South Dakota Franchise Tax on Financial Institutions for Money Lenders Form

What is the South Dakota Franchise Tax On Financial Institutions For Money Lenders Form

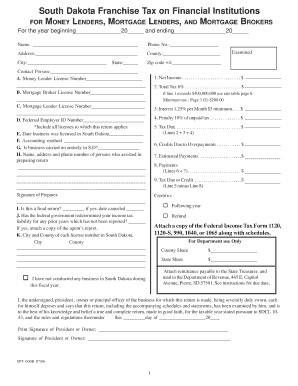

The South Dakota Franchise Tax On Financial Institutions For Money Lenders Form is a crucial document for financial institutions operating within the state. This form is used to report and calculate the franchise tax owed by money lenders, which is based on their gross receipts. The franchise tax is a key aspect of the state's revenue system, ensuring that financial institutions contribute to the public resources they utilize. Understanding this form is essential for compliance and accurate tax reporting.

How to use the South Dakota Franchise Tax On Financial Institutions For Money Lenders Form

Using the South Dakota Franchise Tax On Financial Institutions For Money Lenders Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial records, including gross receipts and any deductions applicable to your institution. Next, carefully fill out each section of the form, ensuring that all figures are accurate. Once completed, review the form for any errors before submission. This form can be submitted electronically, which streamlines the process and enhances efficiency.

Steps to complete the South Dakota Franchise Tax On Financial Institutions For Money Lenders Form

Completing the South Dakota Franchise Tax On Financial Institutions For Money Lenders Form requires attention to detail. Follow these steps:

- Collect all financial documents related to your institution's gross receipts.

- Access the form through the appropriate state website or authorized platform.

- Fill in the required fields, including your institution's name, address, and financial data.

- Double-check all calculations to ensure accuracy.

- Submit the form electronically or via mail, depending on your preference.

Key elements of the South Dakota Franchise Tax On Financial Institutions For Money Lenders Form

The South Dakota Franchise Tax On Financial Institutions For Money Lenders Form includes several key elements that are essential for its validity. These elements typically encompass:

- Institution Information: Name, address, and tax identification number.

- Financial Data: Total gross receipts and any applicable deductions.

- Tax Calculation: The formula used to determine the franchise tax owed.

- Signature: An authorized representative must sign the form to validate it.

Legal use of the South Dakota Franchise Tax On Financial Institutions For Money Lenders Form

The legal use of the South Dakota Franchise Tax On Financial Institutions For Money Lenders Form is governed by state tax laws. Proper completion and timely submission of this form are essential to avoid penalties and ensure compliance with state regulations. The form serves as a formal declaration of the tax owed and is subject to review by state tax authorities. Institutions must maintain accurate records to support the figures reported on this form.

Form Submission Methods (Online / Mail / In-Person)

The South Dakota Franchise Tax On Financial Institutions For Money Lenders Form can be submitted through various methods, providing flexibility for institutions. The available submission methods include:

- Online Submission: Institutions can fill out and submit the form electronically through the state’s tax portal.

- Mail: The completed form can be printed and mailed to the designated tax office.

- In-Person: Institutions may also choose to submit the form in person at local tax offices, if available.

Quick guide on how to complete south dakota franchise tax on financial institutions for money lenders form

Prepare South Dakota Franchise Tax On Financial Institutions For Money Lenders Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the correct template and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents swiftly without delays. Manage South Dakota Franchise Tax On Financial Institutions For Money Lenders Form on any platform with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign South Dakota Franchise Tax On Financial Institutions For Money Lenders Form without hassle

- Obtain South Dakota Franchise Tax On Financial Institutions For Money Lenders Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you'd like to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management within a few clicks from any device you prefer. Edit and eSign South Dakota Franchise Tax On Financial Institutions For Money Lenders Form and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the south dakota franchise tax on financial institutions for money lenders form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the South Dakota Franchise Tax on Financial Institutions for Money Lenders Form?

The South Dakota Franchise Tax On Financial Institutions For Money Lenders Form is a document required for financial institutions operating in South Dakota. It outlines the tax obligations for money lenders in the state. This form is essential for compliance and ensuring the proper tax amount is reported and paid.

-

How can airSlate SignNow help with the South Dakota Franchise Tax on Financial Institutions for Money Lenders Form?

AirSlate SignNow provides a seamless platform to create, send, and eSign the South Dakota Franchise Tax On Financial Institutions For Money Lenders Form. By using our solution, you can streamline the documentation process and ensure that all forms are accurately completed and submitted on time. This enhances efficiency and reduces the risk of errors.

-

What features does airSlate SignNow offer for managing tax forms?

AirSlate SignNow offers features such as customizable templates, electronic signatures, and document tracking specifically for forms like the South Dakota Franchise Tax On Financial Institutions For Money Lenders Form. These features ensure that your tax documents are handled efficiently while maintaining compliance and providing a user-friendly experience.

-

Is there a cost associated with using airSlate SignNow for my tax forms?

Yes, airSlate SignNow offers various pricing plans based on your needs. Each plan provides access to essential features required for handling documents, including the South Dakota Franchise Tax On Financial Institutions For Money Lenders Form. You can choose a plan that best fits your budget and business requirements.

-

Can I integrate airSlate SignNow with other software for my business?

Absolutely! AirSlate SignNow integrates with numerous applications, facilitating a smooth workflow for handling the South Dakota Franchise Tax On Financial Institutions For Money Lenders Form and other documents. Whether you’re using CRM systems, Google Workspace, or file storage services, our integrations enhance productivity and collaboration.

-

What are the benefits of using airSlate SignNow for financial documents?

Using airSlate SignNow for handling financial documents such as the South Dakota Franchise Tax On Financial Institutions For Money Lenders Form offers several benefits. These include increased efficiency through automation, reduced paper waste, enhanced security with encrypted signature workflows, and easy access to documents from anywhere.

-

How secure is the information I submit via airSlate SignNow?

AirSlate SignNow prioritizes security, ensuring that all data, including the South Dakota Franchise Tax On Financial Institutions For Money Lenders Form submissions, are encrypted and protected. Our platform follows industry-standard security protocols to secure sensitive information, making it a trustworthy choice for your document management needs.

Get more for South Dakota Franchise Tax On Financial Institutions For Money Lenders Form

- Firpta form

- Account opening form

- Irp form t 141

- Mooring inspection form

- Ibi sbi sbs sbin pension life certificate form

- Forensics drug test forms

- Reasonable cause individual and fiduciary claim for refund reasonable cause individual and fiduciary claim for refund ftb ca form

- Partnership for llc agreement template form

Find out other South Dakota Franchise Tax On Financial Institutions For Money Lenders Form

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe