Fha Rate and Term Refinance Worksheet Form

Understanding the FHA Rate and Term Refinance Worksheet

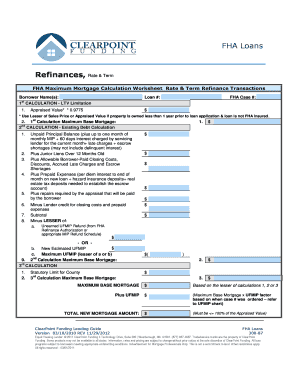

The FHA Rate and Term Refinance Worksheet is a critical document for homeowners looking to refinance their existing FHA loans. This worksheet helps borrowers calculate the potential benefits of refinancing, including lower monthly payments and reduced interest rates. It includes essential information such as loan amounts, interest rates, and terms, allowing users to assess their financial situation accurately. Understanding this worksheet is vital for making informed decisions regarding refinancing options.

How to Use the FHA Rate and Term Refinance Worksheet

Using the FHA Rate and Term Refinance Worksheet involves several steps. First, gather all necessary financial documents, including your current mortgage statement, income verification, and any other relevant financial information. Next, input your current loan details into the worksheet, including outstanding balance and interest rate. After entering your new loan terms, such as the desired interest rate and loan amount, the worksheet will help you calculate potential savings and monthly payment changes. This process allows for a clear comparison between your existing mortgage and the proposed refinance option.

Steps to Complete the FHA Rate and Term Refinance Worksheet

Completing the FHA Rate and Term Refinance Worksheet requires careful attention to detail. Follow these steps:

- Gather your current mortgage information, including the loan balance and interest rate.

- Collect your income documentation to verify your financial status.

- Fill in the worksheet with your current loan details and proposed refinancing terms.

- Calculate the new monthly payment and total interest savings over the life of the loan.

- Review the completed worksheet to ensure accuracy before submitting it to your lender.

Key Elements of the FHA Rate and Term Refinance Worksheet

The FHA Rate and Term Refinance Worksheet includes several key elements that are essential for accurate calculations. These elements typically consist of:

- Current loan information, including balance and interest rate.

- Proposed loan terms, such as new interest rate and loan duration.

- Monthly payment calculations for both current and proposed loans.

- Total interest paid over the life of both loans.

- Potential savings from refinancing, highlighting the financial benefits.

Legal Use of the FHA Rate and Term Refinance Worksheet

The legal use of the FHA Rate and Term Refinance Worksheet is governed by various regulations pertaining to mortgage refinancing. It is essential to ensure that the worksheet is filled out accurately and complies with the guidelines set forth by the FHA. This includes adhering to the necessary documentation and verification requirements. Proper completion of the worksheet not only facilitates a smoother refinancing process but also helps in avoiding potential legal complications in the future.

Eligibility Criteria for the FHA Rate and Term Refinance Worksheet

To utilize the FHA Rate and Term Refinance Worksheet effectively, borrowers must meet specific eligibility criteria. These may include:

- Having an existing FHA-insured mortgage.

- Demonstrating a steady income and creditworthiness.

- Meeting the FHA's seasoning requirements, which typically involve having made timely payments on the current mortgage for a specified period.

- Ensuring that the new loan amount does not exceed the FHA limits for refinancing.

Quick guide on how to complete fha rate and term refinance worksheet

Effortlessly prepare Fha Rate And Term Refinance Worksheet on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without any delays. Manage Fha Rate And Term Refinance Worksheet on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

Edit and eSign Fha Rate And Term Refinance Worksheet with ease

- Find Fha Rate And Term Refinance Worksheet and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Verify all the details and click the Done button to save your changes.

- Select your preferred method to send your form: via email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that require new copies to be printed. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Fha Rate And Term Refinance Worksheet to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fha rate and term refinance worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an FHA streamline worksheet?

The FHA streamline worksheet is a crucial tool used in the refinance process for FHA loans. It helps lenders quickly assess the borrower's qualifications and streamline the approval process. By utilizing the fha streamline worksheet, homeowners can easily navigate the requirements and expedite their refinancing.

-

How can airSlate SignNow assist with the FHA streamline worksheet?

AirSlate SignNow offers an easy-to-use platform to create, send, and eSign the FHA streamline worksheet. Our solution simplifies document management and ensures that all signatures and approvals are obtained efficiently. With airSlate SignNow, you can save time and reduce the hassle of processing these essential documents.

-

Is there a cost associated with using the FHA streamline worksheet through airSlate SignNow?

Using the FHA streamline worksheet through airSlate SignNow comes with competitive pricing options. We offer a range of plans tailored to meet the needs of various businesses, ensuring that you receive affordable access to powerful document signing tools. Check our pricing page for specific details and to find a plan that suits your needs.

-

What features does airSlate SignNow offer for managing the FHA streamline worksheet?

AirSlate SignNow provides several features that enhance the management of the FHA streamline worksheet, including customizable templates, a secure eSigning process, and real-time tracking of document status. By utilizing these features, users can ensure that their FHA streamline worksheets are completed accurately and promptly. Additionally, our platform integrates seamlessly with other tools for improved workflow.

-

How does the FHA streamline worksheet benefit homeowners?

The FHA streamline worksheet benefits homeowners by simplifying the refinance process and making it less intimidating. It outlines the necessary documentation and requirements, enabling homeowners to understand what they need to qualify. Additionally, using an fha streamline worksheet can lead to lower monthly payments and better loan terms.

-

Can I integrate the FHA streamline worksheet with other software tools?

Yes, airSlate SignNow allows you to integrate the FHA streamline worksheet with various software tools such as CRM systems and document management platforms. This integration helps streamline your workflow and ensures that all your documents are organized efficiently. By connecting your tools, you can enhance productivity and improve the overall user experience.

-

What makes airSlate SignNow the best choice for managing the FHA streamline worksheet?

AirSlate SignNow stands out for its user-friendly interface and robust features tailored for document management, including the FHA streamline worksheet. Our platform is designed to save you time and effort in sending and signing documents. Moreover, we prioritize security and compliance, ensuring that your data remains protected while you manage your important financial documents.

Get more for Fha Rate And Term Refinance Worksheet

- Affidavit of loss release of interest 449727933 form

- Ffsr form

- Selda unicatt simulazione inglese form

- Whealth international form

- Fargo baptist church bus rider permission form

- 8th science energy study guide form

- Pouring permit application the city of brookhaven ga form

- Sec 1 1 transformation in the coordinate plane

Find out other Fha Rate And Term Refinance Worksheet

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online