheet. The template will then automatically calculate the total debt, projected payoff dates, and interest savings based on your input. Regularly updating the spreadsheet with your payments will help you stay on track and motivated as you work towards becoming debt-free.

Steps to complete the Credit Card Payoff Spreadsheet

Completing the credit card payoff spreadsheet requires a systematic approach. Follow these steps for optimal results:

- Collect all credit card statements to gather accurate balance and interest rate information.

- Open the credit card payoff spreadsheet template on your device.

- Enter the name of each credit card in the appropriate column.

- Input the current balance for each card.

- Fill in the interest rate associated with each credit card.

- List the minimum payment required for each card.

- Optionally, add any additional payments you plan to make.

- Review the calculated results to understand your payoff timeline and potential interest savings.

Key elements of the Credit Card Payoff Spreadsheet

Several key elements make the credit card payoff spreadsheet an effective tool for managing debt. These elements typically include:

- Credit Card Name: Identifies each credit card being tracked.

- Current Balance: Displays the amount owed on each card.

- Interest Rate: Indicates the annual percentage rate charged on the balance.

- Minimum Payment: Shows the least amount that must be paid each month.

- Additional Payment: Allows users to input any extra payments they plan to make.

- Total Debt: Calculates the sum of all credit card balances.

- Projected Payoff Date: Estimates when the debt will be fully paid off based on current payment habits.

Legal use of the Credit Card Payoff Spreadsheet

The credit card payoff spreadsheet is a legal document that individuals can use to manage their personal finances. While it does not require formal submission to any regulatory body, it is essential to ensure that the information entered is accurate and reflective of actual financial obligations. This tool can assist in budgeting and financial planning, which are crucial for maintaining good credit health. Users should keep the spreadsheet secure and private, as it contains sensitive financial information.

Examples of using the Credit Card Payoff Spreadsheet

There are various scenarios in which the credit card payoff spreadsheet can be beneficial. For instance:

- A user with multiple credit cards can visualize their total debt and strategize payment plans to prioritize higher-interest cards.

- Someone looking to improve their credit score can use the spreadsheet to track payments and ensure they meet minimum requirements.

- A person planning a major purchase can use the template to evaluate how paying off credit card debt sooner can free up funds for savings.

Quick guide on how to complete credit card payoff spreadsheet

Effortlessly Prepare Credit Card Payoff Spreadsheet on Any Device

The management of documents online has gained popularity among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to find the correct template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Credit Card Payoff Spreadsheet on any device using airSlate SignNow's Android or iOS applications and enhance your document-centric processes today.

The easiest way to modify and electronically sign Credit Card Payoff Spreadsheet with ease

- Obtain Credit Card Payoff Spreadsheet and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for such tasks by airSlate SignNow.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal authority as a conventional signature in ink.

- Review all details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Modify and electronically sign Credit Card Payoff Spreadsheet and ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the credit card payoff spreadsheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a credit card payoff spreadsheet?

A credit card payoff spreadsheet is a tool designed to help users track and manage their credit card debts efficiently. It provides a clear overview of outstanding balances, interest rates, and payment schedules, allowing users to strategize their payoffs effectively.

-

How can a credit card payoff spreadsheet benefit me?

Utilizing a credit card payoff spreadsheet can help you visualize your debt and set realistic goals for repayment. By analyzing your payment history and interest rates, it enables you to save money on interest and reduce your debt faster.

-

Is there a cost to use the credit card payoff spreadsheet?

The credit card payoff spreadsheet can be used for free or may be included as part of various financial software packages. With airSlate SignNow, you can easily integrate this feature without incurring signNow costs, making it a cost-effective solution.

-

Can I customize my credit card payoff spreadsheet?

Yes, most credit card payoff spreadsheets are customizable to meet your specific needs. You can add additional columns for personal notes, adjust payment frequencies, and configure it to reflect multiple credit cards, making it a versatile tool for financial management.

-

What features should I look for in a credit card payoff spreadsheet?

Look for features such as automatic calculations of interest, the ability to simulate different payment schedules, and visual charts that track your progress. These functions can enhance your ability to manage your credit cards effectively and expedite your payoff journey.

-

Does the credit card payoff spreadsheet integrate with other financial tools?

Many credit card payoff spreadsheets can integrate with existing financial management applications to streamline your budgeting process. With airSlate SignNow, you can easily share your spreadsheet with financial advisors or other tools for a comprehensive financial overview.

-

Where can I access the credit card payoff spreadsheet?

You can find various templates for credit card payoff spreadsheets online, including options from airSlate SignNow. Simply search for 'credit card payoff spreadsheet' templates to get started with managing your debts efficiently.

Get more for Credit Card Payoff Spreadsheet

- Pesticide sign up form

- Modle ouverture de compte client word 305014489 form

- Semi structured interview questions for a parentguardian of a child wacsep form

- Santa clara university transcripts form 12059726

- Form de 120p california pdf

- Dog walking information sheet

- Ldss 4882b 712 w 1 childsupport ny gov information for an

- Rental parking agreement waterloo student residences form

Find out other Credit Card Payoff Spreadsheet

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement