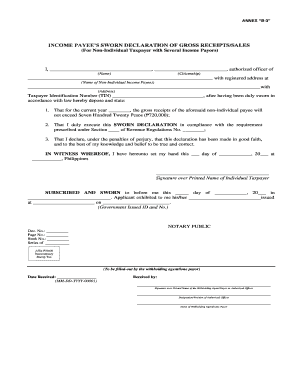

Income Payee's Sworn Declaration of Gross Receipts Sales Form

What is the Income Payee's Sworn Declaration of Gross Receipts Sales?

The Income Payee's Sworn Declaration of Gross Receipts Sales is a legal document used primarily for reporting income received by a payee. This form serves as an official declaration of gross receipts, which may be required for tax purposes or compliance with various regulatory frameworks. It is essential for individuals and businesses to accurately report their income to avoid potential legal issues and ensure transparency in financial dealings.

Steps to Complete the Income Payee's Sworn Declaration of Gross Receipts Sales

Completing the Income Payee's Sworn Declaration of Gross Receipts Sales involves several key steps:

- Gather necessary financial documents, including receipts and income statements.

- Fill out the form accurately, ensuring all gross receipts are reported.

- Review the completed form for any errors or omissions.

- Sign the document, ensuring compliance with eSignature laws if submitting electronically.

Legal Use of the Income Payee's Sworn Declaration of Gross Receipts Sales

This sworn declaration is legally binding when completed correctly. It must adhere to specific regulations, such as the ESIGN Act and UETA, which govern electronic signatures and documents. Proper use of the form can protect the payee from legal repercussions and ensure that their reported income is recognized for tax purposes.

Key Elements of the Income Payee's Sworn Declaration of Gross Receipts Sales

Essential components of the Income Payee's Sworn Declaration include:

- The payee's name and contact information.

- A detailed account of gross receipts, including dates and amounts.

- A declaration statement confirming the accuracy of the information provided.

- The signature of the payee, affirming the truthfulness of the declaration.

How to Obtain the Income Payee's Sworn Declaration of Gross Receipts Sales

The form can typically be obtained from relevant state or federal tax agencies, or it may be available through accounting software. Many organizations also provide templates that can be customized to meet specific needs. It is advisable to ensure that the correct and most current version of the form is used to avoid compliance issues.

Filing Deadlines / Important Dates

Filing deadlines for the Income Payee's Sworn Declaration of Gross Receipts Sales can vary by state and the specific requirements of the tax authority. It is crucial to be aware of these deadlines to avoid penalties. Generally, forms should be submitted by the end of the fiscal year or as specified by the IRS or state tax agency.

Quick guide on how to complete income payees sworn declaration of gross receipts sales

Complete Income Payee's Sworn Declaration Of Gross Receipts Sales effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and secure it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Income Payee's Sworn Declaration Of Gross Receipts Sales on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest method to modify and electronically sign Income Payee's Sworn Declaration Of Gross Receipts Sales with ease

- Locate Income Payee's Sworn Declaration Of Gross Receipts Sales and click on Get Form to begin.

- Leverage the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your modifications.

- Select how you wish to deliver your form, via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Income Payee's Sworn Declaration Of Gross Receipts Sales and ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the income payees sworn declaration of gross receipts sales

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an income payee's sworn declaration of gross receipts sales sample?

An income payee's sworn declaration of gross receipts sales sample is a formal document that verifies the earnings of a payee. This sample serves as proof of income for various purposes, including tax filings and loan applications. Utilizing airSlate SignNow, you can easily create and eSign this document, ensuring it's both legally binding and professionally formatted.

-

How can airSlate SignNow help in creating an income payee's sworn declaration of gross receipts sales sample?

AirSlate SignNow provides intuitive tools to draft your income payee's sworn declaration of gross receipts sales sample quickly. With customizable templates and eSignature capabilities, you can ensure that your documents meet all legal requirements. This process is streamlined, allowing for efficient creation and signing without the hassle of printing and scanning.

-

Is there a cost associated with using airSlate SignNow for the income payee's sworn declaration of gross receipts sales sample?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Depending on your usage and features required, you can choose a plan that fits your budget. With competitive pricing, airSlate SignNow ensures that creating your income payee's sworn declaration of gross receipts sales sample is both cost-effective and efficient.

-

What features does airSlate SignNow offer for document eSigning?

AirSlate SignNow offers several features to enhance the document eSigning experience, including customizable templates, real-time collaboration, and status tracking. Furthermore, you can add multiple signers and set signing order to ensure your income payee's sworn declaration of gross receipts sales sample is executed seamlessly. These features make document management more straightforward and organized.

-

Can I integrate airSlate SignNow with other tools for better workflow efficiency?

Absolutely! AirSlate SignNow allows for integrations with various business applications such as CRM software, accounting tools, and more. By integrating these tools, you can streamline processes related to your income payee's sworn declaration of gross receipts sales sample, making data transfer and document management effortless.

-

Is the eSignature legal for an income payee's sworn declaration of gross receipts sales sample?

Yes, electronic signatures provided by airSlate SignNow are legally recognized in many jurisdictions. This includes documents like the income payee's sworn declaration of gross receipts sales sample, ensuring that your signed documents hold up in court and satisfy regulatory requirements. The platform complies with the latest eSignature laws and standards for your peace of mind.

-

How secure is my information when using airSlate SignNow?

AirSlate SignNow prioritizes the security of your data by employing advanced encryption and security protocols. Your personal information and documents, including the income payee's sworn declaration of gross receipts sales sample, are protected against unauthorized access. We adhere to industry standards to ensure that all transactions are secure and confidential.

Get more for Income Payee's Sworn Declaration Of Gross Receipts Sales

- Protons neutrons electrons practice worksheet answer key pdf form

- Read nora roberts online form

- Reading advantage 1 pdf form

- Junior masterchef uk form

- Philplans makati form

- Police verification 201947366 form

- Digital image processing 4th edition solutions pdf form

- Odontex dental labs removable restoration prescription form 1 1

Find out other Income Payee's Sworn Declaration Of Gross Receipts Sales

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile