Schedule 2k 1 Massachusetts Instructions 2012

What is the Schedule 2k 1 Massachusetts Instructions

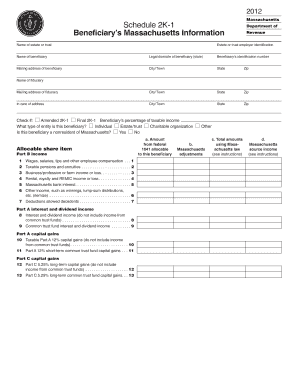

The Schedule 2K-1 is a tax form used in Massachusetts that reports income, deductions, and credits for partners in partnerships, shareholders in S corporations, and beneficiaries of estates or trusts. This form is essential for individuals who receive income from these entities, as it provides the necessary information to report on their personal income tax returns. The Massachusetts Schedule 2K-1 instructions guide users on how to accurately complete the form, ensuring compliance with state tax regulations.

Steps to complete the Schedule 2k 1 Massachusetts Instructions

Completing the Schedule 2K-1 requires several steps to ensure accuracy and compliance. First, gather all relevant financial documents, including K-1 forms from partnerships or S corporations. Next, review the instructions carefully to understand each section of the form. Fill out the personal information section, including your name, address, and taxpayer identification number. Then, report the income, deductions, and credits as detailed in the K-1 forms you received. Finally, double-check all entries for accuracy before submitting the form with your Massachusetts personal income tax return.

Key elements of the Schedule 2k 1 Massachusetts Instructions

Understanding the key elements of the Schedule 2K-1 instructions is crucial for accurate completion. These elements include:

- Income Reporting: Details on how to report various types of income such as ordinary business income, rental income, and capital gains.

- Deductions and Credits: Instructions on how to claim deductions and credits that may apply to your situation.

- Filing Requirements: Information on who must file the Schedule 2K-1 and when it is due.

- Signature Requirements: Guidelines on who must sign the form and any additional documentation needed.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule 2K-1 are aligned with Massachusetts personal income tax deadlines. Typically, the due date for filing your Massachusetts tax return, including the Schedule 2K-1, is April fifteenth. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to keep track of any changes in deadlines or extensions that may apply to your specific tax situation.

Required Documents

To complete the Schedule 2K-1, you will need to gather several key documents:

- Form K-1 from partnerships or S corporations that detail your share of income and deductions.

- Your personal income tax return from the previous year for reference.

- Any additional documentation supporting deductions or credits claimed on the form.

Who Issues the Form

The Schedule 2K-1 is issued by partnerships, S corporations, and estates or trusts that have income to report. Each entity is responsible for providing its partners, shareholders, or beneficiaries with a completed K-1 form, which details the individual's share of income, deductions, and credits. It is crucial to ensure that the information provided on the K-1 aligns with your personal records for accurate tax reporting.

Quick guide on how to complete schedule 2k 1 massachusetts instructions

Prepare Schedule 2k 1 Massachusetts Instructions effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to acquire the appropriate form and securely archive it online. airSlate SignNow equips you with all the necessary tools to design, modify, and eSign your documents quickly and efficiently. Handle Schedule 2k 1 Massachusetts Instructions on any device using airSlate SignNow’s Android or iOS applications and streamline your document-related processes today.

How to modify and eSign Schedule 2k 1 Massachusetts Instructions with ease

- Find Schedule 2k 1 Massachusetts Instructions and click on Get Form to begin.

- Make use of the tools available to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which only takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and hit the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any selected device. Modify and eSign Schedule 2k 1 Massachusetts Instructions and guarantee outstanding communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule 2k 1 massachusetts instructions

Create this form in 5 minutes!

How to create an eSignature for the schedule 2k 1 massachusetts instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Massachusetts Schedule 2K-1 instructions?

The Massachusetts Schedule 2K-1 instructions provide guidance on how to report income, deductions, and credits for partnerships and S corporations in Massachusetts. Understanding these instructions is crucial for accurate tax filing and compliance. Utilizing airSlate SignNow can streamline the document signing process related to these instructions.

-

How can airSlate SignNow help with Massachusetts Schedule 2K-1 forms?

airSlate SignNow simplifies the process of completing and signing Massachusetts Schedule 2K-1 forms. With its user-friendly interface, you can easily fill out the necessary information and send it for eSignature. This ensures that your forms are completed accurately and submitted on time.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as document templates, eSignature capabilities, and secure cloud storage, making it ideal for managing tax documents like the Massachusetts Schedule 2K-1. These features enhance efficiency and reduce the risk of errors during the tax filing process. You can also track document status in real-time.

-

Is airSlate SignNow cost-effective for small businesses handling Massachusetts Schedule 2K-1?

Yes, airSlate SignNow is a cost-effective solution for small businesses managing Massachusetts Schedule 2K-1 forms. With flexible pricing plans, it allows businesses to choose a package that fits their budget while still accessing essential features. This affordability makes it an attractive option for efficient document management.

-

Can I integrate airSlate SignNow with other accounting software for Massachusetts Schedule 2K-1?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, enhancing your workflow for Massachusetts Schedule 2K-1 forms. This integration allows for easy data transfer and ensures that your documents are always up-to-date, saving you time and reducing manual entry errors.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including Massachusetts Schedule 2K-1, offers numerous benefits such as increased efficiency, reduced paperwork, and enhanced security. The platform ensures that your documents are signed and stored securely, providing peace of mind during tax season. Additionally, it helps you stay organized and compliant with tax regulations.

-

How does airSlate SignNow ensure the security of my Massachusetts Schedule 2K-1 documents?

airSlate SignNow prioritizes the security of your documents, including Massachusetts Schedule 2K-1 forms, by employing advanced encryption and secure cloud storage. This ensures that your sensitive information is protected from unauthorized access. Regular security audits and compliance with industry standards further enhance the safety of your documents.

Get more for Schedule 2k 1 Massachusetts Instructions

- Equipment return form 320203417

- Module name module alcohol abstinence self efficacy scale adai washington form

- Application under section 281 of income tax act in word format

- Accident information

- Salary reduction agreement template form

- Iffco tokio health claim form pdf

- Workers compensation medicare set aside arrangement wcmsa cms form

- Ks form av1

Find out other Schedule 2k 1 Massachusetts Instructions

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online