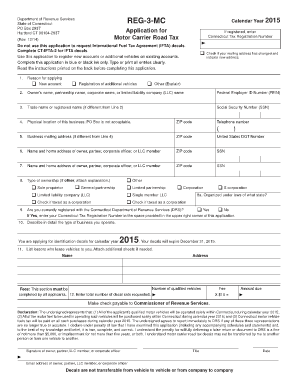

REG 3 MC, Application for Motor Carrier Road Tax Ct Form

What is the REG 3 MC, Application For Motor Carrier Road Tax Ct

The REG 3 MC, Application For Motor Carrier Road Tax Ct, is a form used by motor carriers in Connecticut to apply for a road tax permit. This application is essential for businesses that operate commercial vehicles on public highways. The form collects important information about the vehicle and the carrier, ensuring compliance with state tax regulations. By submitting this form, motor carriers can legally operate their vehicles while adhering to the state's tax requirements.

Steps to complete the REG 3 MC, Application For Motor Carrier Road Tax Ct

Completing the REG 3 MC form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including vehicle details, business identification, and tax information. Next, fill out the form carefully, ensuring that all fields are completed accurately. It is crucial to review the form for any errors before submission. Once completed, submit the form through the appropriate channel, whether online, by mail, or in person, depending on your preference and state guidelines.

Required Documents for the REG 3 MC, Application For Motor Carrier Road Tax Ct

When applying for the REG 3 MC, certain documents are required to support your application. These typically include:

- Proof of business registration

- Vehicle registration details

- Tax identification number

- Any previous road tax permits, if applicable

Having these documents ready will streamline the application process and help ensure that your submission is complete.

Legal use of the REG 3 MC, Application For Motor Carrier Road Tax Ct

The REG 3 MC form serves a legal purpose by providing a framework for tax compliance among motor carriers. It is important to understand that submitting this form is not just a bureaucratic step; it establishes your legal right to operate commercial vehicles on public roads in Connecticut. Failure to submit this application or inaccuracies in the information provided can lead to legal penalties and complications with state authorities.

Form Submission Methods for the REG 3 MC, Application For Motor Carrier Road Tax Ct

Motor carriers have several options for submitting the REG 3 MC form. The most common methods include:

- Online submission through the state’s official website

- Mailing the completed form to the designated state office

- In-person submission at local tax offices

Choosing the right submission method can depend on your convenience and the urgency of your application.

Eligibility Criteria for the REG 3 MC, Application For Motor Carrier Road Tax Ct

To be eligible for the REG 3 MC application, applicants must meet specific criteria. Generally, this includes being a registered motor carrier operating within Connecticut, owning or leasing commercial vehicles that travel on public highways, and being compliant with state tax laws. It is essential to verify that your business meets these requirements before initiating the application process to avoid delays.

Quick guide on how to complete reg 3 mc application for motor carrier road tax ct

Effortlessly Prepare REG 3 MC, Application For Motor Carrier Road Tax Ct on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without any holdup. Handle REG 3 MC, Application For Motor Carrier Road Tax Ct on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and Electronically Sign REG 3 MC, Application For Motor Carrier Road Tax Ct with Ease

- Find REG 3 MC, Application For Motor Carrier Road Tax Ct and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiresome form searching, or mistakes that necessitate reprinting document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign REG 3 MC, Application For Motor Carrier Road Tax Ct and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the reg 3 mc application for motor carrier road tax ct

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the REG 3 MC, Application For Motor Carrier Road Tax Ct. used for?

The REG 3 MC, Application For Motor Carrier Road Tax Ct. is a form used by businesses that operate motor carriers in Connecticut to apply for a road tax permit. This document helps ensure compliance with state regulations regarding motor carrier operations, enabling companies to legally transport goods within the state.

-

How can airSlate SignNow help with the REG 3 MC, Application For Motor Carrier Road Tax Ct.?

airSlate SignNow streamlines the process of filling out and eSigning the REG 3 MC, Application For Motor Carrier Road Tax Ct. With its user-friendly interface, businesses can effortlessly complete and send the application, ensuring timely submissions and reducing paperwork hassles.

-

What features does airSlate SignNow offer for the REG 3 MC, Application For Motor Carrier Road Tax Ct.?

airSlate SignNow provides features such as document templates, customizable workflows, and eSignature capabilities specifically for the REG 3 MC, Application For Motor Carrier Road Tax Ct. These tools enhance productivity by allowing users to manage their applications efficiently and securely.

-

Is there a cost associated with using airSlate SignNow for the REG 3 MC, Application For Motor Carrier Road Tax Ct.?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution for businesses. Pricing plans vary depending on the features you need, ensuring you only pay for what benefits your application process for the REG 3 MC, Application For Motor Carrier Road Tax Ct.

-

Can I integrate airSlate SignNow with other software for handling the REG 3 MC, Application For Motor Carrier Road Tax Ct.?

Absolutely! airSlate SignNow offers seamless integrations with various productivity and business management tools. This can enhance your workflows when dealing with the REG 3 MC, Application For Motor Carrier Road Tax Ct., allowing for a more streamlined application process.

-

How secure is airSlate SignNow when managing the REG 3 MC, Application For Motor Carrier Road Tax Ct.?

Security is a top priority for airSlate SignNow. When managing the REG 3 MC, Application For Motor Carrier Road Tax Ct., users benefit from advanced encryption and authentication measures, ensuring that your sensitive information remains safe throughout the document lifecycle.

-

What benefits does airSlate SignNow provide for users completing the REG 3 MC, Application For Motor Carrier Road Tax Ct.?

Using airSlate SignNow for the REG 3 MC, Application For Motor Carrier Road Tax Ct. provides several benefits, including time savings, reduced errors, and improved compliance. This digital solution enhances collaboration and communication among stakeholders, resulting in a smoother application process.

Get more for REG 3 MC, Application For Motor Carrier Road Tax Ct

- Hvac service agreement royal plus home amp commercial form

- Transit pass issued under section 69 form

- Pre authorization letter sample form

- Drill exercise report template bblueb bh2obbcomb form

- Form b strata template

- Calstrs direct deposit form

- House arrest contacts and information sheet philadelphia bar bb donation philabarfoundation

- Woodside sports complex operations llc form

Find out other REG 3 MC, Application For Motor Carrier Road Tax Ct

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile