Nys Fillable Online Tax Form

What is the Nys Fillable Online Tax Form

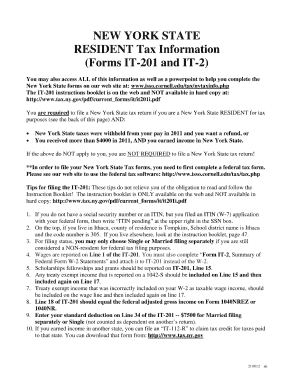

The Nys Fillable Online Tax Form is a digital document designed for taxpayers in New York State to report their income and calculate their tax obligations. This form simplifies the tax filing process by allowing users to fill it out electronically, ensuring accuracy and efficiency. The online format is particularly beneficial as it reduces the need for paper documents and facilitates quicker submissions.

How to use the Nys Fillable Online Tax Form

Using the Nys Fillable Online Tax Form is straightforward. Begin by accessing the form through a compatible web browser. Once opened, you can fill in the required fields with your personal and financial information. The form includes built-in calculations to assist in determining your tax liability. After completing the form, it is essential to review all entries for accuracy before submitting it electronically or printing it for mailing.

Steps to complete the Nys Fillable Online Tax Form

Completing the Nys Fillable Online Tax Form involves several key steps:

- Access the form online through a secure platform.

- Enter your personal information, including your name, address, and Social Security number.

- Input your income details, deductions, and credits as applicable.

- Review the calculations provided by the form to ensure accuracy.

- Sign the form electronically using a secure eSignature option.

- Submit the form online or print it for mailing if preferred.

Legal use of the Nys Fillable Online Tax Form

The Nys Fillable Online Tax Form is legally recognized as a valid document for tax filing purposes, provided it meets specific requirements. To ensure its legal status, users must follow the guidelines set forth by the New York State Department of Taxation and Finance. This includes using a secure platform for submission and ensuring that all information is accurate and complete. Electronic signatures are also accepted, provided they comply with applicable eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for the Nys Fillable Online Tax Form typically align with federal tax deadlines. For most individual taxpayers, the deadline is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial to stay informed about any changes to these dates to avoid penalties and ensure timely filing.

Required Documents

To complete the Nys Fillable Online Tax Form, certain documents are necessary. These may include:

- W-2 forms from employers.

- 1099 forms for additional income.

- Documentation for deductions, such as receipts for medical expenses or charitable contributions.

- Previous year’s tax return for reference.

Form Submission Methods (Online / Mail / In-Person)

The Nys Fillable Online Tax Form can be submitted through various methods. The preferred method is online submission, which is efficient and secure. Alternatively, taxpayers can print the completed form and mail it to the appropriate tax office. In-person submission is also an option at designated tax offices, though it may require an appointment or be subject to availability.

Quick guide on how to complete nys fillable online tax form

Complete Nys Fillable Online Tax Form easily on any device

Digital document management has become favored by both companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Nys Fillable Online Tax Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to edit and eSign Nys Fillable Online Tax Form effortlessly

- Locate Nys Fillable Online Tax Form and click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Nys Fillable Online Tax Form and ensure outstanding communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nys fillable online tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nys Fillable Online Tax Form?

The Nys Fillable Online Tax Form is a digital version of the New York State tax form that allows users to easily fill out, save, and submit their tax documents online. This convenient solution simplifies the filing process and reduces the risk of errors, making tax season less stressful.

-

How can I access the Nys Fillable Online Tax Form?

To access the Nys Fillable Online Tax Form, visit the official New York State Department of Taxation and Finance website. From there, you can find and complete the necessary forms, or leverage platforms like airSlate SignNow for enhanced document management and e-signature capabilities.

-

Is the Nys Fillable Online Tax Form free to use?

The basic access to the Nys Fillable Online Tax Form is free; however, using advanced features and e-signing through services like airSlate SignNow may incur costs. Keep in mind that investing in professional tools can save you time and ensure compliance with the latest tax regulations.

-

What features does airSlate SignNow offer for the Nys Fillable Online Tax Form?

airSlate SignNow provides a variety of features to enhance your experience with the Nys Fillable Online Tax Form, including easy e-signature functionality, document sharing, and secure cloud storage. These features ensure that your tax documents are completed efficiently and securely.

-

Can I integrate airSlate SignNow with my existing accounting software for the Nys Fillable Online Tax Form?

Yes, airSlate SignNow offers integrations with popular accounting and tax software, allowing you to streamline the process for the Nys Fillable Online Tax Form. This integration helps maintain accurate records and simplifies the filing process by syncing data directly between platforms.

-

What are the benefits of using airSlate SignNow for the Nys Fillable Online Tax Form?

Using airSlate SignNow for the Nys Fillable Online Tax Form provides signNow benefits, including improved accuracy, reduced processing time, and enhanced collaboration. With its user-friendly interface, you can fill out forms quickly and e-sign documents with minimal hassle.

-

How secure is the Nys Fillable Online Tax Form on airSlate SignNow?

Security is a priority for airSlate SignNow, which implements industry-standard encryption and secure storage for your Nys Fillable Online Tax Form. Rest assured that your sensitive information is protected while you complete and submit your tax documents efficiently.

Get more for Nys Fillable Online Tax Form

- Carta de perdn immigration form

- Personal information list

- Clear 100 mail in rebate form

- Certificate of eligibility for parking placard state of new mexico form

- Kentucky income tax forms requisition department of revenue

- County state of iowalicense no iowa departm form

- Schedule e cash bank deposits misc personal property rev 1508 formspublications

- Visa creditdebit card form

Find out other Nys Fillable Online Tax Form

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure