Ohio Sd 100es Form

What is the Ohio Sd 100es

The Ohio Sd 100es is a tax form used by residents of Ohio to report their estimated school district income tax. This form is essential for individuals who anticipate owing school district taxes based on their income. It helps taxpayers calculate and submit their estimated tax payments to the appropriate school district, ensuring compliance with local tax regulations. The form is specifically designed for those who may not have taxes withheld from their income, such as self-employed individuals or those with multiple income sources.

How to use the Ohio Sd 100es

Using the Ohio Sd 100es involves several straightforward steps. First, gather all necessary financial documents, including income statements and previous tax returns. Next, calculate your estimated income for the year, which will help determine the amount of tax owed. Complete the form by filling in the required fields accurately, ensuring that all calculations are correct. Once completed, submit the form to your local school district by the designated deadline, either online or by mail, to avoid any penalties.

Steps to complete the Ohio Sd 100es

Completing the Ohio Sd 100es requires careful attention to detail. Follow these steps for accurate submission:

- Gather your financial documents, including W-2s, 1099s, and any other income records.

- Estimate your total income for the year, taking into account any deductions or credits you may qualify for.

- Fill out the form, ensuring that you enter your estimated income and calculate the corresponding tax owed based on the current school district tax rate.

- Review the completed form for accuracy, checking all calculations and personal information.

- Submit the form to your school district by the deadline, ensuring you keep a copy for your records.

Legal use of the Ohio Sd 100es

The Ohio Sd 100es is legally binding when completed and submitted according to state regulations. It complies with the legal requirements set forth by the Ohio Department of Taxation, ensuring that taxpayers fulfill their obligations regarding school district income taxes. Proper use of the form helps prevent legal issues related to tax compliance, and it is crucial for maintaining good standing with local tax authorities.

Filing Deadlines / Important Dates

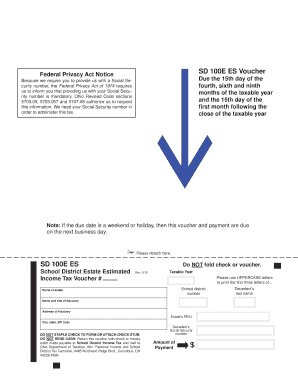

Filing deadlines for the Ohio Sd 100es are critical to ensure timely compliance. Typically, the estimated tax payments are due on specific dates throughout the year, often aligned with quarterly deadlines. It is important to check the Ohio Department of Taxation's official calendar for the most current dates, as missing a deadline can result in penalties and interest on unpaid taxes. Taxpayers should mark these dates on their calendars to avoid any oversight.

Required Documents

To accurately complete the Ohio Sd 100es, certain documents are required. These typically include:

- Income statements, such as W-2 forms and 1099 forms.

- Previous year’s tax returns for reference.

- Documentation of any deductions or credits that may apply.

Having these documents ready will facilitate a smoother and more accurate completion process.

Quick guide on how to complete ohio sd 100es

Effortlessly prepare Ohio Sd 100es on any device

Digital document management has become increasingly favored by both companies and individuals. It offers an excellent eco-friendly solution to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without any delays. Manage Ohio Sd 100es on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign Ohio Sd 100es with ease

- Obtain Ohio Sd 100es and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and eSign Ohio Sd 100es and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ohio sd 100es

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the sd 100es and how does it work?

The sd 100es is a powerful eSignature tool integrated within airSlate SignNow, designed to streamline document workflows. It allows users to send, sign, and manage documents electronically, ensuring a quick and efficient signing process. By utilizing the sd 100es, businesses can reduce paperwork and automate their signature workflows.

-

What are the key features of the sd 100es?

The sd 100es offers a range of features that include customizable templates, real-time tracking, and secure cloud storage. Users can easily create signing workflows that suit their business needs. With the sd 100es, you can also integrate your documents with other applications for enhanced productivity.

-

How much does the sd 100es cost?

Pricing for the sd 100es varies based on the plan selected, but airSlate SignNow offers competitive rates that cater to different business sizes. Users can choose from monthly or annual subscriptions, making it a cost-effective option for document signing. To find a plan that fits your needs, visit our pricing page.

-

Is the sd 100es suitable for small businesses?

Absolutely! The sd 100es is designed to meet the needs of businesses of all sizes, including small businesses. Its user-friendly interface and affordable pricing make it an ideal choice for those looking to streamline their eSigning processes without breaking the bank.

-

Can the sd 100es integrate with other software?

Yes, the sd 100es seamlessly integrates with various applications including CRM software, cloud storage services, and productivity tools. This integration capability enhances your workflow and provides a cohesive experience across different platforms. Discover more integrations on our website.

-

What are the benefits of using the sd 100es for eSigning?

The sd 100es transforms how businesses handle document signing by making it faster, secure, and environmentally friendly. It reduces the time spent on manual processes, enabling quick turnaround times for important documents. Additionally, it enhances security with encryption and audit trails, providing peace of mind.

-

Is the sd 100es compliant with legal standards?

The sd 100es complies with global eSignature laws, ensuring that your electronically signed documents are legally binding. This compliance not only protects your business but also instills trust in your clients. With the sd 100es, you can confidently manage your document signing needs.

Get more for Ohio Sd 100es

Find out other Ohio Sd 100es

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy