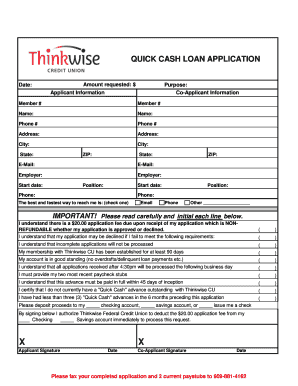

Quick Cash Loan Application Thinkwise Credit Union Form

What is the Quick Cash Loan Application Thinkwise Credit Union

The Quick Cash Loan Application from Thinkwise Credit Union is a streamlined process designed for members seeking immediate financial assistance. This application allows individuals to request a loan quickly, facilitating access to funds for various personal needs, such as unexpected expenses or urgent purchases. The form is tailored to meet the requirements of Thinkwise Credit Union, ensuring that applicants provide all necessary information to support their loan request.

Steps to complete the Quick Cash Loan Application Thinkwise Credit Union

Completing the Quick Cash Loan Application involves several key steps to ensure accuracy and efficiency:

- Gather necessary personal information, including your Social Security number, employment details, and income verification.

- Access the application form through the Thinkwise Credit Union website or mobile app.

- Fill out the form with accurate and complete information, ensuring all required fields are addressed.

- Review your application for any errors or omissions before submission.

- Submit the application electronically for processing.

Legal use of the Quick Cash Loan Application Thinkwise Credit Union

The Quick Cash Loan Application is legally binding when completed and submitted according to the guidelines set by Thinkwise Credit Union. To ensure its validity, applicants must comply with the eSignature regulations outlined in the ESIGN Act and UETA. This means that the digital signature provided during the application process holds the same legal weight as a handwritten signature, provided that the necessary compliance measures are in place.

Eligibility Criteria

To qualify for a Quick Cash Loan through Thinkwise Credit Union, applicants must meet specific eligibility criteria. Generally, this includes being a member of the credit union, demonstrating a stable source of income, and having a satisfactory credit history. Additional factors may be considered, such as the applicant's debt-to-income ratio and existing financial obligations. Meeting these criteria helps ensure responsible lending practices.

Required Documents

When applying for the Quick Cash Loan, applicants must provide certain documents to support their application. Commonly required documents include:

- Proof of identity, such as a driver's license or passport.

- Recent pay stubs or income statements to verify employment and income.

- Bank statements to assess financial stability.

Having these documents ready can expedite the application process and improve the chances of approval.

Application Process & Approval Time

The application process for the Quick Cash Loan is designed to be efficient. Once the application is submitted, Thinkwise Credit Union typically reviews it within one to two business days. Factors influencing approval time include the completeness of the application and the verification of provided information. Once approved, funds are often disbursed quickly, allowing applicants to access their loans without unnecessary delays.

Quick guide on how to complete quick cash loan application thinkwise credit union

Effortlessly Prepare Quick Cash Loan Application Thinkwise Credit Union on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely archive it online. airSlate SignNow equips you with all the tools you need to generate, modify, and electronically sign your documents quickly without delays. Manage Quick Cash Loan Application Thinkwise Credit Union on any device with airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

The easiest method to modify and electronically sign Quick Cash Loan Application Thinkwise Credit Union without hassle

- Obtain Quick Cash Loan Application Thinkwise Credit Union and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important parts of your documents or redact sensitive data with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to missing or disorganized documents, tedious form navigation, or mistakes that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Alter and electronically sign Quick Cash Loan Application Thinkwise Credit Union and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the quick cash loan application thinkwise credit union

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Quick Cash Loan Application at Thinkwise Credit Union?

A Quick Cash Loan Application at Thinkwise Credit Union is a streamlined process that allows you to apply for a fast loan online. It is designed to provide financial support when you need it most, ensuring a user-friendly experience from start to finish.

-

How can I apply for a Quick Cash Loan at Thinkwise Credit Union?

To apply for a Quick Cash Loan at Thinkwise Credit Union, visit our website and navigate to the loan section. Simply fill out the online application form, providing all necessary information, and submit it for review.

-

What are the eligibility requirements for a Quick Cash Loan Application at Thinkwise Credit Union?

Eligibility for a Quick Cash Loan Application at Thinkwise Credit Union typically includes being a member of the credit union, meeting a minimum income threshold, and having a good credit history. Check our website for detailed eligibility criteria.

-

What are the interest rates for a Quick Cash Loan Application at Thinkwise Credit Union?

Interest rates for a Quick Cash Loan Application at Thinkwise Credit Union are competitive and may vary based on your credit score and the loan amount. We recommend checking our rates online to find the most accurate information.

-

What documents do I need for a Quick Cash Loan Application at Thinkwise Credit Union?

For a Quick Cash Loan Application at Thinkwise Credit Union, you'll generally need to provide proof of identity, income documentation, and possibly other financial information. Ensuring that you have these documents ready will streamline the application process.

-

What are the benefits of using Thinkwise Credit Union for a Quick Cash Loan Application?

Using Thinkwise Credit Union for a Quick Cash Loan Application comes with several benefits, including personalized service, accessible repayment terms, and competitive interest rates. Our goal is to make your borrowing experience as simple and rewarding as possible.

-

How quickly can I receive funds after my Quick Cash Loan Application at Thinkwise Credit Union is approved?

After your Quick Cash Loan Application at Thinkwise Credit Union is approved, you can typically expect to receive the funds within one to two business days. The speed of funding may vary based on your banking institution.

Get more for Quick Cash Loan Application Thinkwise Credit Union

- Fort hare prospectures form

- Lesson 11 1 comparing data displayed in dot plots answer key form

- Macc gift shop consignment bapplicationb city of marquette mqtcty form

- Visionworks com contactlensrebates form

- Delaware residential lease agreement form

- 1040es me form

- Pub ks 1510 sales tax and compensating use tax booklet rev 11 24 this publication has been prepared by the kansas department of form

- Form 1099 b proceeds from broker and barter exchange transactions

Find out other Quick Cash Loan Application Thinkwise Credit Union

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile