Sales Tax Return Worksheetinstructions State Sd Us State Sd Form

What is the Sales Tax Return Worksheetinstructions State sd us State Sd

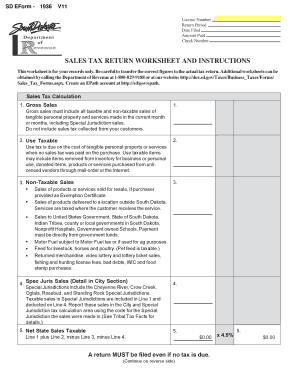

The Sales Tax Return Worksheet is a crucial document used by businesses in South Dakota to report and remit sales tax collected during a specific period. This form helps ensure compliance with state tax regulations and provides a structured way for businesses to calculate their tax obligations. The worksheet includes sections for detailing gross sales, exempt sales, and the total sales tax due. Understanding this form is essential for maintaining accurate financial records and fulfilling legal responsibilities.

How to use the Sales Tax Return Worksheetinstructions State sd us State Sd

Using the Sales Tax Return Worksheet involves several straightforward steps. First, gather all necessary sales data for the reporting period. This includes total sales, any exempt transactions, and the applicable tax rates. Next, fill out each section of the worksheet accurately, ensuring all figures are correctly calculated. After completing the form, review it for any errors before submission. This careful approach helps prevent compliance issues and potential penalties.

Steps to complete the Sales Tax Return Worksheetinstructions State sd us State Sd

Completing the Sales Tax Return Worksheet requires a methodical approach:

- Collect sales records for the reporting period.

- Identify any exempt sales and document them separately.

- Calculate the total sales tax collected based on applicable rates.

- Fill in the worksheet with accurate figures, ensuring clarity.

- Double-check all entries for accuracy and completeness.

- Submit the completed worksheet by the state’s deadline.

Legal use of the Sales Tax Return Worksheetinstructions State sd us State Sd

The legal use of the Sales Tax Return Worksheet is governed by South Dakota state tax laws. Businesses are required to file this form to report sales tax accurately. Failure to submit the worksheet or inaccuracies in reporting can lead to penalties, including fines and interest on unpaid taxes. It is essential for businesses to understand their obligations under state law to avoid legal complications.

Filing Deadlines / Important Dates

Filing deadlines for the Sales Tax Return Worksheet vary based on the reporting period. Typically, businesses must submit their sales tax returns monthly, quarterly, or annually, depending on their sales volume. It is important to check the South Dakota Department of Revenue website for specific deadlines to ensure timely submissions and avoid penalties for late filings.

Required Documents

To complete the Sales Tax Return Worksheet, businesses need to gather several key documents:

- Sales records for the reporting period.

- Invoices and receipts for exempt sales.

- Any prior tax returns or worksheets for reference.

- Documentation of tax rates applicable during the reporting period.

Penalties for Non-Compliance

Non-compliance with the requirements for the Sales Tax Return Worksheet can result in significant penalties. Businesses may face fines based on the amount of tax owed, interest on late payments, and potential legal action from the state. It is crucial for businesses to adhere to filing requirements and deadlines to avoid these consequences.

Quick guide on how to complete sales tax return worksheetinstructions state sd us state sd

Complete Sales Tax Return Worksheetinstructions State sd us State Sd effortlessly on any gadget

Managing documents online has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and electronically sign your documents quickly and without delays. Handle Sales Tax Return Worksheetinstructions State sd us State Sd on any gadget with airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to adjust and electronically sign Sales Tax Return Worksheetinstructions State sd us State Sd with ease

- Obtain Sales Tax Return Worksheetinstructions State sd us State Sd and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically offered by airSlate SignNow.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal authority as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes necessitating the printing of new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Adjust and electronically sign Sales Tax Return Worksheetinstructions State sd us State Sd to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sales tax return worksheetinstructions state sd us state sd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Sales Tax Return Worksheetinstructions State sd us State Sd?

The Sales Tax Return Worksheetinstructions State sd us State Sd is a comprehensive guide designed to help businesses in South Dakota accurately fill out their sales tax returns. It provides step-by-step instructions, ensuring compliance with state tax regulations and simplifying the filing process.

-

How can airSlate SignNow assist with the Sales Tax Return Worksheetinstructions State sd us State Sd?

airSlate SignNow streamlines the completion and e-signing of the Sales Tax Return Worksheetinstructions State sd us State Sd. With its easy-to-use platform, users can fill out tax forms, obtain necessary signatures, and securely send documents in just a few clicks.

-

Is there a cost associated with using airSlate SignNow for tax-related documents?

Yes, while airSlate SignNow offers competitive pricing, it also provides a cost-effective solution for managing tax documents, including the Sales Tax Return Worksheetinstructions State sd us State Sd. Check their website for the latest pricing plans tailored to your business needs.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as template creation, secure storage, and mobile accessibility. These capabilities make handling the Sales Tax Return Worksheetinstructions State sd us State Sd more efficient and ensure that you can access your documents anytime, anywhere.

-

Can I integrate airSlate SignNow with my existing business applications?

Absolutely! airSlate SignNow seamlessly integrates with various business applications such as ERP systems and CRM platforms. This integration simplifies the document flow for the Sales Tax Return Worksheetinstructions State sd us State Sd and helps you maintain organized records with ease.

-

What are the benefits of using airSlate SignNow for tax preparation?

Using airSlate SignNow for tax preparation, including the Sales Tax Return Worksheetinstructions State sd us State Sd, saves time and reduces errors. With electronic signatures and automated workflows, businesses can expedite their tax processes and stay compliant with state regulations.

-

Is airSlate SignNow easy to use for first-time users?

Yes, airSlate SignNow is designed with user-friendliness in mind. First-time users can easily navigate the platform to efficiently handle the Sales Tax Return Worksheetinstructions State sd us State Sd without needing extensive training.

Get more for Sales Tax Return Worksheetinstructions State sd us State Sd

- Cardio clearance form

- Aboveground petroleum tank monthly inspection report with 6136 ne equip form

- Pa 1000 instructions form

- Myanmar social visa application form pdf

- Walmart mastercard pre authorized payment form

- Fedex kyc form download

- Bonafite form

- Ftb 914 taxpayer advocate assistance request ftb 914 taxpayer advocate assistance request 01 form

Find out other Sales Tax Return Worksheetinstructions State sd us State Sd

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form