Declaration under Probate Code Section 13101 Form

What is the Declaration Under Probate Code Section 13101

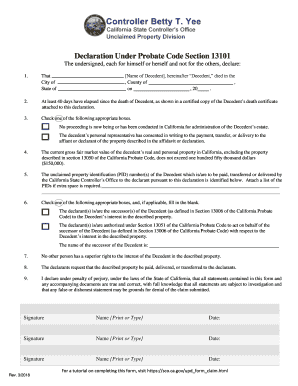

The Declaration Under Probate Code Section 13101 is a legal document utilized in the probate process, primarily in the state of California. This declaration serves to establish the validity of a will or the authority of an executor or administrator in managing an estate. It outlines the decedent's wishes regarding the distribution of assets and provides essential information about the estate's beneficiaries. Understanding this declaration is crucial for ensuring that the probate process adheres to legal requirements and that the decedent's intentions are honored.

How to use the Declaration Under Probate Code Section 13101

Using the Declaration Under Probate Code Section 13101 involves several steps to ensure compliance with legal standards. First, gather all necessary information about the decedent, including their full name, date of death, and details of the will, if applicable. Next, complete the declaration form accurately, ensuring that all required fields are filled out. Once completed, the document must be signed by the appropriate parties, which may include witnesses or notaries, depending on state laws. Finally, the declaration should be filed with the probate court to initiate the probate process.

Steps to complete the Declaration Under Probate Code Section 13101

Completing the Declaration Under Probate Code Section 13101 requires careful attention to detail. Follow these steps:

- Gather necessary documents, including the decedent's will, if available.

- Fill out the declaration form with accurate information about the decedent and beneficiaries.

- Ensure that all required signatures are obtained, which may include witnesses or a notary public.

- Review the completed declaration for accuracy and completeness.

- File the declaration with the appropriate probate court in your jurisdiction.

Legal use of the Declaration Under Probate Code Section 13101

The Declaration Under Probate Code Section 13101 is legally binding when executed in accordance with state laws. It serves as a formal statement regarding the decedent's wishes and the management of their estate. For the declaration to be valid, it must meet specific requirements, such as proper signatures and adherence to filing procedures. Courts rely on this document to ensure that the probate process is conducted fairly and in accordance with the decedent's intentions.

Key elements of the Declaration Under Probate Code Section 13101

Several key elements are essential for the Declaration Under Probate Code Section 13101 to be effective:

- Decedent's Information: Full name, date of birth, and date of death.

- Executor or Administrator Details: Name and contact information of the appointed executor or administrator.

- Beneficiaries: Names and relationships of individuals or entities entitled to inherit.

- Will Information: Reference to the decedent's will, if one exists.

- Signatures: Required signatures of the executor and witnesses, if applicable.

State-specific rules for the Declaration Under Probate Code Section 13101

Each state may have specific rules regarding the Declaration Under Probate Code Section 13101. In California, for instance, the declaration must comply with the California Probate Code, which outlines the necessary content and filing procedures. It is important to consult state-specific guidelines to ensure that all legal requirements are met. This includes understanding any additional documentation that may be required and the proper court for filing the declaration.

Quick guide on how to complete declaration under probate code section 13101

Effortlessly Prepare Declaration Under Probate Code Section 13101 on Any Device

The management of online documents has gained immense popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can access the appropriate format and securely keep it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents quickly without interruptions. Handle Declaration Under Probate Code Section 13101 on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

How to Edit and eSign Declaration Under Probate Code Section 13101 with Ease

- Obtain Declaration Under Probate Code Section 13101 and then click Get Form to begin.

- Make use of the available tools to complete your document.

- Emphasize signNow sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Formulate your eSignature using the Sign feature, which only takes a few seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Choose your preferred method of sharing your form, via email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, the hassle of searching for forms, or mistakes that require reprinting new copies. airSlate SignNow efficiently addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Declaration Under Probate Code Section 13101 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the declaration under probate code section 13101

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Declaration Under Probate Code Section 13101?

A Declaration Under Probate Code Section 13101 is a legal document that declares the intentions of a decedent regarding the distribution of their assets after passing. This declaration can be essential in ensuring that the decedent's wishes are honored and can simplify the probate process. It is crucial for individuals handling estate planning or settling an estate to understand its implications.

-

How does airSlate SignNow facilitate the signing of a Declaration Under Probate Code Section 13101?

airSlate SignNow provides an intuitive platform that allows users to upload, send, and securely eSign a Declaration Under Probate Code Section 13101 with ease. With our document editing tools, you can customize the declaration and gather signatures quickly. This streamlines the process and ensures compliance with legal standards.

-

What are the costs associated with using airSlate SignNow for electronic signatures?

The pricing for airSlate SignNow varies based on the plan you choose, but it is designed to be cost-effective. Our subscription plans include features optimized for signing documents like the Declaration Under Probate Code Section 13101, making it a valuable tool for both individuals and businesses. You can explore our pricing options on our website to find the best fit for your needs.

-

Can airSlate SignNow integrate with other platforms for document management?

Yes, airSlate SignNow offers integrations with various platforms, enhancing its functionality for managing documents like the Declaration Under Probate Code Section 13101. Popular integrations include Google Drive, Dropbox, and more. This allows you to streamline your workflow and keep all your important documents in one place.

-

What are the key features of airSlate SignNow for handling legal documents?

Key features of airSlate SignNow include easy document creation, secure eSigning, template management, and audit trails, all of which are essential for processing a Declaration Under Probate Code Section 13101. These features help you maintain compliance and create a seamless experience for all parties involved. Our platform is tailored for legal professionals and estate planners alike.

-

Is airSlate SignNow compliant with eSignature laws?

Yes, airSlate SignNow complies with federal and international eSignature laws, including the ESIGN Act and UETA, ensuring that your Declaration Under Probate Code Section 13101 is legally binding. This compliance is critical for the validity of electronic signatures in legal documents. We prioritize security and legality to provide peace of mind for our users.

-

How can airSlate SignNow improve efficiency in the probate process?

By using airSlate SignNow, you can signNowly improve efficiency in the probate process, especially when dealing with a Declaration Under Probate Code Section 13101. Our user-friendly interface allows for quick document turnaround and signature collection. This efficiency reduces the time and resources required to settle estates, benefiting both executors and beneficiaries.

Get more for Declaration Under Probate Code Section 13101

Find out other Declaration Under Probate Code Section 13101

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form