DR 654 Form

What is the DR 654

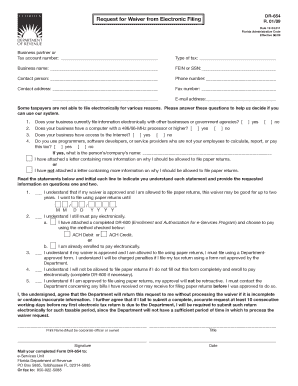

The DR 654 form is a crucial document used in various legal and financial contexts within the United States. It serves as an official declaration or request related to specific administrative processes. Understanding the purpose and requirements of the DR 654 is essential for ensuring compliance and proper handling of the associated matters.

How to use the DR 654

Using the DR 654 form involves several straightforward steps. First, gather all necessary information and documentation required to complete the form accurately. Next, fill out the form carefully, ensuring that all fields are completed to avoid delays. Once completed, submit the form through the appropriate channels, which may include online submission, mailing, or in-person delivery, depending on the specific requirements.

Steps to complete the DR 654

Completing the DR 654 form requires attention to detail. Follow these steps:

- Review the instructions provided with the form.

- Gather all required documentation to support your submission.

- Fill out the form accurately, ensuring all information is correct.

- Double-check for any errors or omissions.

- Submit the form via the designated method.

Legal use of the DR 654

The DR 654 form must be used in accordance with applicable laws and regulations. This includes ensuring that all information provided is truthful and that the form is submitted within any required timeframes. Legal compliance is critical, as improper use of the form can lead to penalties or rejection of the submission.

Key elements of the DR 654

Several key elements must be included when completing the DR 654 form. These typically include:

- Personal identification information.

- Details specific to the request or declaration being made.

- Signatures and dates to validate the submission.

Who Issues the Form

The DR 654 form is issued by a designated authority, which may vary based on the context in which the form is used. Typically, state or federal agencies are responsible for providing this form, ensuring that it meets the necessary legal standards for its intended purpose.

Quick guide on how to complete dr 654

Effortlessly Complete DR 654 on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly and without delays. Process DR 654 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related activity today.

How to Edit and Electronically Sign DR 654 with Ease

- Locate DR 654 and click on Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to submit the form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing out new copies. airSlate SignNow addresses your document management needs in just a few clicks, from any device you choose. Edit and electronically sign DR 654 while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr 654

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is DR 654 and how does it benefit my business?

DR 654 is a document management solution that streamlines the eSigning process, allowing businesses to send and sign documents efficiently. By utilizing DR 654, companies can reduce turnaround times and enhance collaboration, leading to increased productivity and improved client relations.

-

How much does airSlate SignNow with DR 654 cost?

AirSlate SignNow offers competitive pricing for its services, including the DR 654 features. Depending on your business needs, you can choose from various pricing plans that provide access to essential eSigning functionalities at an affordable rate.

-

What features does DR 654 include for document management?

DR 654 includes a range of features such as customizable templates, automated workflows, and secure cloud storage. These functionalities make it easier for users to manage documents and ensure smooth eSigning experiences across teams and clients.

-

Can DR 654 integrate with other software tools?

Yes, DR 654 is designed to integrate seamlessly with various software applications, including CRM systems and productivity tools. This allows businesses to enhance their workflows by incorporating eSigning capabilities directly into their existing platforms.

-

Is DR 654 suitable for small businesses?

Absolutely! DR 654 is an ideal solution for small businesses looking to optimize their document management and eSigning processes. Its cost-effective pricing and user-friendly interface make it accessible and beneficial for teams of all sizes.

-

What security measures does DR 654 implement?

DR 654 provides robust security measures to protect your documents and sensitive information. It includes features such as encryption, two-factor authentication, and compliance with industry standards, ensuring your eSigned documents are secure.

-

How can DR 654 enhance team collaboration?

DR 654 enhances team collaboration by enabling multiple users to work on the same document simultaneously. With real-time updates and notifications, team members can send, review, and sign documents efficiently, leading to faster decision-making.

Get more for DR 654

Find out other DR 654

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer