Form 593

What is the Form 593

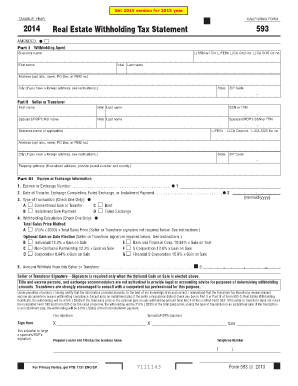

The Form 593 is a California tax document used to report the sale or transfer of real estate. It is primarily utilized by buyers and sellers to disclose information regarding the transaction to the California Franchise Tax Board (FTB). This form is essential for ensuring compliance with state tax laws, particularly for non-residents who may be subject to withholding requirements. Understanding the purpose and details of the Form 593 is crucial for anyone involved in real estate transactions in California.

How to use the Form 593

To use the Form 593 effectively, individuals must first gather all relevant information about the property transaction. This includes details such as the sale price, date of transfer, and the parties involved. The form must be completed accurately, ensuring that all required fields are filled out. Once completed, the form should be submitted to the appropriate authorities, typically alongside the tax return for the year in which the transaction occurred. Proper use of the form helps avoid penalties and ensures that any withholding tax obligations are met.

Steps to complete the Form 593

Completing the Form 593 involves several important steps:

- Gather necessary information: Collect details about the property, including the address, sale price, and the names of the buyer and seller.

- Fill out the form: Enter the required information in the designated fields, ensuring accuracy to avoid delays.

- Review the form: Double-check all entries for correctness, including calculations and signatures.

- Submit the form: File the completed Form 593 with the California Franchise Tax Board, either electronically or via mail.

Legal use of the Form 593

The legal use of the Form 593 is governed by California tax laws. It serves as a declaration of the sale or transfer of real estate and is required for compliance with withholding tax regulations. Failure to submit the form can result in penalties or legal repercussions. It is important for both buyers and sellers to understand their obligations under the law and ensure that the form is completed and submitted correctly to avoid any issues with the California Franchise Tax Board.

Key elements of the Form 593

Several key elements must be included in the Form 593 to ensure its validity:

- Transaction details: This includes the date of sale and the sale price of the property.

- Buyer and seller information: Names, addresses, and tax identification numbers of both parties.

- Withholding information: If applicable, details about any withholding tax that needs to be reported.

- Signature: The form must be signed by the seller or their authorized representative.

Filing Deadlines / Important Dates

Filing deadlines for the Form 593 are crucial to avoid penalties. Generally, the form must be submitted to the California Franchise Tax Board by the due date of the tax return for the year in which the property was sold. It is advisable to keep track of any changes in tax law that may affect these deadlines. Staying informed about important dates ensures compliance and helps avoid unnecessary complications.

Quick guide on how to complete form 593 100307925

Effortlessly Prepare Form 593 on Any Device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow offers all the tools you need to create, modify, and electronically sign your documents swiftly without any delays. Manage Form 593 on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Alter and Electronically Sign Form 593 with Ease

- Find Form 593 and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, the hassle of searching through forms, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Form 593 and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 593 100307925

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form 593 example and how is it used?

A form 593 example refers to a sample document that demonstrates the information required for California withholding tax purposes. It helps taxpayers understand how to properly fill out the form when receiving income from California sources. Studying a form 593 example can simplify the submission process and reduce errors.

-

How can airSlate SignNow assist with filling out a form 593 example?

airSlate SignNow provides users with customizable templates, including a form 593 example. This feature allows users to easily fill in necessary information, ensuring that all fields are completed accurately. The platform also helps track signatures and manage documents efficiently.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to different business needs, starting from an affordable basic plan to more advanced solutions for larger organizations. Each plan comes with features that include document templates like a form 593 example. You can choose a plan that best fits your budget and requirements.

-

Does airSlate SignNow integrate with other software for managing form 593 example?

Yes, airSlate SignNow integrates seamlessly with popular business applications such as Google Workspace, Salesforce, and more. These integrations enable users to streamline their workflows when handling documents like a form 593 example. This connectivity enhances productivity by allowing users to manage their documents from one central platform.

-

What are the benefits of using airSlate SignNow for a form 593 example?

Using airSlate SignNow for a form 593 example comes with several benefits, including efficiency and ease of use. The platform’s intuitive interface ensures that users can quickly fill out and sign the document. Additionally, electronic signatures enhance the speed of transaction completion.

-

Is my data secure when using airSlate SignNow for form 593 example documents?

Absolutely. airSlate SignNow prioritizes data security by employing advanced encryption and compliance with industry standards. When using the platform to manage your form 593 example documents, you can rest assured that your sensitive information is protected.

-

Can I create a custom form 593 example with airSlate SignNow?

Yes, airSlate SignNow allows users to create customized versions of a form 593 example tailored to their unique requirements. This feature is particularly useful for businesses that need specific information captured in the document. Tailoring the form can improve accuracy and compliance with tax regulations.

Get more for Form 593

- Torque it exam booking form

- Fsco family law form 2 commission des services financiers de l fsco gov on

- Pep loans form

- Transition planning form example

- Bill blank the science guy form

- Nm statement of borrowers benefits homebridge wholesale form

- Download maryland eviction notice forms pdf wikidownload

- Publication 115 county motor fuel tax publication 115 county motor fuel tax form

Find out other Form 593

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement