Non Resident Form

What is the Non Resident Form

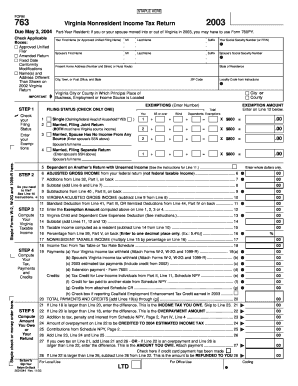

The Non Resident Form is a crucial document used primarily for tax purposes by individuals who do not reside in the United States but have income sourced from within the country. This form helps the Internal Revenue Service (IRS) track income earned by non-residents and ensures compliance with U.S. tax laws. It is essential for those who may be subject to U.S. tax obligations despite their non-resident status. Understanding the specific requirements and implications of this form is vital for accurate tax reporting and avoidance of penalties.

How to use the Non Resident Form

Using the Non Resident Form involves several steps to ensure accurate completion and submission. First, gather all necessary information, including personal identification details and income sources. Next, fill out the form accurately, ensuring that all sections are completed according to IRS guidelines. It is advisable to double-check for any errors or omissions before submission. Once completed, the form can be submitted electronically or via mail, depending on the specific instructions provided by the IRS for that tax year.

Steps to complete the Non Resident Form

Completing the Non Resident Form requires careful attention to detail. Here are the steps to follow:

- Obtain the latest version of the Non Resident Form from the IRS website.

- Provide your personal information, including name, address, and taxpayer identification number.

- Report all income earned in the U.S., ensuring to include any relevant deductions or credits.

- Review the completed form for accuracy and completeness.

- Submit the form following the IRS submission guidelines, either electronically or by mail.

Legal use of the Non Resident Form

The legal use of the Non Resident Form is governed by IRS regulations. It is essential for non-residents to use this form to report income accurately and comply with U.S. tax laws. Failure to file the form can lead to significant penalties, including fines and interest on unpaid taxes. Additionally, using the form correctly helps establish a non-resident’s tax obligations and may affect eligibility for certain tax treaties between the U.S. and the individual’s home country.

Required Documents

When completing the Non Resident Form, specific documents are required to support the information provided. These typically include:

- Proof of identity, such as a passport or government-issued ID.

- Documentation of income earned in the U.S., including W-2 forms or 1099 forms.

- Any relevant tax treaty documents that may apply to the individual’s situation.

Having these documents ready will facilitate a smoother filing process and help ensure compliance with IRS requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Non Resident Form are critical to avoid penalties. Generally, non-residents must file their tax returns by April 15 of the year following the tax year in question. However, if the individual is living outside the U.S., they may qualify for an automatic extension until June 15. It is important to be aware of these deadlines to ensure timely submission and compliance with U.S. tax laws.

Quick guide on how to complete non resident form

Complete Non Resident Form effortlessly on any device

Managing documents online has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without delays. Handle Non Resident Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The easiest way to edit and eSign Non Resident Form without hassle

- Find Non Resident Form and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and possesses the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to submit your form, via email, text message (SMS), or invite link, or download it to your computer.

No more worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Non Resident Form and ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the non resident form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Non Resident Form and why do I need it?

A Non Resident Form is an essential document used for individuals who do not reside in a particular state or country but may have tax or legal obligations. This form helps ensure compliance with local regulations and enables you to conduct necessary transactions. Using airSlate SignNow simplifies the process of completing and managing your Non Resident Form with ease.

-

How does airSlate SignNow help with filling out the Non Resident Form?

With airSlate SignNow, you can easily upload, fill out, and eSign your Non Resident Form online. Our user-friendly interface allows for quick navigation, ensuring that you complete your form accurately and efficiently. This saves you time and reduces the chances of errors associated with manual entry.

-

Is there a cost associated with using airSlate SignNow for the Non Resident Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. While we provide a free trial to test the platform, the cost of using our services for documents like the Non Resident Form depends on the plan you choose. Each plan is designed to deliver value and includes features tailored to enhance your document management experience.

-

What features does airSlate SignNow offer for my Non Resident Form?

airSlate SignNow provides features such as customizable templates, secure eSigning, cloud storage, and real-time collaboration to streamline your Non Resident Form processes. Additionally, you can track the status of your documents and automate reminders for timely responses. These features enhance efficiency and ensure your documents are handled smoothly.

-

Can I integrate airSlate SignNow with other applications when managing my Non Resident Form?

Yes, airSlate SignNow offers a wide range of integrations with popular applications such as Google Drive, Dropbox, and CRM systems. This lets you seamlessly manage your Non Resident Form alongside other business tools, enhancing your workflow and simplifying document management across platforms.

-

What are the benefits of using airSlate SignNow for a Non Resident Form?

Using airSlate SignNow for your Non Resident Form offers numerous benefits including enhanced security, reduced processing time, and improved organization of paperwork. Our platform ensures that your documents are securely stored and easily accessible, while eSigning reduces the time spent on physical signatures. Together, these advantages streamline your document management experience.

-

Is my data safe when using airSlate SignNow for the Non Resident Form?

Absolutely! airSlate SignNow prioritizes the security of your data. We employ advanced encryption protocols, secure cloud storage, and comply with industry standards to ensure that your Non Resident Form and any related documents remain confidential and protected from unauthorized access.

Get more for Non Resident Form

- 42 usc 408 a 8 form

- Images of bi wekly time sheets form

- Nhbrc competent person renewal form

- Epa form 7520 11 rev 8 01 annual disposalinjection deq state ok

- Medicationtreatment consent form grps

- Companies house sr01 form

- Barnstable police department ltcfid application form

- Website evaluation form wawestfordk12us wa westfordk12

Find out other Non Resident Form

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement