T5007 Form

What is the T5007

The T5007 form is a tax document used in Canada to report certain types of income, specifically related to social assistance payments and workers' compensation benefits. It serves as a means for recipients to disclose these payments to the Canada Revenue Agency (CRA) for tax purposes. Understanding the T5007 is crucial for individuals who have received these benefits, as it ensures compliance with tax regulations and helps in accurately reporting income during tax season.

How to use the T5007

Using the T5007 involves several steps to ensure proper reporting of income. Recipients must first receive the form from the issuing agency, such as a provincial workers' compensation board or social services department. Once in possession of the T5007, individuals should carefully review the information provided, including the amounts received and the relevant tax year. This information must then be accurately entered into the individual's tax return, ensuring that all figures align with the details on the T5007 to avoid discrepancies.

Steps to complete the T5007

Completing the T5007 form requires attention to detail. Here are the essential steps:

- Receive the T5007 form from the appropriate agency.

- Verify that all personal information, such as name and address, is correct.

- Check the amounts listed for accuracy, ensuring they match the payments received.

- Enter the information from the T5007 into the relevant sections of your tax return.

- Keep a copy of the T5007 for your records after filing your taxes.

Legal use of the T5007

The legal use of the T5007 is governed by tax laws that require individuals to report all sources of income, including social assistance and workers' compensation. Failing to report this income can lead to penalties and interest on unpaid taxes. It is essential for recipients to understand their obligations under the law and to use the T5007 correctly to ensure compliance with the Canada Revenue Agency's requirements.

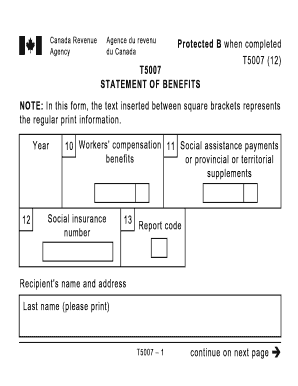

Key elements of the T5007

Several key elements are vital to understanding the T5007 form. These include:

- Recipient Information: Personal details of the individual receiving the payments.

- Issuing Agency: The organization responsible for providing the benefits.

- Payment Amount: The total amount of social assistance or workers' compensation received during the tax year.

- Tax Year: The specific year for which the income is being reported.

IRS Guidelines

While the T5007 is primarily a Canadian tax form, understanding IRS guidelines is essential for individuals who may have cross-border tax obligations. U.S. taxpayers must report foreign income, including certain benefits received from Canadian agencies, on their U.S. tax returns. It is important to consult with a tax professional familiar with both Canadian and U.S. tax laws to ensure compliance and avoid potential issues with the IRS.

Quick guide on how to complete t5007

Effortlessly Prepare T5007 on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. air Slate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without any hold-ups. Handle T5007 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest method to edit and eSign T5007 seamlessly

- Obtain T5007 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature utilizing the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign T5007, ensuring outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the t5007

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the t5007 form and how does airSlate SignNow help with it?

The t5007 form is used for reporting social assistance payments. airSlate SignNow streamlines the process by allowing you to eSign and send this form quickly, ensuring compliance and accuracy while saving time.

-

How much does it cost to use airSlate SignNow for t5007 forms?

airSlate SignNow offers flexible pricing plans that cater to various business needs. Whether you are handling a few t5007 forms or a large volume, there is a cost-effective solution that can help you manage your digital signatures effortlessly.

-

What features does airSlate SignNow offer for t5007 document management?

With airSlate SignNow, you get features like customizable templates, document routing, and advanced security. These features make it easy to manage t5007 forms efficiently and securely.

-

Is it easy to integrate airSlate SignNow with existing software for handling t5007 forms?

Absolutely! airSlate SignNow integrates seamlessly with popular applications like Salesforce and Google Drive, making it simple to incorporate t5007 form management into your existing workflow without disruption.

-

What are the benefits of using airSlate SignNow for t5007 processing?

Using airSlate SignNow for your t5007 processing allows for faster turnaround times and reduced paper usage, which is environmentally friendly. Additionally, it increases overall efficiency, ensuring you never miss deadlines or compliance requirements.

-

Can I track t5007 forms sent with airSlate SignNow?

Yes, airSlate SignNow provides tracking options that allow you to monitor the status of your t5007 forms in real time. You can see who has signed, who needs to sign, and when the document is completed.

-

How does airSlate SignNow ensure the security of my t5007 documents?

Security is a top priority at airSlate SignNow. Your t5007 documents are protected with advanced encryption, secure authentication protocols, and regular security audits to ensure your data remains safe.

Get more for T5007

Find out other T5007

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document