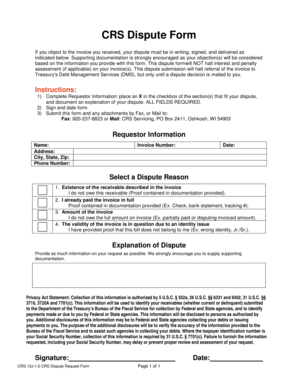

Crs Dispute Form

What is the CRS Dispute?

The CRS dispute form is a document used to address discrepancies related to the Common Reporting Standard (CRS) information reported by financial institutions. This form allows individuals or entities to formally contest the accuracy of their reported financial data, ensuring compliance with international tax regulations. The CRS aims to combat tax evasion by facilitating the automatic exchange of financial account information between participating countries.

Steps to Complete the CRS Dispute

Filling out the CRS dispute form involves several key steps to ensure accuracy and compliance. Follow these steps for a successful submission:

- Gather necessary information: Collect all relevant documents, including your identification and any prior correspondence regarding the disputed information.

- Fill out the form: Accurately provide your personal details, including your name, address, and taxpayer identification number.

- Detail the dispute: Clearly explain the nature of the dispute, including specific inaccuracies in the reported information.

- Attach supporting documents: Include any evidence that supports your claim, such as bank statements or previous tax filings.

- Review the form: Double-check all entries for accuracy before submission.

- Submit the form: Follow the designated submission method, whether online, by mail, or in person.

Legal Use of the CRS Dispute

The CRS dispute form is legally binding once completed and submitted according to the relevant regulations. It is essential to understand the legal implications of submitting this form, as it serves as an official request for correction. By using this form, individuals affirm that the information provided is truthful and accurate to the best of their knowledge, which can have legal consequences if found otherwise.

Required Documents

When submitting a CRS dispute form, certain documents are necessary to support your claim. These typically include:

- A copy of your identification, such as a driver’s license or passport.

- Documentation of the disputed information, such as account statements or tax returns.

- Any correspondence with the financial institution regarding the dispute.

Providing comprehensive documentation can significantly enhance the credibility of your dispute.

Examples of Using the CRS Dispute

There are various scenarios in which individuals may need to use the CRS dispute form. Common examples include:

- Discrepancies in reported income that differ from your records.

- Errors in personal information, such as name or address mismatches.

- Claims of incorrect residency status affecting tax obligations.

Addressing these issues promptly through the CRS dispute form can help maintain compliance and avoid potential penalties.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the CRS dispute form is crucial. Typically, disputes should be filed within a specific timeframe after the reporting period. It is advisable to consult the guidelines provided by the relevant tax authority to ensure timely submission. Missing deadlines can result in complications or the inability to contest the reported information.

Quick guide on how to complete crs dispute

Complete Crs Dispute effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Handle Crs Dispute on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Crs Dispute seamlessly

- Obtain Crs Dispute and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Select important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you want to deliver your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Edit and eSign Crs Dispute to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the crs dispute

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a CRS dispute form?

A CRS dispute form is a specialized document used to address discrepancies or conflicts within a company's records or transactions. With airSlate SignNow, you can easily create and eSign a CRS dispute form to ensure accurate record-keeping and resolution of issues.

-

How does airSlate SignNow help with CRS dispute forms?

AirSlate SignNow streamlines the process of creating, sending, and signing CRS dispute forms. Our user-friendly platform allows you to customize your form and obtain electronic signatures quickly, ensuring a smooth dispute resolution process.

-

What are the costs associated with using airSlate SignNow for CRS dispute forms?

Our pricing plans are designed to be cost-effective, allowing businesses of all sizes to use airSlate SignNow for their CRS dispute forms. We offer various subscription options that cater to different needs, providing you with the flexibility to choose the right plan for your organization.

-

Are there any specific features for handling CRS dispute forms on airSlate SignNow?

Yes, airSlate SignNow includes features like document templates, automated workflows, and secure storage, all tailored for managing CRS dispute forms. These features enhance efficiency, save time, and ensure that all necessary information is captured accurately.

-

Can I integrate airSlate SignNow with other applications to manage CRS dispute forms?

AirSlate SignNow seamlessly integrates with various third-party applications, allowing you to manage CRS dispute forms alongside your existing tools. This integration capability enhances your workflow, providing a centralized solution for all your document signing needs.

-

What benefits does using airSlate SignNow provide for CRS dispute forms?

Using airSlate SignNow for your CRS dispute forms offers several benefits, including enhanced accuracy, improved turnaround times, and greater transparency in the dispute resolution process. Our solution helps mitigate risks and ensures that your documents are legally binding and secure.

-

Is it easy to track the status of CRS dispute forms with airSlate SignNow?

Absolutely! AirSlate SignNow provides real-time tracking for your CRS dispute forms, allowing you to monitor the status of each document as it moves through the signing process. This feature keeps you informed and ensures timely resolutions to disputes.

Get more for Crs Dispute

- Ct teacher retirement statement form

- Allinurl online repo form

- Allergy and anaphylaxis emergency plan form

- Transcript release req form ccv

- Pca 100 answer sheet form

- Qut abn form

- Junior high and high school student questionnaire solution tree transitions wiki conestogavalley form

- Affidavit of death form texas

Find out other Crs Dispute

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile